- United States

- /

- Specialized REITs

- /

- NasdaqGS:SBAC

Stronger Q3 AFFO and Tower Expansion Could Be A Game Changer For SBA Communications (SBAC)

Reviewed by Sasha Jovanovic

- In the third quarter of 2025, SBA Communications reported adjusted funds from operations of US$3.30 per share, 10% year-over-year revenue growth, and expanded its tower portfolio through hundreds of site acquisitions and new builds across the Americas and Africa.

- Alongside this operational expansion, SBA Communications intensified capital returns by repurchasing 748,000 Class A shares for US$154.10 million and paying US$119.10 million in dividends, underscoring management’s focus on both growth and shareholder returns.

- We’ll now examine how SBA’s stronger-than-expected AFFO and accelerated tower acquisitions may influence its existing investment narrative and future assumptions.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

SBA Communications Investment Narrative Recap

To own SBA Communications, you need to believe that demand for wireless infrastructure and tower colocation will support durable AFFO and dividend growth despite carrier consolidation and alternative technologies. Q3 2025’s stronger-than-expected AFFO and rapid tower expansion slightly strengthen the near term growth catalyst, but do not materially change the key risk around high leverage and refinancing in a higher rate setting.

Among recent announcements, the board’s decision to maintain a US$1.11 quarterly dividend across multiple 2025 declarations stands out in this context, because it ties directly into how SBA balances growth investments, buybacks and shareholder payouts while carrying US$12.6 billion of debt and facing upcoming maturities that could reset at higher interest costs.

Yet even with solid tower growth and steady dividends, investors should be aware that refinancing SBA’s sizeable debt burden could...

Read the full narrative on SBA Communications (it's free!)

SBA Communications' narrative projects $3.1 billion revenue and $1.0 billion earnings by 2028. This requires 4.1% yearly revenue growth and an earnings increase of about $121 million from $878.7 million.

Uncover how SBA Communications' forecasts yield a $235.29 fair value, a 24% upside to its current price.

Exploring Other Perspectives

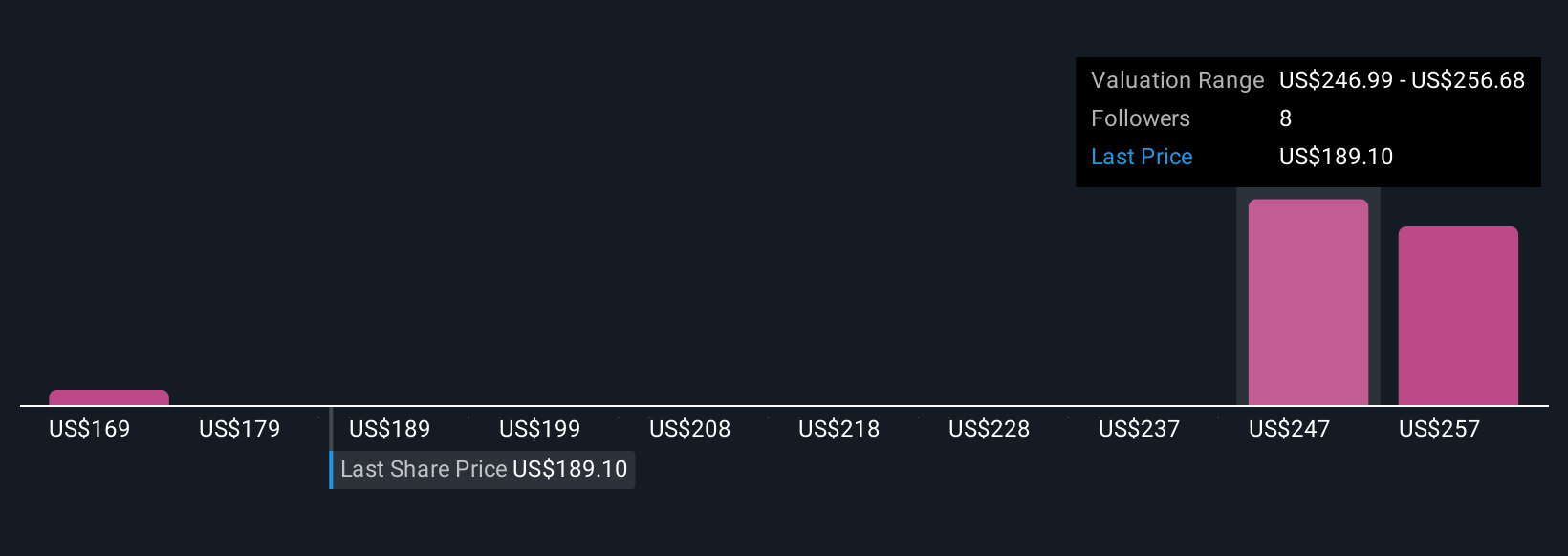

Three Simply Wall St Community fair value estimates for SBA Communications span roughly US$169 to US$235 per share, showing how far apart individual views can be. When you set those opinions against SBA’s sizeable debt load and upcoming refinancing needs, it underscores why many investors look at both upside potential and balance sheet risk before deciding where they stand.

Explore 3 other fair value estimates on SBA Communications - why the stock might be worth as much as 24% more than the current price!

Build Your Own SBA Communications Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SBA Communications research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free SBA Communications research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SBA Communications' overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SBAC

SBA Communications

A leading independent owner and operator of wireless communications infrastructure including towers, buildings, rooftops, distributed antenna systems (DAS) and small cells.

Undervalued with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026