- United States

- /

- Industrial REITs

- /

- NasdaqGS:LINE

How Could Advanced AI Partnerships Shape Lineage's (LINE) Competitive Edge in Logistics Innovation?

Reviewed by Simply Wall St

- Earlier this week, Cognizant announced the expansion of its partnership with Lineage, Inc. to drive customer service transformation, introducing Agentic AI technologies and enhanced service models within Lineage's cold chain logistics operations.

- This initiative highlights Lineage's commitment to streamlined solutions and the preservation of trusted client relationships amid a broader push for digital innovation in customer care.

- We'll explore how integrating advanced AI-powered customer service tools could shape Lineage's investment narrative moving forward.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

What Is Lineage's Investment Narrative?

For anyone considering Lineage, Inc. as a potential investment, the big picture hinges on a belief that the company's improvements in customer care and digital innovation can help it bridge persistent profit challenges and capitalize on its low relative valuation. The newly announced enhanced partnership with Cognizant may offer a short-term catalyst, signaling a meaningful attempt to drive service quality and operational efficiency, which could help address recent concerns around stagnant sales and ongoing losses. However, while the initial market reaction was positive, it's not yet clear whether these changes will materially accelerate financial recovery or resolve core profitability risks. With a sizable new debt issuance and board inexperience among ongoing concerns, the integration of advanced AI solutions could shift investor attention toward execution: translating service improvements into sustained earnings growth remains the key hurdle.

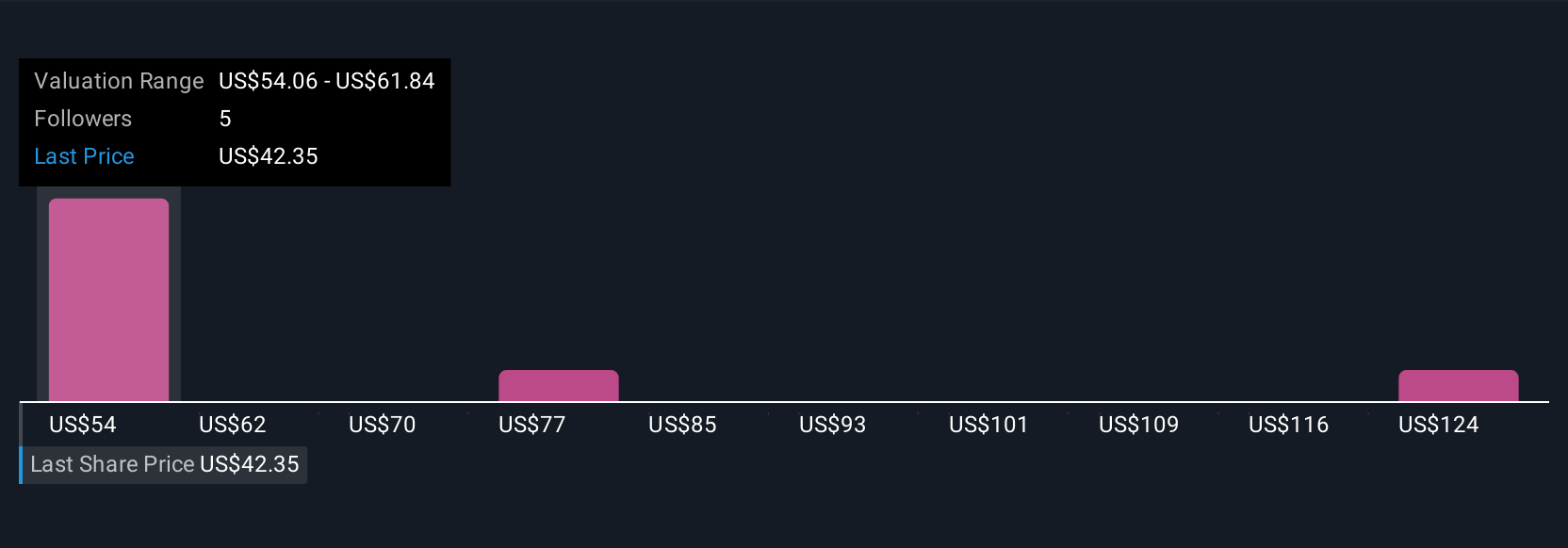

But despite positive innovation, board inexperience is an ongoing concern investors should be aware of. Lineage's shares have been on the rise but are still potentially undervalued by 44%. Find out what it's worth.Exploring Other Perspectives

Explore 3 other fair value estimates on Lineage - why the stock might be worth just $54.06!

Build Your Own Lineage Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lineage research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Lineage research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lineage's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LINE

Lineage

Lineage, Inc. (NASDAQ: LINE) is the world’s largest global temperature-controlled warehouse REIT with a network of over 485 strategically located facilities totaling approximately 86 million square feet and approximately 3.1 billion cubic feet of capacity across countries in North America, Europe, and Asia-Pacific.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives