- United States

- /

- Retail REITs

- /

- NYSE:ADC

Agree Realty (ADC): Evaluating Valuation Following Major 2025 Acquisition Plans and Safe Dividend Stock Recognition

Reviewed by Kshitija Bhandaru

Agree Realty (ADC) has been popping up on the radar lately and for good reason. Recent coverage placed the company among the safest monthly dividend stocks to buy, which tends to get the attention of anyone looking for steady income from their investments. On top of that, management announced plans to pour roughly $1.5 billion into property acquisitions in the coming year, a signal that the REIT is just getting started with portfolio expansion and has its sights set on long-term rental growth. For investors, these moves could mean more than just reliable dividend payments, especially in a market where defensive income is in high demand.

Agree Realty’s business model remains rooted in leases with essential retail tenants, such as grocery and home improvement stores, which generally weather economic cooldowns better than discretionary retailers. While the company’s share price has slid just over 2% in the past month and declined slightly over the year, its longer-term track record shows solid gains, especially over the past five years. Recent news of planned property investments signals confidence from management and has kept the stock in the conversation among income-focused investors, even as broader sector momentum has cooled a bit.

So, as capital flows into new acquisitions and dividend reliability remains a calling card, is Agree Realty offering a rare buying window for patient investors, or has the market already priced in all the future growth?

Most Popular Narrative: 13% Undervalued

The most widely followed narrative suggests that Agree Realty’s current stock price is undervalued by 13%, driven by optimistic outlooks on its operational stability and future growth potential.

Aggressive yet disciplined ramp in external growth platforms (acquisitions, development, and development funding), supported by ample low-cost liquidity and a best-in-class balance sheet, enables rapid portfolio expansion while locking in favorable cap rates. This approach helps bolster future AFFO and earnings visibility.

Curious what’s fueling this bullish valuation? The narrative claims that Agree Realty’s expansion strategy, efficiency gains, and margin improvements are set to power a substantial earnings increase and a future profit multiple more often found in faster-growing sectors. Want to uncover the ambitious assumptions behind this price target and see which numbers are making waves? Discover the surprising financial story that’s shaping this fair value estimate.

Result: Fair Value of $81.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, looming risks such as shareholder dilution from equity issuances or disruptions among major tenants could quickly shift Agree Realty’s growth outlook.

Find out about the key risks to this Agree Realty narrative.Another View: Market-Based Comparison

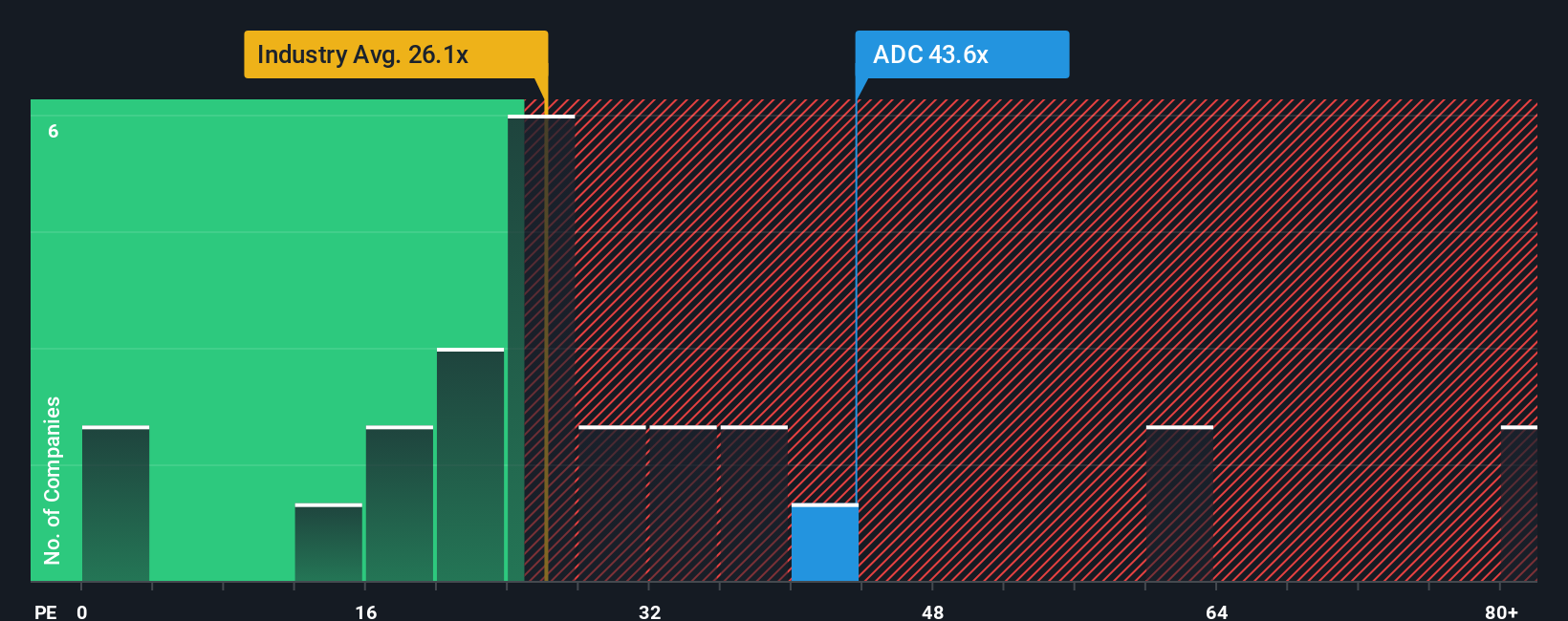

Taking a look from a different angle, the market’s most common valuation method, which compares Agree Realty to its wider sector, tells a less optimistic story and suggests the stock is expensive right now. Could this signal hidden challenges for future returns, or is the market overlooking something?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Agree Realty Narrative

If you see the story differently, or want to dive deeper into the numbers yourself, it's easy to build your own perspective in just a few minutes. Do it your way

A great starting point for your Agree Realty research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep new opportunities in sight. If you want to stay ahead of the market, now is the perfect time to tap into proven strategies and uncover stocks that could outperform.

- Target higher yields and steady cash flow by using dividend stocks with yields > 3%, which is designed to spotlight picks with impressive payout records.

- Seize the momentum in emerging tech by exploring AI penny stocks, featuring companies leveraging artificial intelligence for explosive potential.

- Zero in on stocks that may be trading below their worth with undervalued stocks based on cash flows, helping you pinpoint today's undervalued gems based on robust cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ADC

Agree Realty

A publicly traded real estate investment trust that is RETHINKING RETAIL through the acquisition and development of properties net leased to industry-leading, omni-channel retail tenants.

Established dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives