- United States

- /

- Retail REITs

- /

- NYSE:ADC

A Look at Agree Realty’s Valuation Following $1.5 Billion Investment Plans and Upbeat 2025 Guidance

Reviewed by Kshitija Bhandaru

Agree Realty (ADC) has laid out ambitious plans for 2025, announcing a $1.5 billion investment in real estate in addition to upward revisions to its AFFO guidance and acquisition targets. The company also named a new Vice President of Leasing, highlighting a renewed focus on growth and leadership.

See our latest analysis for Agree Realty.

Agree Realty’s recent strategic moves come at a time when the stock’s momentum has been steady, with longer-term investors seeing total shareholder returns of around 24% over three years and 30% over five years. While the share price itself has not delivered standout short-term gains, the company’s ongoing investments and leadership changes may shape market sentiment going forward.

If these updates have you wondering what else might be gaining traction, it’s a great opportunity to explore fast growing stocks with high insider ownership.

Given Agree Realty’s recent guidance boost and investment plans, is the market underestimating its growth potential, or has future performance already been factored into today’s price, leaving little room for upside?

Most Popular Narrative: 13.8% Undervalued

With Agree Realty’s widely followed narrative pricing the shares at $81.88, compared to a last close of $70.57, some see significant upside potential if expectations play out. As investor attention sharpens on those fair value projections, it’s important to understand the bold assumptions beneath the surface.

“Aggressive yet disciplined ramp in external growth platforms (acquisitions, development, and development funding), backed by ample low-cost liquidity and a best-in-class balance sheet, enables rapid portfolio expansion while locking in favorable cap rates, bolstering future AFFO and earnings visibility.”

Want to know the growth blueprint driving this optimistic price? This narrative is built on rapid expansion, boosting rental income, and a sustained jump in future profits. Surprised by the bold math underpinning such a premium? Dive in to uncover which headline numbers could electrify the stock’s story.

Result: Fair Value of $81.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on large tenants and rapid, acquisition-fueled growth introduce real risks that could challenge future earnings and stability.

Find out about the key risks to this Agree Realty narrative.

Another View: What Do Market Multiples Say?

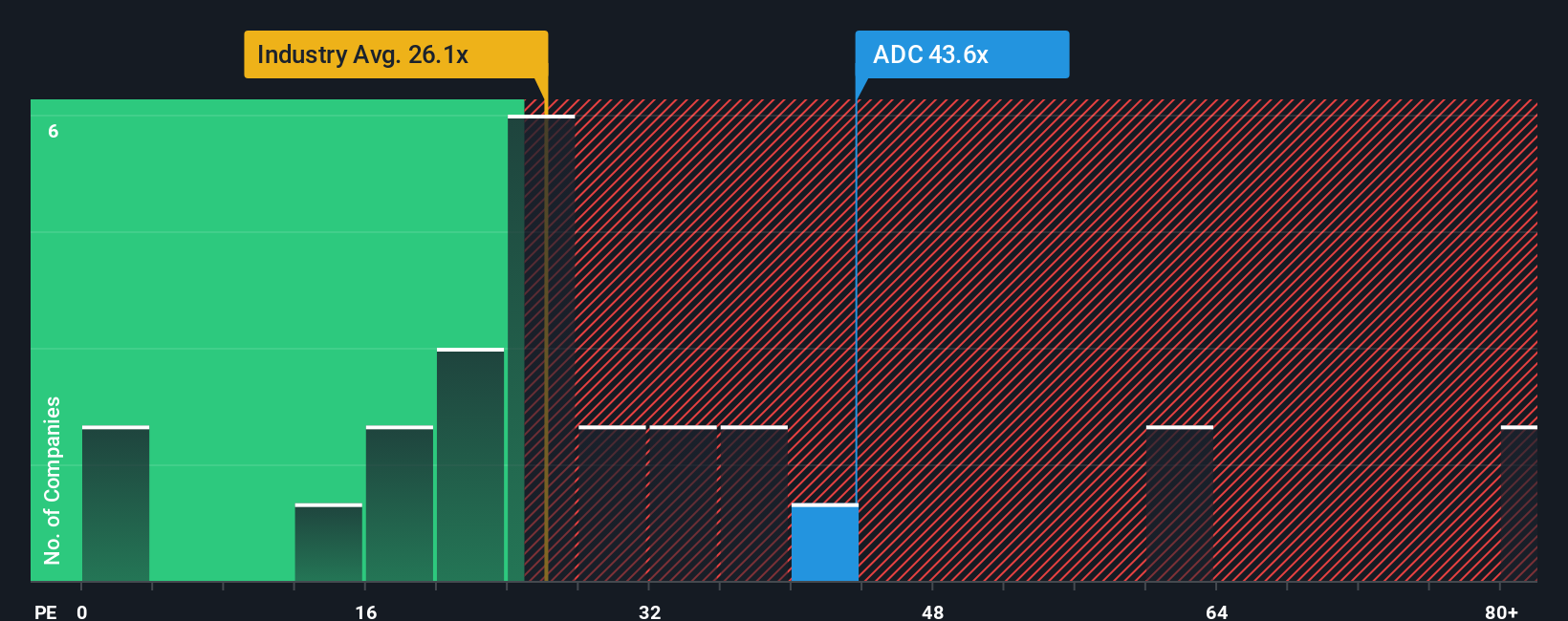

Examining Agree Realty through its price-to-earnings ratio reveals an interesting contrast. Shares trade at 43.8x earnings, well above both the US Retail REITs industry average of 26x and the company’s fair ratio of 36.8x. This sizable premium suggests the market is pricing in big growth and raises the stakes for execution. Could this leave little margin for error if profits fall short?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Agree Realty Narrative

If you have your own perspective or prefer hands-on analysis, it’s easy to dig into the numbers and build a personalized view in just minutes. Do it your way

A great starting point for your Agree Realty research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Take your next step and expand your portfolio with fresh opportunities you might have overlooked. The right screener could reveal tomorrow’s big winner and help you stay ahead of the crowd.

- Uncover income powerhouses with reliable returns by checking out these 19 dividend stocks with yields > 3%, which offers strong yields above 3%.

- Zero in on innovation by targeting these 24 AI penny stocks, which harness artificial intelligence to disrupt entire industries.

- Tap into high-potential bargains before the rest of the market catches on with these 896 undervalued stocks based on cash flows, based on their cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ADC

Agree Realty

A publicly traded real estate investment trust that is RETHINKING RETAIL through the acquisition and development of properties net leased to industry-leading, omni-channel retail tenants.

Established dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives