- United States

- /

- REITS

- /

- NYSE:AAT

American Assets Trust (AAT) One-Off Gain Drives Margin Beat, Challenging Bearish Profitability Narrative

Reviewed by Simply Wall St

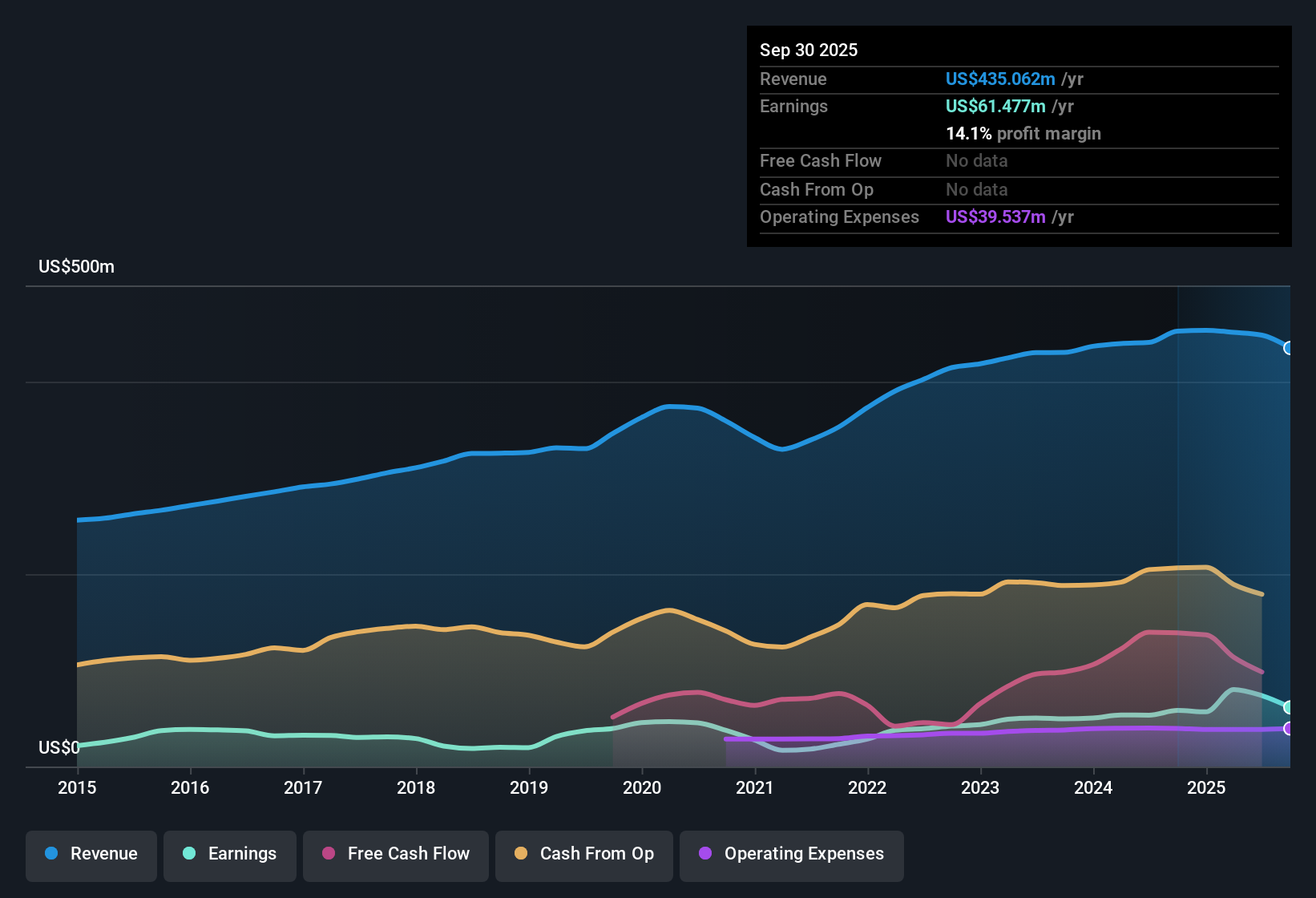

American Assets Trust (AAT) posted a net profit margin of 14.1%, up from 12.9% last year, highlighting a clear gain in profitability. Although earnings have grown at 21.6% per year over the last five years, growth slowed to 5.4% most recently and was significantly affected by a one-off gain of $54.5 million reported in the latest twelve months ending September 2025. With a current Price-to-Earnings ratio of 18.8x, which is lower than the peer average but above the global REIT industry, AAT trades at $18.95 per share, below its estimated fair value of $21.06, as investors weigh solid historic profit growth against the forecast for declining earnings ahead.

See our full analysis for American Assets Trust.The next section puts these headline results head-to-head with the most widely followed narratives for AAT, highlighting where market expectations and the numbers truly align, or part ways.

See what the community is saying about American Assets Trust

Guidance Signals: 173% Projected Drop in Profits

- Analysts are forecasting American Assets Trust's earnings to decline by 173.5% per year over the next three years, even as revenue is estimated to grow just 2% annually. This steep drop-off highlights a sharp contrast between modest top-line growth and a sudden swing to negative profitability.

- According to analysts' consensus view, the expectation is that shrinking profit margins, from 12.9% today to just 0.1% in three years, could erase recent gains from successful rent escalations and accretive acquisitions.

- This challenges the optimism about embedded rent increases and asset densification, since the overwhelming drag from higher costs or one-offs is set to overwhelm incremental revenue benefits.

- The forecasted earnings slide suggests that positive catalysts, such as Oahu tourism recovery and strategic property deals, may not be enough to offset structural headwinds impacting overall profitability.

- Surprisingly, despite a current profit margin of 14.1% and a strong track record of growth, consensus expects little improvement in net results due to ongoing risks flagged, namely, unsustainable dividends and weak financial positioning.

Investors looking for the full range of strategic views on these profit forecasts should see how the consensus narrative breaks it down in detail. 📊 Read the full American Assets Trust Consensus Narrative.

Bond Issuance and Portfolio Stability Backstop Financial Flexibility

- American Assets Trust recently completed the issuance of a $525 million bond, which has increased liquidity and improved financial flexibility even as future earnings forecasts turn sharply negative.

- Analysts' consensus view notes that this influx of capital, along with a diversified and high-quality property portfolio, is expected to help keep revenue streams stable and mitigate short-term financing risks in the face of challenging earnings guidance.

- The retail segment's resilience, highlighted by tenant sales increases and stronger leasing spreads, provides an additional backstop against more volatile sectors in the portfolio.

- Strong demand for multifamily properties and high occupancy rates are sources of medium-term stability, though they may not be enough to counteract sector-wide headwinds weighing on growth.

Share Price Lags DCF Fair Value and Analyst Target

- With American Assets Trust trading at $18.95 per share, the current price sits below both its DCF fair value of $21.06 and the analyst consensus price target of $20.50. This creates a visible discount even as analyst targets remain only modestly above current trading levels.

- Consensus narrative highlights that analysts see near-fair pricing, with a limited gap of just 5.4% between projected value and the current share price. This implies that risk-reward expectations are already reflected in the stock and leaves little room for upside unless business fundamentals or industry trends outperform the muted forecasts.

- This discounted valuation, trading below peer averages, supports the argument that market participants are cautious given looming profit declines, despite historical strength in revenue and portfolio diversification.

- If future headwinds are less severe than expected, this gap could narrow, but as of now, the market is baking in considerable skepticism about recovery against consensus guidance.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for American Assets Trust on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the figures from a new angle? Add your insights and shape your unique take in just a few minutes with us: Do it your way.

A great starting point for your American Assets Trust research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite a historically strong portfolio, American Assets Trust faces a sharp profit decline ahead, constrained by thin margins, weak financial positioning, and dividend risks.

If resilient financials and solid fundamentals matter more to you, check out solid balance sheet and fundamentals stocks screener (1980 results) which is built to pinpoint companies with healthier balance sheets and lower risk profiles right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AAT

American Assets Trust

A full service, vertically integrated and self-administered real estate investment trust ("REIT"), headquartered in San Diego, California.

Average dividend payer with slight risk.

Market Insights

Community Narratives