- United States

- /

- Specialized REITs

- /

- NasdaqGS:SBAC

Shareholders May Not Be So Generous With SBA Communications Corporation's (NASDAQ:SBAC) CEO Compensation And Here's Why

CEO Jeff Stoops has done a decent job of delivering relatively good performance at SBA Communications Corporation (NASDAQ:SBAC) recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 13 May 2021. However, some shareholders will still be cautious of paying the CEO excessively.

Check out our latest analysis for SBA Communications

Comparing SBA Communications Corporation's CEO Compensation With the industry

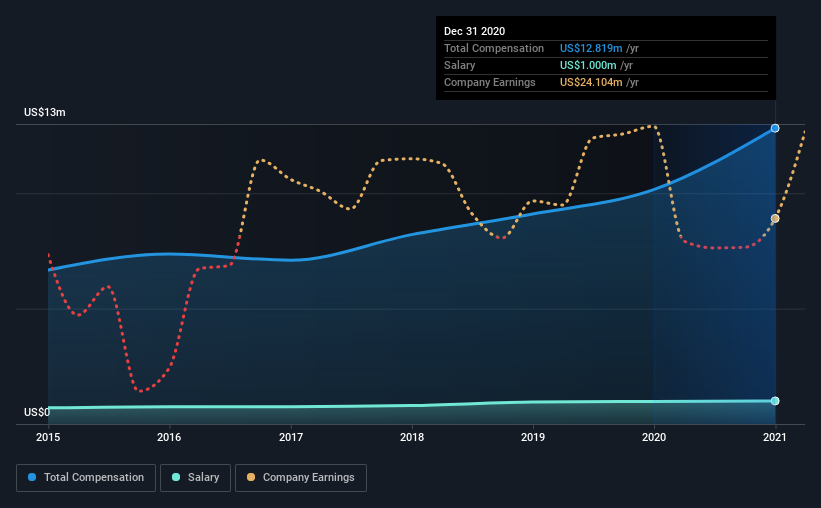

Our data indicates that SBA Communications Corporation has a market capitalization of US$32b, and total annual CEO compensation was reported as US$13m for the year to December 2020. Notably, that's an increase of 26% over the year before. We think total compensation is more important but our data shows that the CEO salary is lower, at US$1.0m.

On comparing similar companies in the industry with market capitalizations above US$8.0b, we found that the median total CEO compensation was US$7.8m. This suggests that Jeff Stoops is paid more than the median for the industry. Furthermore, Jeff Stoops directly owns US$220m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$1.0m | US$980k | 8% |

| Other | US$12m | US$9.2m | 92% |

| Total Compensation | US$13m | US$10m | 100% |

Talking in terms of the industry, salary represented approximately 15% of total compensation out of all the companies we analyzed, while other remuneration made up 85% of the pie. SBA Communications pays a modest slice of remuneration through salary, as compared to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

SBA Communications Corporation's Growth

Its revenue is up 3.7% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's also good to see modest revenue growth, suggesting the underlying business is healthy. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has SBA Communications Corporation Been A Good Investment?

We think that the total shareholder return of 82%, over three years, would leave most SBA Communications Corporation shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. That's why we did our research, and identified 4 warning signs for SBA Communications (of which 2 shouldn't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from SBA Communications, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade SBA Communications, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade SBA Communications, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:SBAC

SBA Communications

A leading independent owner and operator of wireless communications infrastructure including towers, buildings, rooftops, distributed antenna systems (DAS) and small cells.

Solid track record slight.

Similar Companies

Market Insights

Community Narratives