- United States

- /

- Specialized REITs

- /

- NasdaqGS:SBAC

If You Had Bought SBA Communications (NASDAQ:SBAC) Stock Five Years Ago, You Could Pocket A 174% Gain Today

It hasn't been the best quarter for SBA Communications Corporation (NASDAQ:SBAC) shareholders, since the share price has fallen 10% in that time. But that scarcely detracts from the really solid long term returns generated by the company over five years. Indeed, the share price is up an impressive 174% in that time. We think it's more important to dwell on the long term returns than the short term returns. The more important question is whether the stock is too cheap or too expensive today.

See our latest analysis for SBA Communications

Because SBA Communications made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

For the last half decade, SBA Communications can boast revenue growth at a rate of 5.6% per year. That's not a very high growth rate considering the bottom line. So we wouldn't have expected to see the share price to have lifted 22% for each year during that time, but that's what happened. Shareholders should be pretty happy with that, although interested investors might want to examine the financial data more closely to see if the gains are really justified. Some might suggest that the sentiment around the stock is rather positive.

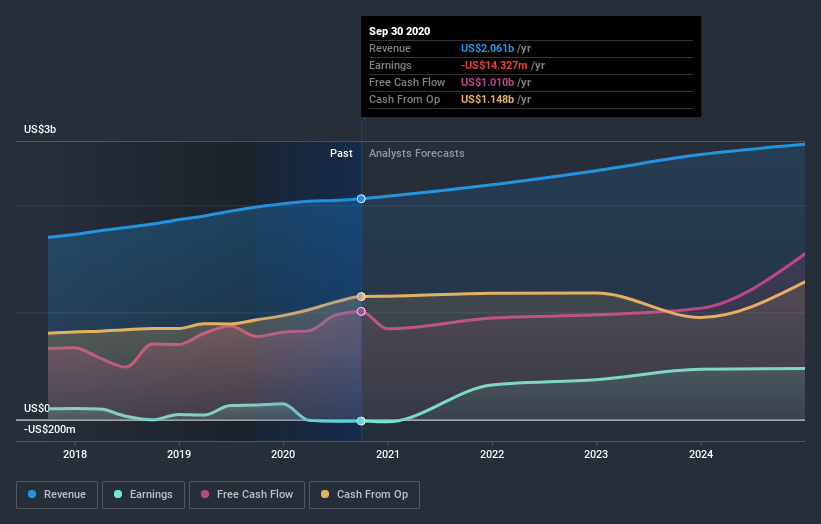

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

SBA Communications is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling SBA Communications stock, you should check out this free report showing analyst consensus estimates for future profits.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, SBA Communications' TSR for the last 5 years was 176%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

SBA Communications shareholders gained a total return of 20% during the year. But that was short of the market average. On the bright side, the longer term returns (running at about 23% a year, over half a decade) look better. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with SBA Communications (at least 1 which is concerning) , and understanding them should be part of your investment process.

We will like SBA Communications better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading SBA Communications or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGS:SBAC

SBA Communications

A leading independent owner and operator of wireless communications infrastructure including towers, buildings, rooftops, distributed antenna systems (DAS) and small cells.

Solid track record slight.

Similar Companies

Market Insights

Community Narratives