In 2016, Chris Benjamin was appointed CEO of Alexander & Baldwin, Inc. (NYSE:ALEX). This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. Next, we'll consider growth that the business demonstrates. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. The aim of all this is to consider the appropriateness of CEO pay levels.

See our latest analysis for Alexander & Baldwin

How Does Chris Benjamin's Compensation Compare With Similar Sized Companies?

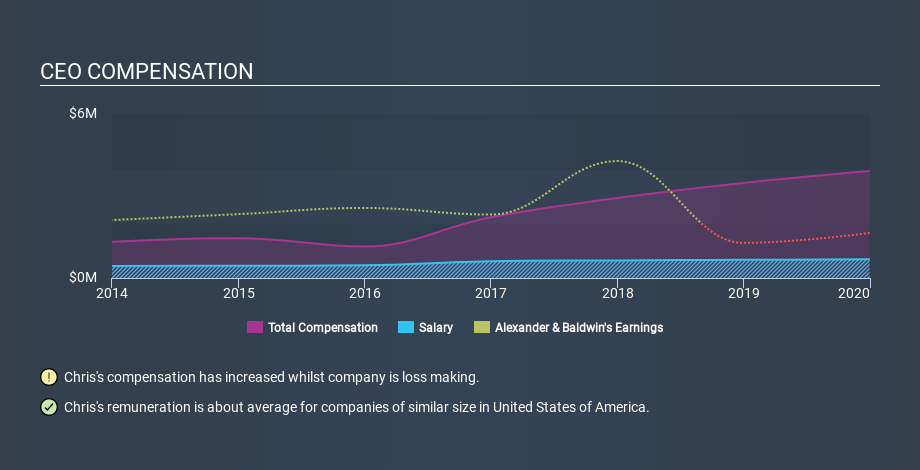

At the time of writing, our data says that Alexander & Baldwin, Inc. has a market cap of US$786m, and reported total annual CEO compensation of US$3.9m for the year to December 2019. Notably, that's an increase of 12% over the year before. While this analysis focuses on total compensation, it's worth noting the salary is lower, valued at US$685k. Importantly, there may be performance hurdles relating to the non-salary component of the total compensation. As part of our analysis we looked at companies in the same jurisdiction, with market capitalizations of US$400m to US$1.6b. The median total CEO compensation was US$3.3m.

Now let's take a look at the pay mix on an industry and company level to gain a better understanding of where Alexander & Baldwin stands. On an industry level, roughly 15% of total compensation represents salary and 85% is other remuneration. Our data reveals that Alexander & Baldwin allocates salary in line with the wider market.

So Chris Benjamin is paid around the average of the companies we looked at. This doesn't tell us a whole lot on its own, but looking at the performance of the actual business will give us useful context. The graphic below shows how CEO compensation at Alexander & Baldwin has changed from year to year.

Is Alexander & Baldwin, Inc. Growing?

On average over the last three years, Alexander & Baldwin, Inc. has shrunk earnings per share by 51% each year (measured with a line of best fit). It saw its revenue drop 31% over the last year.

Sadly for shareholders, earnings per share are actually down, over three years. And the impression is worse when you consider revenue is down year-on-year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. You might want to check this free visual report on analyst forecasts for future earnings.

Has Alexander & Baldwin, Inc. Been A Good Investment?

Since shareholders would have lost about 62% over three years, some Alexander & Baldwin, Inc. shareholders would surely be feeling negative emotions. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Chris Benjamin is paid around the same as most CEOs of similar size companies.

The company isn't growing EPS, and shareholder returns have been disappointing. This doesn't look great when you consider CEO remuneration is up on last year. Suffice it to say, we don't think the CEO is underpaid! CEO compensation is an important area to keep your eyes on, but we've also identified 4 warning signs for Alexander & Baldwin (1 is concerning!) that you should be aware of before investing here.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies, that have HIGH return on equity and low debt.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:ALEX

Alexander & Baldwin

Alexander & Baldwin, Inc. (NYSE: ALEX) (A&B) is the only publicly-traded real estate investment trust to focus exclusively on Hawai'i commercial real estate and is the state's largest owner of grocery-anchored, neighborhood shopping centers.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success