- United States

- /

- Specialized REITs

- /

- NYSE:AMT

Did AT&T Mexico’s Payment Settlement Alter the Tenant Risk Equation for American Tower (AMT)?

Reviewed by Sasha Jovanovic

- On September 23, American Tower Corporation announced it had reached an agreement with AT&T Mexico to resolve a payment dispute involving outstanding tower rent, leading AT&T Mexico to resume monthly payments and settle most withheld amounts.

- This development comes as analysts raise concerns about American Tower’s exposure to lease renegotiations with major tenants, particularly Verizon’s move toward a high-rent relocation program ahead of a critical master lease expiration.

- We’ll explore how questions over tenant concentration risk and lease negotiations could influence American Tower’s investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

American Tower Investment Narrative Recap

American Tower’s investment case centers on durable demand for communications infrastructure, supported by long-term leases and continued growth in wireless data usage. While the recent resolution of the AT&T Mexico payment dispute is a positive step, the more pressing near-term catalyst remains lease renewal negotiations with major U.S. tenants, particularly regarding Verizon’s high-rent relocation program. For now, the settlement with AT&T Mexico appears not to materially shift the biggest short-term risk, which is tenant concentration and potential pressure on lease rates.

One recent dividend announcement stands out: the Board of Directors declared a quarterly cash distribution of US$1.70 per share, payable October 20, 2025. This continued commitment to shareholder returns highlights management’s focus on maintaining reliable income during a period of heightened scrutiny on lease negotiations and tenant risk, aligning with the importance of stable cash flow in the current environment.

However, if key tenant negotiations lead to unfavorable lease terms or increased churn, especially with major carriers...

Read the full narrative on American Tower (it's free!)

American Tower's narrative projects $12.0 billion revenue and $3.7 billion earnings by 2028. This requires 5.2% yearly revenue growth and a $1.2 billion earnings increase from $2.5 billion today.

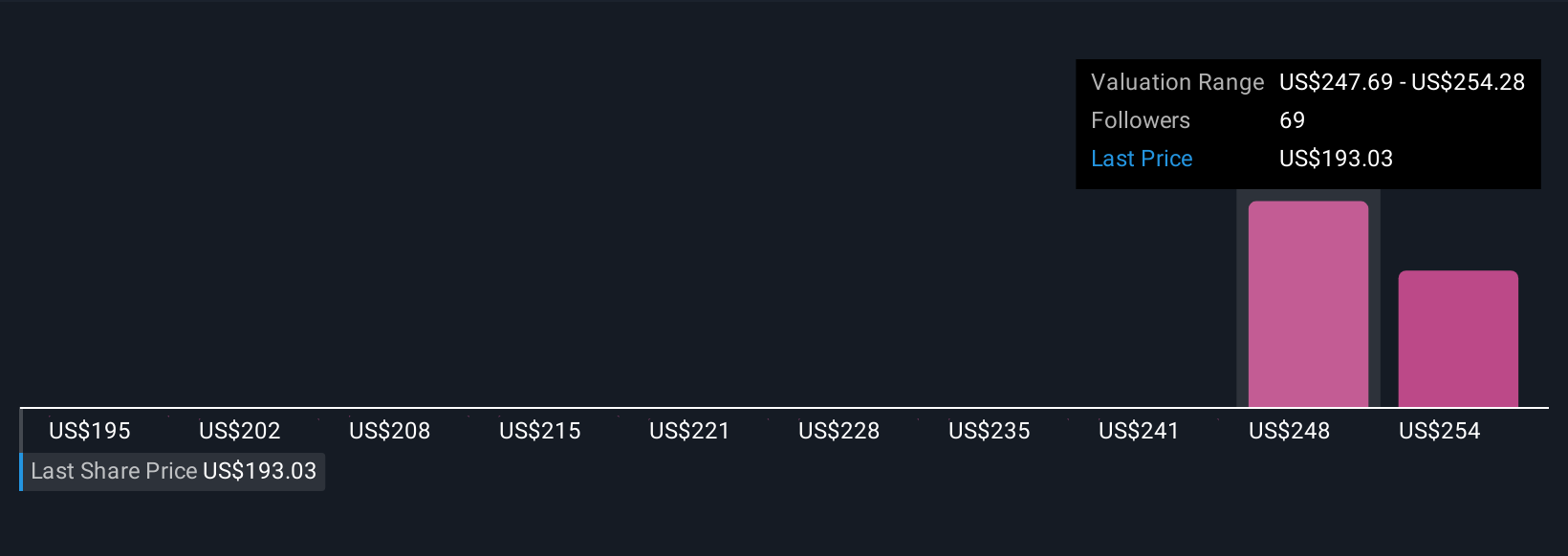

Uncover how American Tower's forecasts yield a $249.21 fair value, a 30% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community place American Tower between US$190 and US$259 per share, with the widest views still suggesting potential undervaluation. As investors assess these varied valuations, the focus on lease renewal risks remains an important factor for understanding future returns and stability.

Explore 5 other fair value estimates on American Tower - why the stock might be worth as much as 36% more than the current price!

Build Your Own American Tower Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Tower research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free American Tower research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Tower's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMT

American Tower

American Tower, one of the largest global REITs, is a leading independent owner, operator and developer of multitenant communications real estate with a portfolio of nearly 150,000 communications sites and a highly interconnected footprint of U.S.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives