- United States

- /

- Health Care REITs

- /

- NYSE:AHR

How Strong Is American Healthcare REIT After Its 69% Rally in 2024?

Reviewed by Bailey Pemberton

Thinking about what to do with American Healthcare REIT stock? You are not alone. With a year-to-date climb of 47.4% and an impressive 69.0% boost over the past year, plenty of investors are weighing whether its run has staying power or if the easy money has already been made. Of course, not every movement has been straight up. Over the past 7 days, the stock is down 2.1%, and over the past month, it has slid 4.3%. These short-term dips have been matched by shifts across the broader healthcare REIT sector as investors have juggled worries about rising interest rates and evolving demand trends for healthcare facilities.

Yet, despite some recent volatility, American Healthcare REIT has earned a value score of 4 out of 6 on major valuation checks. In plain English, that means the stock is considered undervalued in four key areas, which can be an important signal for those looking beyond day-to-day price swings.

Whether you are chasing growth potential, yield, or simply more stability in your portfolio, American Healthcare REIT’s recent moves are drawing extra attention for a reason. So how does it actually stack up when you dig into different valuation techniques? Let us take a closer look at what is behind that value score, and stick around, because I will also share a smarter way to think about valuation further on.

Approach 1: American Healthcare REIT Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the intrinsic value of a stock by forecasting future cash flows, in this case using adjusted funds from operations, and discounting those amounts back to today’s dollar value. This method seeks to capture the long-term earning power of American Healthcare REIT, moving beyond just current performance or market sentiment.

For American Healthcare REIT, the DCF model starts with its most recent Free Cash Flow of $165.1 million. Analyst estimates indicate this number is expected to grow substantially, with projections reaching $418.6 million by 2029. While analysts provide direct estimates through 2029, further projections beyond that are calculated by extrapolation, continuing the upward trend through 2035. Each annual cash flow is discounted back to its present value.

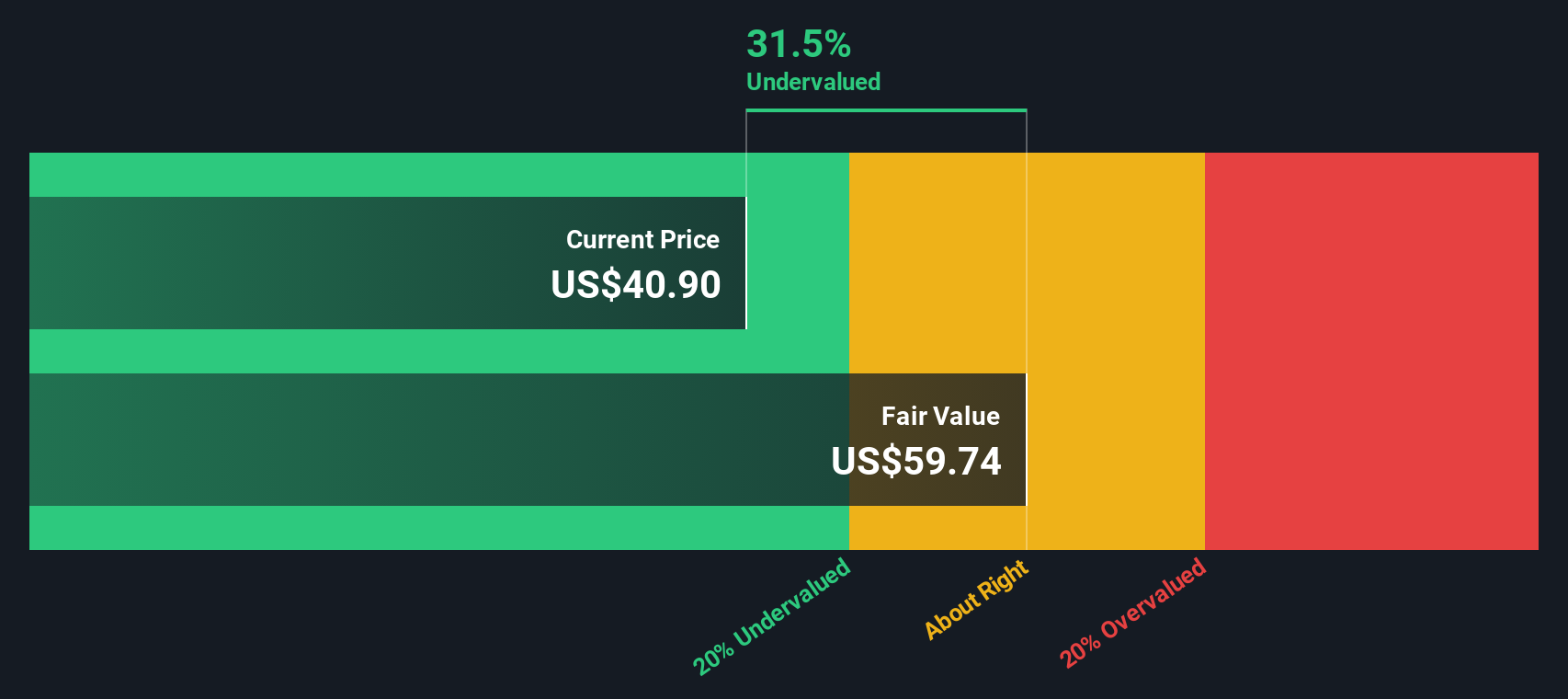

By tallying these present values, the DCF model produces an estimated intrinsic value per share of $59.74. Compared to the current market price, this figure signals that the stock trades at a 31.5% discount to fair value, suggesting meaningful upside for investors willing to look past short-term noise.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests American Healthcare REIT is undervalued by 31.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: American Healthcare REIT Price vs Sales

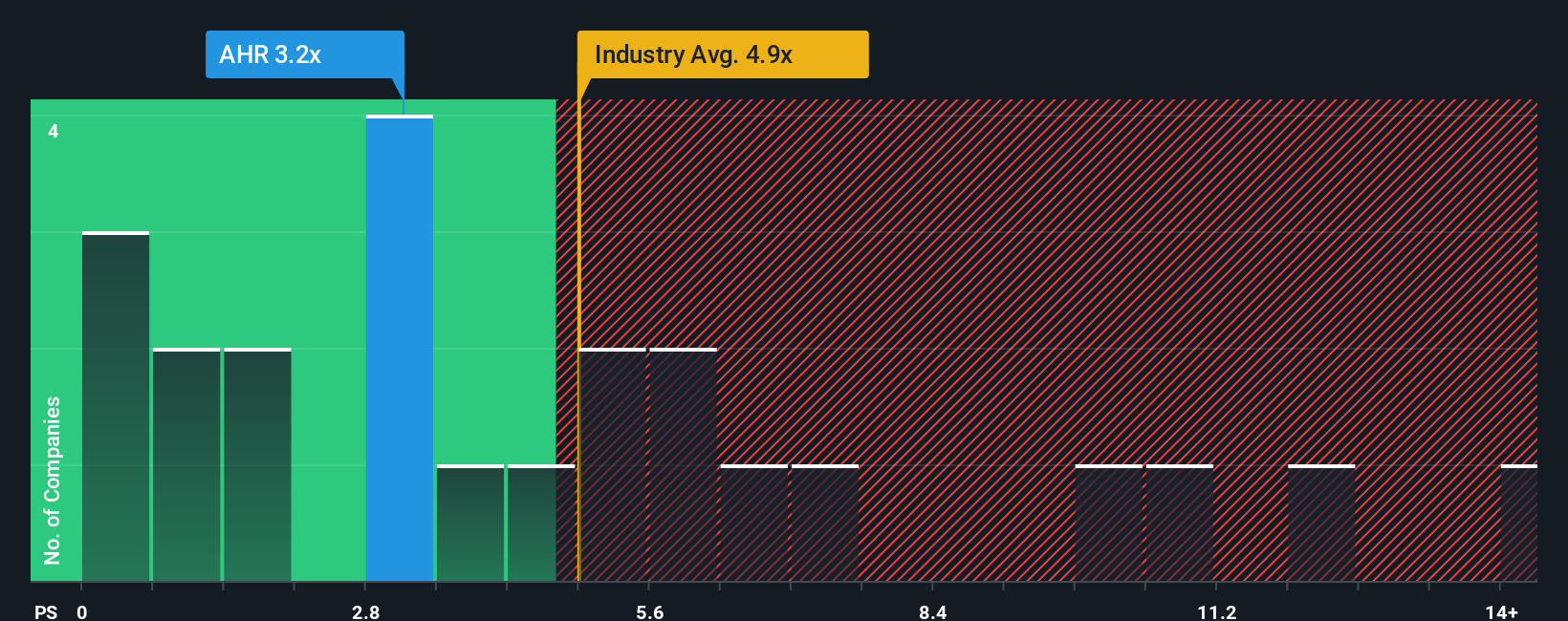

The Price-to-Sales (P/S) ratio is often a preferred valuation approach for real estate investment trusts like American Healthcare REIT, especially when traditional earnings-based multiples are skewed by non-cash items or irregular earnings patterns. This multiple helps investors compare how the market values each dollar of the company’s sales revenue, making it a practical tool for analyzing companies where profits may be cyclical or temporarily negative.

It is important to remember that growth expectations and perceived risks play a big role in what a “normal” or “fair” P/S ratio should be. Faster-growing companies or those with higher margins usually fetch higher P/S values, while those with slower growth or higher risks tend to trade at lower multiples. Comparing these figures to industry norms and peers helps, but it isn’t always the whole story.

Right now, American Healthcare REIT trades at a P/S ratio of 3.22x. For context, the average P/S among its closest peers is 8.41x, and the Health Care REIT industry average is 6.24x. This means AHR is trading noticeably below both. However, Simply Wall St’s proprietary Fair Ratio for American Healthcare REIT is 2.41x. The Fair Ratio goes beyond simple averages by weighing company-specific details like future growth outlook, profit margin, market cap, and unique business risks, making it a more tailored benchmark than broad peer or industry averages.

Comparing the Fair Ratio of 2.41x with American Healthcare REIT’s actual P/S of 3.22x shows the stock is valued a bit above where its fundamentals suggest it should be, but not by a dramatic margin.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your American Healthcare REIT Narrative

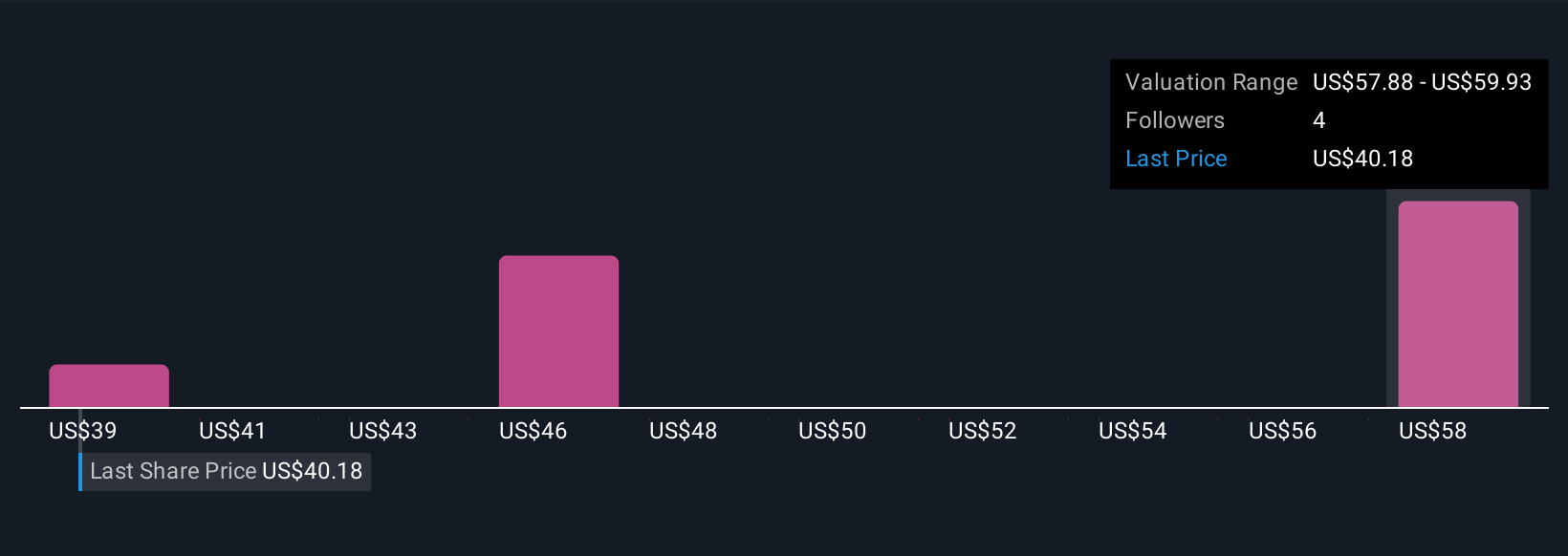

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is your personal story about a company, combining beliefs about its future prospects with financial forecasts and a calculated fair value. Instead of just relying on ratios or analyst targets, Narratives let you lay out your assumptions, such as how fast American Healthcare REIT’s revenues or margins will grow, and see what that means for its true worth.

Narratives are accessible, dynamic tools built into the Simply Wall St Community page, used by millions of investors to turn opinions into actionable investment signals. A Narrative links the story you believe in with a forecast and then a fair value, so you can clearly see if the current share price is above or below where your story says it should be. As new earnings, news, or market changes come in, Narratives update in real time, so your investment thesis stays fresh and relevant.

For example, some investors expect robust demand and margin expansion will drive American Healthcare REIT’s fair value up to $50 per share, while others, citing slowing occupancy growth, see a downside risk closer to $40. Narratives empower you to compare these perspectives, adjust your own assumptions, and make buy or sell decisions grounded in your unique outlook.

Do you think there's more to the story for American Healthcare REIT? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AHR

American Healthcare REIT

A Maryland corporation, is a self-managed real estate investment trust, or REIT, that acquires, owns and operates a diversified portfolio of clinical healthcare real estate properties, focusing primarily on senior housing, skilled nursing facilities, or SNFs, outpatient medical, or OM, buildings and other healthcare-related facilities.

Good value with adequate balance sheet.

Market Insights

Community Narratives