- United States

- /

- Industrial REITs

- /

- NasdaqGS:LINE

Lineage (LINE): Valuation in Focus as Analyst Outlook and Earnings Anticipation Shape Investor Sentiment

Reviewed by Simply Wall St

Lineage (LINE) shares are in focus after management's cautious tone last quarter and sector challenges highlighted by recent analyst commentary. With third-quarter earnings due on November 5, investors are keeping a close watch on upcoming results.

See our latest analysis for Lineage.

After a turbulent year for the broader cold storage sector, Lineage’s share price has struggled to find stable ground. Despite a brief uptick today, momentum remains shaky. The year-to-date share price return stands at -33.14%, and the total shareholder return over the past year is a striking -44.95%. This pricing reflects persistent worries about sector headwinds and adjusted guidance, even as the CFO transition adds another layer of focus ahead of upcoming results.

If you’re curious where else opportunity might be building while Lineage’s outlook shakes out, it’s worth broadening your search and checking out fast growing stocks with high insider ownership

With shares trading at a notable discount to analyst targets and a new CFO set to join, the question remains: is the recent pessimism already reflected in Lineage’s valuation, or could there be a buying opportunity as markets digest possible growth ahead?

Price-to-Sales of 1.7x: Is it justified?

Lineage currently trades at a price-to-sales ratio of just 1.7x, well below both peer and sector averages. At the last close of $39.02, the stock stands out as notably undervalued on this basis.

The price-to-sales ratio shows how much investors are willing to pay per dollar of revenue. This metric is particularly useful for companies like Lineage that are still unprofitable. A lower ratio can indicate that the market has lower growth expectations or is wary of near-term earnings volatility.

Compared to the global industrial REITs industry average of 8.8x and peer average of 10.6x, Lineage’s ratio signals a major discount. Even when measured against the estimated fair price-to-sales ratio of 2.5x, the company appears attractively valued and could see a reversal if market sentiment shifts or fundamentals improve.

Explore the SWS fair ratio for Lineage

Result: Price-to-Sales of 1.7x (UNDERVALUED)

However, continued revenue growth may not offset persistent net losses. Confidence could decline further if sector headwinds intensify this quarter.

Find out about the key risks to this Lineage narrative.

Another View: What Does Our DCF Model Say?

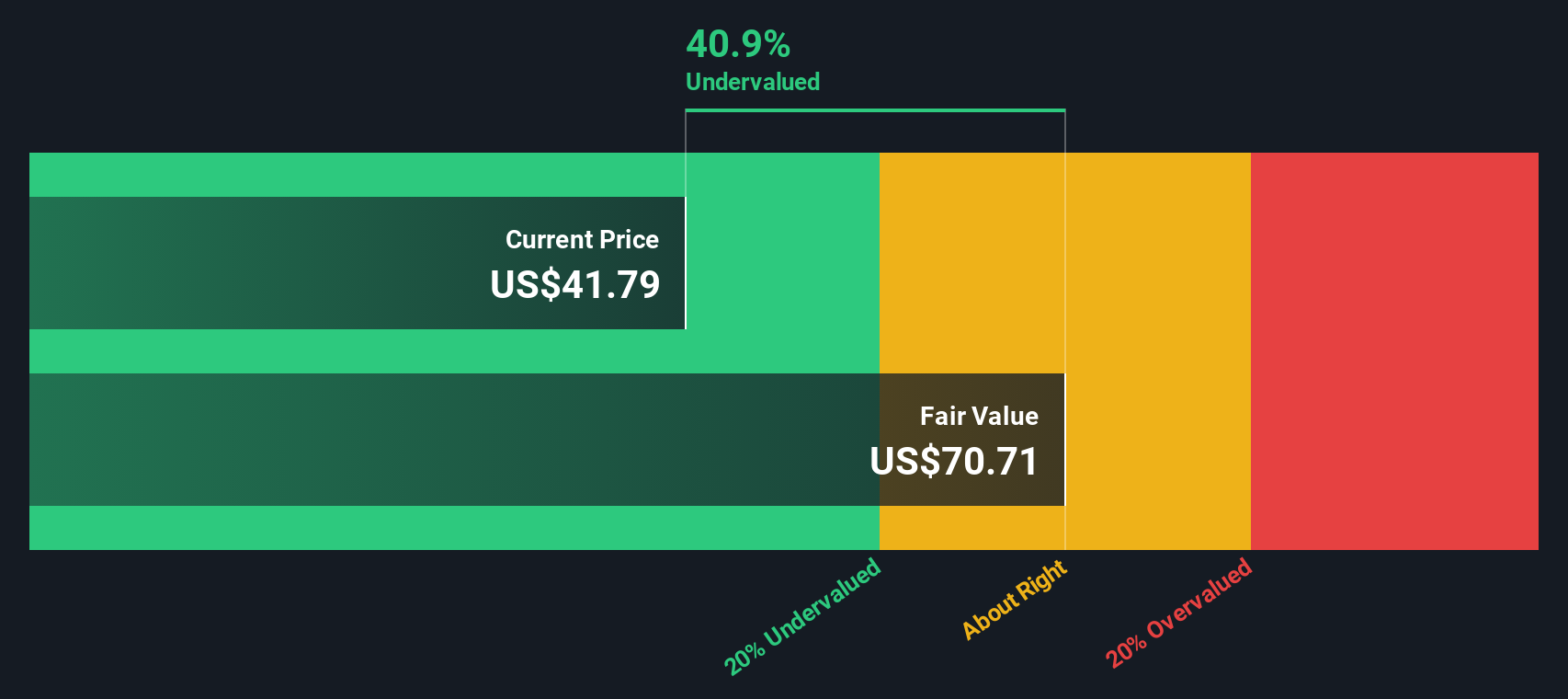

Looking at Lineage through the lens of our SWS DCF model provides a different perspective. This approach estimates the company’s fair value at $67.96 per share and suggests the current price of $39.02 leaves significant upside. But does this mean the market is really missing something, or is caution about ongoing losses justified?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Lineage for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 850 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Lineage Narrative

If you have a different perspective or want to see where your own analysis leads, you can build your own interpretation quickly and easily. Do it your way

A great starting point for your Lineage research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Tapping into new opportunities could be the smartest move you make today. Uncover leading trends and hidden winners that go beyond a single stock’s story.

- Tap into fast-growing digital assets by checking out these 81 cryptocurrency and blockchain stocks, which are poised to transform the future of finance and blockchain solutions.

- Harness steady cash flow with these 23 dividend stocks with yields > 3%, which offers reliable yields above 3% that could boost your portfolio’s income potential right now.

- Seize the edge in innovation and automation by targeting these 26 AI penny stocks, focusing on artificial intelligence breakthroughs and strong growth momentum.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LINE

Lineage

Lineage, Inc. (NASDAQ: LINE) is the world’s largest global temperature-controlled warehouse REIT with a network of over 485 strategically located facilities totaling approximately 88 million square feet and approximately 3.1 billion cubic feet of capacity across countries in North America, Europe, and Asia-Pacific.

Undervalued second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives