- United States

- /

- Real Estate

- /

- NasdaqGS:OPEN

Increasing losses over year doesn't faze Opendoor Technologies (NASDAQ:OPEN) investors as stock ascends 6.3% this past week

It's not a secret that every investor will make bad investments, from time to time. But serious investors should think long and hard about avoiding extreme losses. So spare a thought for the long term shareholders of Opendoor Technologies Inc. (NASDAQ:OPEN); the share price is down a whopping 77% in the last twelve months. That'd be enough to make even the strongest stomachs churn. Opendoor Technologies hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. More recently, the share price has dropped a further 41% in a month. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

Although the past week has been more reassuring for shareholders, they're still in the red over the last year, so let's see if the underlying business has been responsible for the decline.

View our latest analysis for Opendoor Technologies

Because Opendoor Technologies made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Opendoor Technologies grew its revenue by 94% over the last year. That's a strong result which is better than most other loss making companies. So the hefty 77% share price crash makes us think the company has somehow offended market participants. There's clearly something unusual going on here such as an acquisition that hasn't delivered expected profits. What is clear is that the market is not judging the company on its revenue growth right now. Of course, investors do over-react when they are stressed out, so the sell-off could be unjustifiably severe.

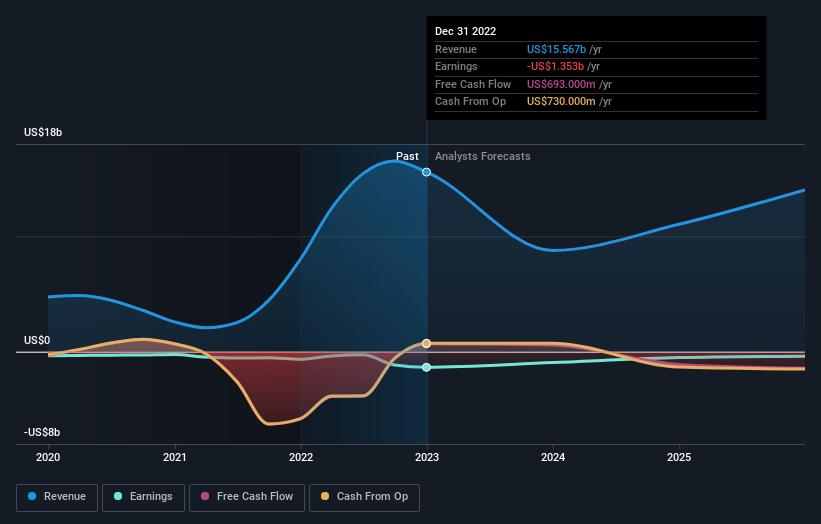

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. You can see what analysts are predicting for Opendoor Technologies in this interactive graph of future profit estimates.

A Different Perspective

We doubt Opendoor Technologies shareholders are happy with the loss of 77% over twelve months. That falls short of the market, which lost 6.1%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. Putting aside the last twelve months, it's good to see the share price has rebounded by 8.5%, in the last ninety days. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). It's always interesting to track share price performance over the longer term. But to understand Opendoor Technologies better, we need to consider many other factors. For example, we've discovered 3 warning signs for Opendoor Technologies (1 doesn't sit too well with us!) that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:OPEN

Opendoor Technologies

Operates a digital platform for residential real estate transactions in the United States.

Adequate balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives