- United States

- /

- Retail REITs

- /

- NasdaqGS:REG

Will Analyst Optimism and Lower Short Interest Shift Investor Perception of Regency Centers (REG)?

Reviewed by Sasha Jovanovic

- Regency Centers recently received analyst attention, with Barclays upgrading the company to a buy rating and Truist Securities maintaining its buy rating, alongside adjustments to outlooks.

- An interesting shift is Regency Centers' short interest, which is now well below the average for its peer group, offering a unique indicator of investor sentiment.

- We'll now explore how these analyst upgrades and declining short interest might influence Regency Centers' investment narrative and outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Regency Centers Investment Narrative Recap

Regency Centers shareholders are typically looking for steady, necessity-driven demand from grocery-anchored shopping centers, supported by disciplined growth and stable dividends. The recent analyst upgrades and falling short interest point to strengthening investor sentiment, though these changes are not expected to materially shift the near-term outlook, where tenant health remains the critical catalyst and the potential for tenant bankruptcies continues to be a primary risk for the business.

Of recent company developments, the increase in quarterly common dividends stands out, up 7.1 percent in October 2025, which highlights management's confidence in recurring cash flows and positions the stock as attractive for income-focused investors. Against a backdrop of robust operating results and a focus on high-barrier-to-entry markets, investors watching for growth in recurring earnings may view this announcement as a key indicator of short-term catalyst momentum.

However, it's worth noting that despite strong fundamentals, the risk of tenant bankruptcies remains and any change in tenant stability is information every investor should...

Read the full narrative on Regency Centers (it's free!)

Regency Centers is projected to reach $1.7 billion in revenue and $506.7 million in earnings by 2028. This outlook requires 2.3% annual revenue growth and a $116.8 million increase in earnings from current earnings of $389.9 million.

Uncover how Regency Centers' forecasts yield a $80.05 fair value, a 13% upside to its current price.

Exploring Other Perspectives

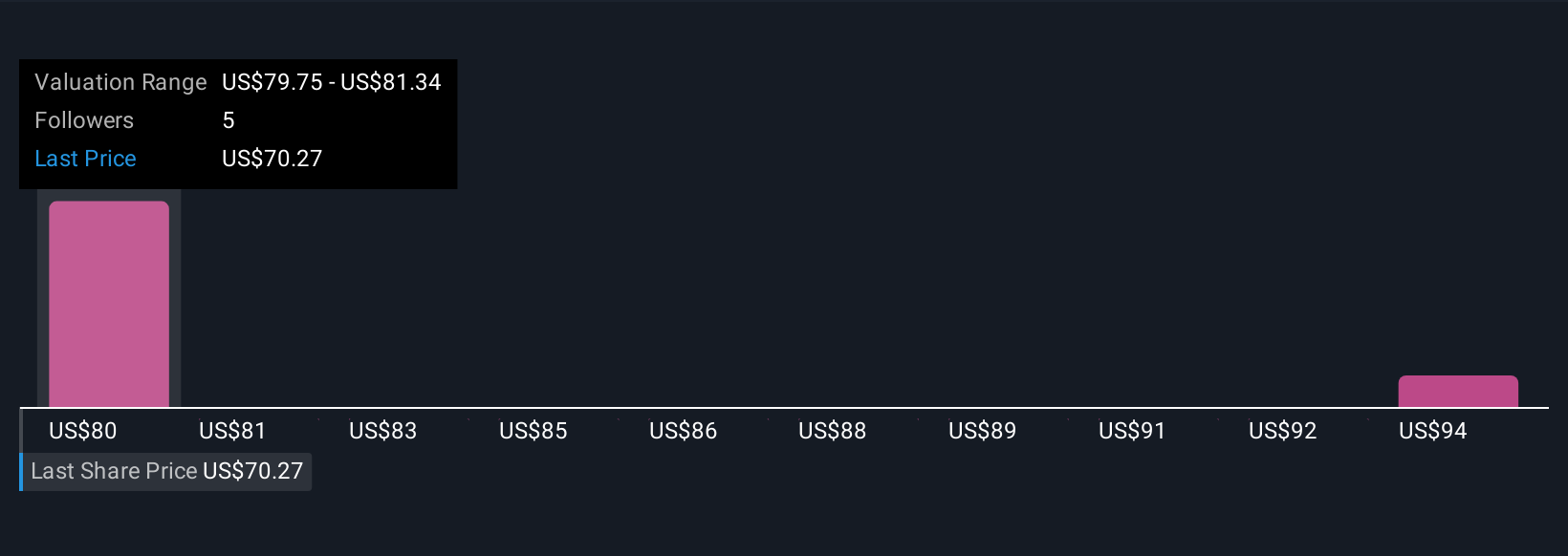

Two community members on Simply Wall St estimate Regency Centers’ fair value between US$80.05 and US$97.30 per share. With this wide spread, keep in mind that sustained tenant demand, critical to the company’s cash flow, remains top of mind for many investors seeking multiple viewpoints.

Explore 2 other fair value estimates on Regency Centers - why the stock might be worth just $80.05!

Build Your Own Regency Centers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Regency Centers research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Regency Centers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Regency Centers' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:REG

Regency Centers

Regency Centers is a preeminent national owner, operator, and developer of shopping centers located in suburban trade areas with compelling demographics.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives