- United States

- /

- Hotel and Resort REITs

- /

- NYSE:APLE

Apple Hospitality REIT (APLE): Exploring Valuation After Recent Zacks Buy Rating and Strong Value Grade

Reviewed by Simply Wall St

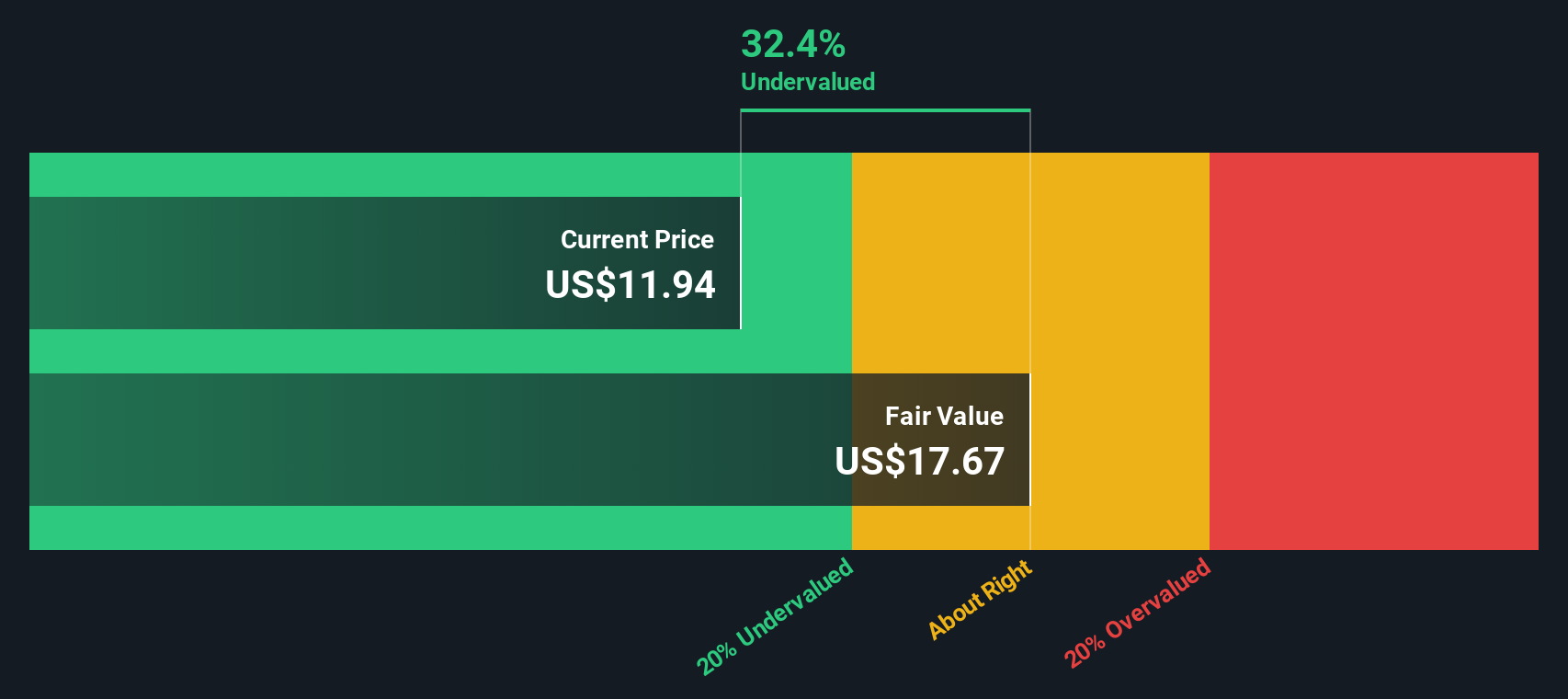

If you have been tracking Apple Hospitality REIT (APLE) lately, you may have noticed the buzz around its valuation. The company has just been rated a Zacks Rank #2 (Buy) and awarded a Value grade of A, which is drawing fresh attention from investors searching for bargains in the real estate market. The headlines highlight that several of APLE’s key valuation metrics, such as price-to-book and price-to-cash flow ratios, are well below the industry norm, painting a picture of an undervalued stock that could be flying under the radar.

Zooming out, APLE has seen both ups and downs over the past year. While the stock has gained about 9% in the past three months, its overall one-year return remains in negative territory, reflecting a broader period of volatility and shifting views on real estate investment trusts. Even so, a modest rebound in the past month hints that investor confidence could be on the upswing, at least in the short run.

So here is the big question: after this period of uneven performance, does APLE offer genuine value at today’s prices or is the market already anticipating a turnaround?

Most Popular Narrative: 7.6% Undervalued

The most widely followed narrative positions Apple Hospitality REIT as undervalued by 7.6%, setting its fair value above current prices.

The company's demonstrated ability to opportunistically acquire and cluster assets (such as the recent Tampa acquisition at a favorable cap rate and price below replacement cost), paired with strong execution on synergies and market positioning, suggests potential for enhanced long-term portfolio earnings and asset value growth. This view contradicts expectations of sustained earnings decline.

Curious how Apple Hospitality’s future cash flows and margin forecasts add up to that undervalued designation? There is a surprisingly optimistic projection driving this fair value, built on a mix of modest top-line growth and an earnings multiple that challenges the industry’s standards. Want to uncover which specific financial assumptions tip the scales? Keep reading to see how this popular narrative pieces together its bullish case.

Result: Fair Value of $13.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, several factors, such as historically low new hotel supply and effective asset management, could strengthen Apple Hospitality’s earnings in the face of pessimistic forecasts.

Find out about the key risks to this Apple Hospitality REIT narrative.Another View: What Does the SWS DCF Model Say?

Looking beyond multiples, the SWS DCF model offers an alternative perspective on Apple Hospitality REIT’s value. This approach still points toward an undervalued stock. However, does it give a stronger case for upside, or does it simply reframe the same risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Apple Hospitality REIT Narrative

If you are inclined to dig deeper or prefer to build your own case, it takes just a few minutes to assemble your own perspective, so Do it your way.

A great starting point for your Apple Hospitality REIT research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t settle for the usual picks when exceptional stocks are just a few clicks away. Unlock a world of promising opportunities to fuel your portfolio growth today.

- Spot undervalued companies with solid future cash flows by using our undervalued stocks based on cash flows.

- Capitalize on innovations reshaping medicine with the range of game-changing businesses in healthcare AI stocks.

- Explore bold moves in the digital currency space by discovering companies powering the future of cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APLE

Apple Hospitality REIT

Apple Hospitality REIT, Inc. (NYSE: APLE) is a publicly traded real estate investment trust (“REIT”) that owns one of the largest and most diverse portfolios of upscale, rooms-focused hotels in the United States.

Undervalued average dividend payer.

Market Insights

Community Narratives