- United States

- /

- Real Estate

- /

- NasdaqGS:OPEN

Opendoor Technologies (NASDAQ:OPEN) Still Burns a Lot of Cash

Opendoor Technologies ( NASDAQ:OPEN ) delivered an earnings surprise a few days ago. While still operating at a loss, it was much lower than anticipated.

However, looking at the 12-month trailing cash burn leaves us a bit less optimistic. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth.

Company Overview

Opendoor Technologies is an Arizona-based real estate digital platform. It launched in 2014 and went public in 2020 through a reverse merger with a special purpose acquisition company (SPAC). Over the last 7 years, the company brokered over 90,000 homes in 27 U.S markets. Its current market cap is at US$10.6b

Compared to the traditional real estate agent business model, Opendoor innovates by purchasing the home directly from a seller by using an AI-driven assessment to make an initial offer. Upon further inspection, the deal can close as fast as 3 days. Then, the company looks to improve the property before reselling it through its network.

Recent Earnings Results

- Q2 GAAP EPS: -US$0.24 (beat by US$0.10)

- Revenue: US$1.2b (beat by US$110m)

- Q3 Guidance: US$1.8b to US$1.9b (consensus US$1.62b)

The CEO Eric Wu noted that the company purchased 8,494 homes, a 136% increase from the first quarter. He remains optimistic about exceeding the 2023 targets he set at the time of the stock listing.

View our latest analysis for Opendoor Technologies

Does Opendoor Technologies Have A Long Cash Runway?

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash.

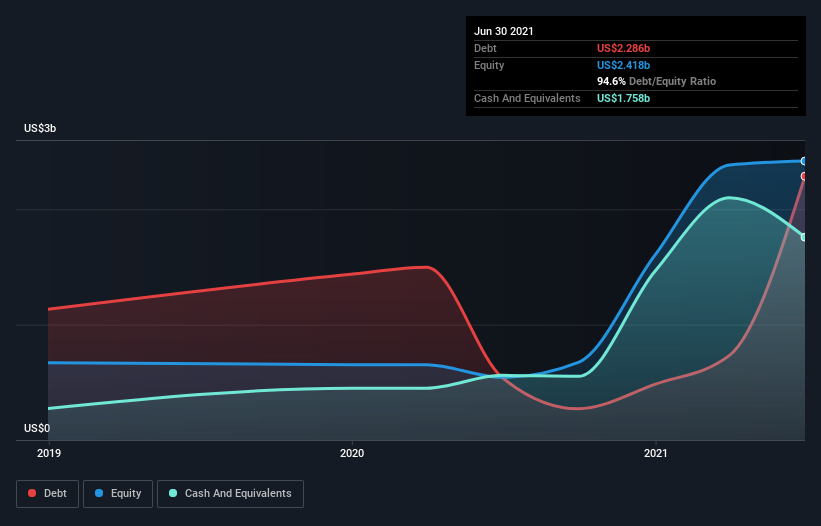

Opendoor Technologies has such a small amount of debt that we'll set it aside and focus on the US$1.8b in cash it held in June 2021. Importantly, its cash burn was US$2.6b over the trailing twelve months.That means it had a cash runway of around 8 months as of June 2021.

This kind of short runway puts us on edge, as it indicates the company must reduce its cash burn significantly or else raise cash imminently. However, we should note that if we extrapolate recent trends in its cash burn, then its cash runway would get a lot longer.The image below shows how its cash balance has been changing over time.

Is Opendoor Technologies' Revenue Growing?

Given that Opendoor Technologies actually had positive free cash flow last year, before burning cash this year, we'll focus on its operating revenue to get a measure of the business trajectory.

Unfortunately, the last year has been a disappointment, with operating revenue dropping 44% during the period.However, the crucial factor is whether the company will grow its business in the future. So you might want to take a peek at how much the company is expected to grow in the next few years .

How Hard Would It Be For Opendoor Technologies To Raise More Cash For Growth?

Since its revenue growth is moving in the wrong direction, Opendoor Technologies shareholders may wish to think ahead to when the company may need to raise more cash.Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business.Many companies end up issuing new shares to fund future growth.By looking at a company's cash burn relative to its market capitalization, we understand how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Opendoor Technologies has a market capitalization of US$11b and burnt through US$2.6b last year, which is 24% of the company's market value.

That's not insignificant, and if the company had to sell enough shares to fund another year's growth at the current share price, you'd likely witness fairly costly dilution.

How Risky Is Opendoor Technologies' Cash Burn Situation?

We must admit that we don't think Opendoor Technologies is in a strong position regarding its cash burn.While the positive development in revenue might help the cause, the company has started to deal with more expensive real estate, leaving less margin for error.

After looking at that range of measures, we think shareholders should be highly attentive to how the company uses its cash, as the cash burn makes us uncomfortable. An in-depth examination of risks revealed 3 warning signs for Opendoor Technologies that readers should consider before committing capital to this stock.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:OPEN

Opendoor Technologies

Operates a digital platform for residential real estate transactions in the United States.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.