- United States

- /

- Health Care REITs

- /

- NasdaqGS:SBRA

Here's Why We Think Sabra Health Care REIT, Inc.'s (NASDAQ:SBRA) CEO Compensation Looks Fair for the time being

Performance at Sabra Health Care REIT, Inc. (NASDAQ:SBRA) has been reasonably good and CEO Rick Matros has done a decent job of steering the company in the right direction. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 16 June 2021. Here is our take on why we think the CEO compensation looks appropriate.

View our latest analysis for Sabra Health Care REIT

How Does Total Compensation For Rick Matros Compare With Other Companies In The Industry?

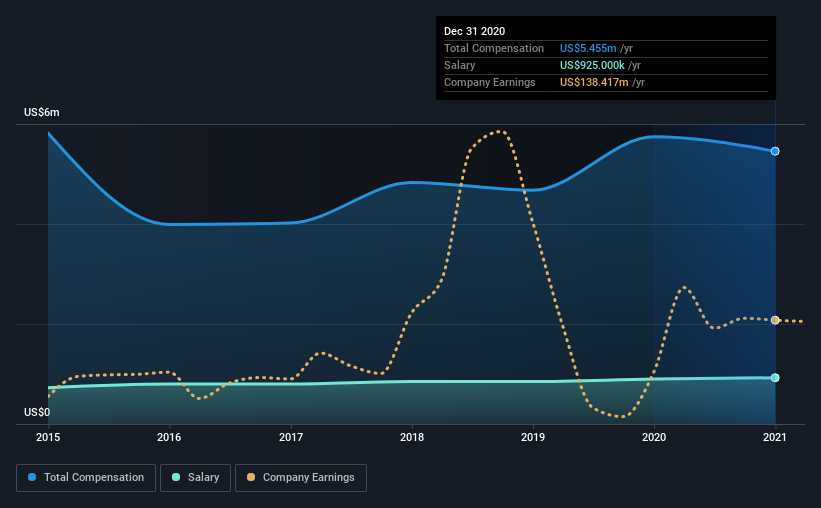

Our data indicates that Sabra Health Care REIT, Inc. has a market capitalization of US$3.8b, and total annual CEO compensation was reported as US$5.5m for the year to December 2020. That's a slight decrease of 5.0% on the prior year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$925k.

On comparing similar companies from the same industry with market caps ranging from US$2.0b to US$6.4b, we found that the median CEO total compensation was US$5.3m. So it looks like Sabra Health Care REIT compensates Rick Matros in line with the median for the industry. Furthermore, Rick Matros directly owns US$29m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$925k | US$900k | 17% |

| Other | US$4.5m | US$4.8m | 83% |

| Total Compensation | US$5.5m | US$5.7m | 100% |

On an industry level, roughly 15% of total compensation represents salary and 85% is other remuneration. According to our research, Sabra Health Care REIT has allocated a higher percentage of pay to salary in comparison to the wider industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Sabra Health Care REIT, Inc.'s Growth

Sabra Health Care REIT, Inc.'s funds from operations (FFO) grew 5.7% per yearover the last three years. In the last year, its revenue is down 1.7%.

We would argue that the lack of revenue growth in the last year is less than ideal, but the modest FFO growth gives us some relief. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Sabra Health Care REIT, Inc. Been A Good Investment?

With a total shareholder return of 6.7% over three years, Sabra Health Care REIT, Inc. has done okay by shareholders, but there's always room for improvement. In light of that, investors might probably want to see an improvement on their returns before they feel generous about increasing the CEO remuneration.

In Summary...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. Despite the pleasing results, we still think that any proposed increases to CEO compensation will be examined based on a case by case basis and linked to performance outcomes.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. In our study, we found 3 warning signs for Sabra Health Care REIT you should be aware of, and 1 of them is potentially serious.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade Sabra Health Care REIT, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:SBRA

Sabra Health Care REIT

As of September 30, 2024, Sabra’s investment portfolio included 373 real estate properties held for investment (consisting of (i) 233 skilled nursing/transitional care facilities, (ii) 39 senior housing communities (“senior housing - leased”), (iii) 68 senior housing communities operated by third-party property managers pursuant to property management agreements (“senior housing - managed”), (iv) 18 behavioral health facilities and (v) 15 specialty hospitals and other facilities), 14 investments in loans receivable (consisting of three mortgage loans and 11 other loans), five preferred equity investments and two investments in unconsolidated joint ventures.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives