- United States

- /

- Retail REITs

- /

- NasdaqGS:PECO

Phillips Edison (PECO): Evaluating Value After Mixed Momentum and Long-Term Outperformance

Reviewed by Simply Wall St

See our latest analysis for Phillips Edison.

Momentum for Phillips Edison has been mixed, with the share price recently rebounding a bit but remaining down 6.2% year-to-date. While the one-year total shareholder return shows a decline of 8.3%, the stock’s three-year total return is up 21%, highlighting that long-term holders have still come out ahead.

If you’re looking to spot the next potential outperformers, now is a good time to broaden your search and discover fast growing stocks with high insider ownership

With shares currently trading at a notable discount to analyst targets and underlying fundamentals showing growth, the key question is whether Phillips Edison is genuinely undervalued or if the market has already accounted for future gains. Does this present a true buying opportunity, or is everything already priced in?

Most Popular Narrative: 11.6% Undervalued

The latest narrative sees Phillips Edison’s fair value estimated at $39.18, nicely above the last close of $34.65. This is an optimistic gap, but one based on bold long-term forecasts.

Active portfolio recycling and disciplined acquisitions of high-growth, grocery-anchored properties—often below replacement cost and at 6%+ cap rates with 9%+ target IRRs—enhance asset quality and earnings potential. Cash acquisitions and low leverage (5.4x EBITDAre, 5.7 years weighted avg. maturity, 95% fixed-rate debt) allow for opportunistic external growth without the need for dilutive equity issuance, supporting long-term FFO/EPS expansion.

Want to know what ambitious numbers set this fair value apart? This narrative banks on a unique blend of recurring income, net margin boosts, and a future profit multiple you’d expect from a sector leader. The drivers behind this price target may surprise you. Peel back the layers to see which key assumptions fuel these projections.

Result: Fair Value of $39.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing shifts toward online shopping and persistently high inflation could quickly weaken Phillips Edison’s growth outlook if these headwinds intensify.

Find out about the key risks to this Phillips Edison narrative.

Another View: Earnings Multiple Tells a Different Story

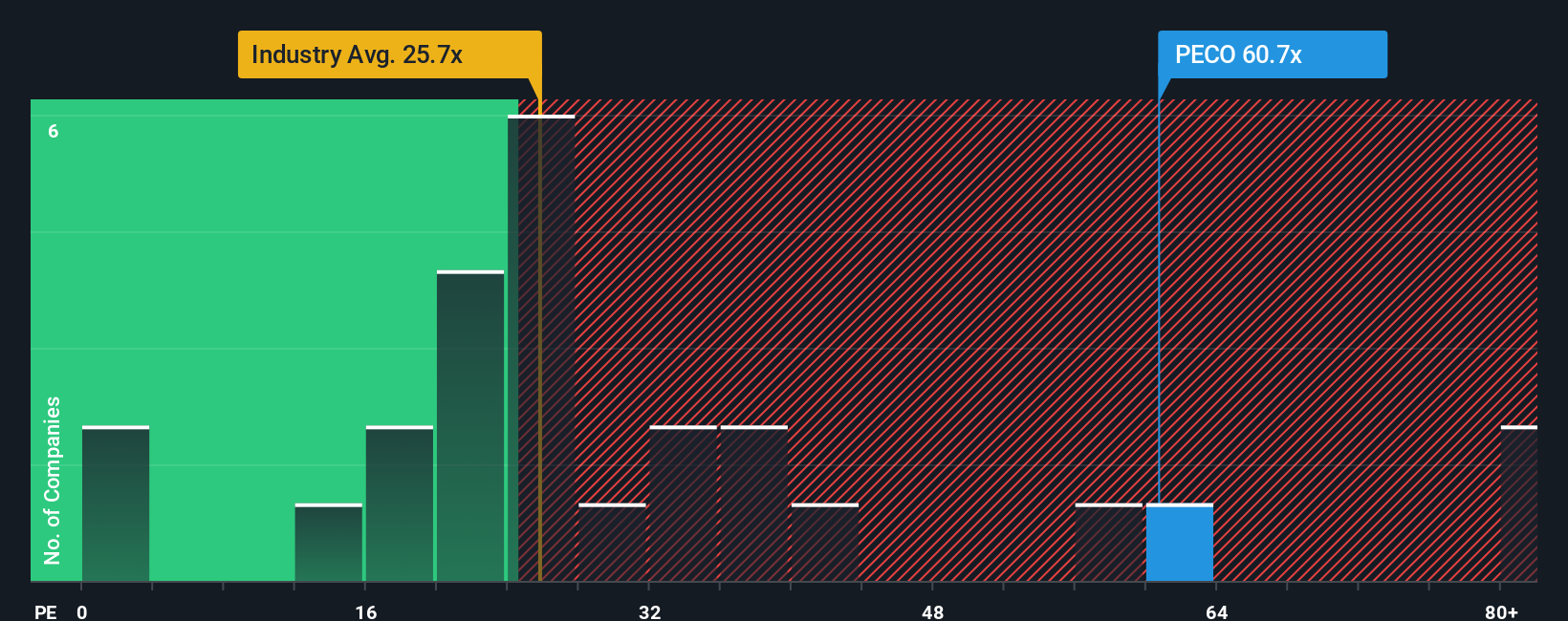

While the latest fair value points to Phillips Edison being undervalued, the current market price implies a price-to-earnings ratio of 53.2x. This is well above both the US Retail REITs industry average of 26.4x, the peer average of 29.1x, and also exceeds the fair ratio of 34.2x. Such a high ratio may signal investors are overlooking potential risks, or that the company's growth prospects are receiving considerable credit. If the market sentiment shifts, could this premium come under pressure?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Phillips Edison Narrative

If you see things differently or want to dig deeper on your own terms, it’s never been easier to analyze the data and shape your own view in just a few minutes. Do it your way

A great starting point for your Phillips Edison research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Winning Investment Ideas?

Smart investors never limit themselves to just one stock. Take the next step and find your next portfolio standout with these tailored picks on Simply Wall Street.

- Capture the next wave of artificial intelligence breakthroughs and spot tomorrow’s tech leaders with these 24 AI penny stocks.

- Lock in income potential and stability by seeking out these 16 dividend stocks with yields > 3%, which offers robust yields and a track record of rewarding shareholders.

- Leap ahead of the mainstream by targeting these 26 quantum computing stocks, a group pioneering advancements in quantum computing for real world impact.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PECO

Phillips Edison

Phillips Edison & Company, Inc. (“PECO”) is one of the nation’s largest owners and operators of high-quality, grocery-anchored neighborhood shopping centers.

Solid track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives