- United States

- /

- Specialized REITs

- /

- NYSE:AMT

How Slowing Cash Flows Amid Rising Revenue at American Tower (AMT) Could Shape Its Investment Story

Reviewed by Sasha Jovanovic

- American Tower recently reported its third quarter results, showing a 7.7% year-over-year increase in revenue driven by tenant billings and property revenues, surpassing analyst expectations.

- Despite the strong topline growth, some investor concerns emerged as the company experienced a slight decline in both free cash flows and operating cash flows compared to the same period last year.

- We’ll explore how concerns over declining cash flows could shape American Tower’s broader investment narrative moving forward.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is American Tower's Investment Narrative?

To be a shareholder of American Tower, you generally need to believe in the long-term durability of its large global tower network and the mission-critical role it plays in mobile and data communications infrastructure. While the company just posted a strong revenue beat and raised its annual guidance, the stock's 3.7% drop after earnings underscores how investor focus has shifted to cash flow trends. In the near term, much of the attention is likely to remain on operating cash flows and free cash flows, especially since recent results showed a slight decline. That said, the company still maintains a reliable dividend and continues to expand both its AI-ready data center footprint and clean energy efforts, which remain relevant catalysts. For now, the softer cash flow results, rather than topline momentum, may weigh more heavily as the leading risk to monitor, but it doesn't appear to fundamentally alter the bigger picture for the business.

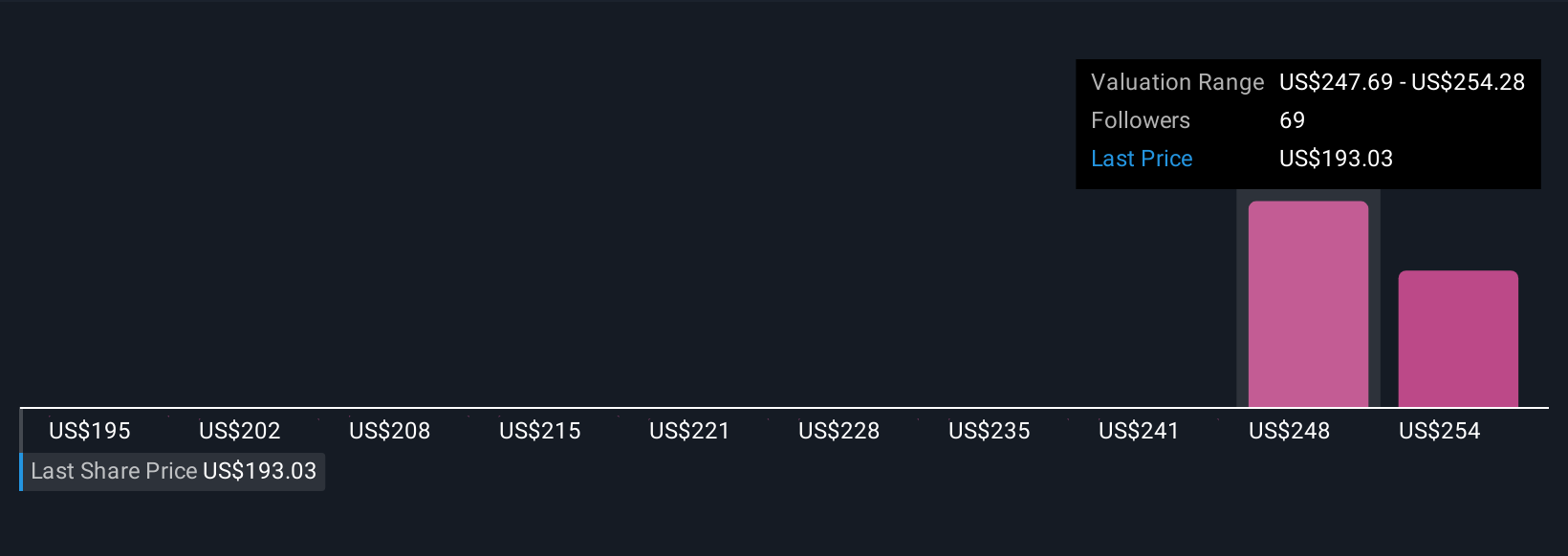

But with cash flow softness now top of mind, there’s a key risk you’ll want to consider. American Tower's shares have been on the rise but are still potentially undervalued by 31%. Find out what it's worth.Exploring Other Perspectives

Explore 5 other fair value estimates on American Tower - why the stock might be worth as much as 45% more than the current price!

Build Your Own American Tower Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Tower research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free American Tower research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Tower's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMT

American Tower

American Tower, one of the largest global REITs, is a leading independent owner, operator and developer of multitenant communications real estate with a portfolio of over 149,000 communications sites and a highly interconnected footprint of U.S.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.