- United States

- /

- Specialized REITs

- /

- NasdaqGS:LAMR

Does Lamar (LAMR) Ending Its Buyback Program Hint at a Shift in Growth Priorities?

Reviewed by Sasha Jovanovic

- Lamar Advertising Company recently reported its third quarter and nine-month results, with third quarter sales rising to US$585.54 million and net income slightly down at US$141.75 million compared to the prior year.

- Additionally, the company completed its share buyback program announced in May 2020, having repurchased 1,388,091 shares for US$150 million, but reported no repurchases during the July to September 2025 period.

- We'll assess how the combination of higher sales and a completed buyback program impacts Lamar Advertising’s investment outlook and growth factors.

Find companies with promising cash flow potential yet trading below their fair value.

Lamar Advertising Investment Narrative Recap

To own shares of Lamar Advertising, investors need to believe in the company's ability to grow its out-of-home advertising presence, especially its digital billboards, while maintaining reliable local and regional ad sales. The latest results, featuring higher sales but a modest dip in quarterly net income and the conclusion of its share buyback program, do not appear to materially shift the main short-term catalyst: continued digital expansion and improved digital board performance. The biggest existing risk remains any signs of softening revenue growth or weakness from specific advertiser categories, which have not been significantly addressed by the recent news flow.

Of the recent announcements, Lamar’s completion of its multi-year US$150 million buyback is most relevant here. While buybacks can offer support to share price and signal management confidence, the absence of additional repurchases in the latest quarter may prompt closer scrutiny given ongoing margin pressures and a need to demonstrate operating leverage, especially as attention turns to digital revenue growth as a primary driver.

By contrast, investors should be aware that ongoing volatility in certain advertising segments and contract renewals could weigh on near-term results if conditions worsen...

Read the full narrative on Lamar Advertising (it's free!)

Lamar Advertising's narrative projects $2.5 billion revenue and $723.9 million earnings by 2028. This requires 3.7% yearly revenue growth and a $284.9 million increase in earnings from $439.0 million today.

Uncover how Lamar Advertising's forecasts yield a $133.80 fair value, a 5% upside to its current price.

Exploring Other Perspectives

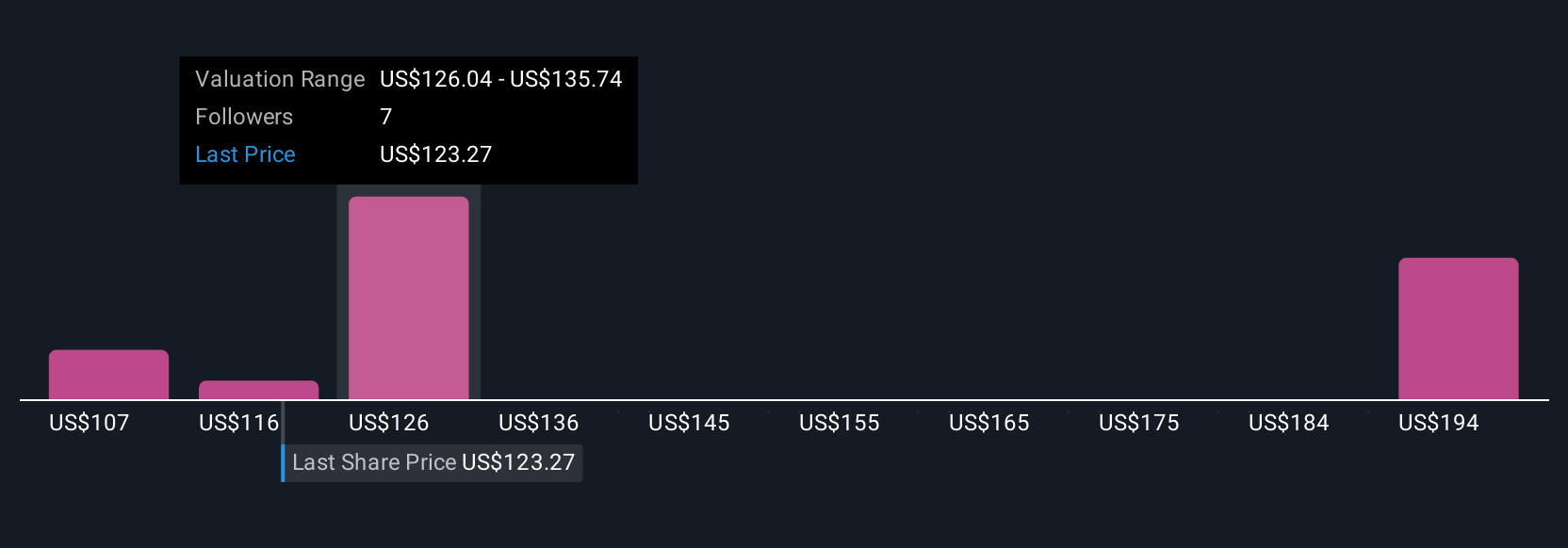

Across four fair value estimates from the Simply Wall St Community, opinions on Lamar’s worth range from US$106.64 to US$202.84 per share. While optimism is seen around accelerating digital expansion, recent earnings softness shows why market participants can arrive at widely different assessments of future performance and value.

Explore 4 other fair value estimates on Lamar Advertising - why the stock might be worth as much as 59% more than the current price!

Build Your Own Lamar Advertising Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lamar Advertising research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Lamar Advertising research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lamar Advertising's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LAMR

Lamar Advertising

Founded in 1902, Lamar Advertising (Nasdaq: LAMR) is one of the largest outdoor advertising companies in North America, with over 362,000 displays across the United States and Canada.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives