- United States

- /

- Specialized REITs

- /

- NasdaqGS:LAMR

Introducing Lamar Advertising Company (REIT) (NASDAQ:LAMR), A Stock That Climbed 54% In The Last Five Years

When we invest, we're generally looking for stocks that outperform the market average. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. For example, the Lamar Advertising Company (REIT) (NASDAQ:LAMR) share price is up 54% in the last 5 years, clearly besting than the market return of around 39% (ignoring dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 11% in the last year, including dividends.

View our latest analysis for Lamar Advertising Company (REIT)

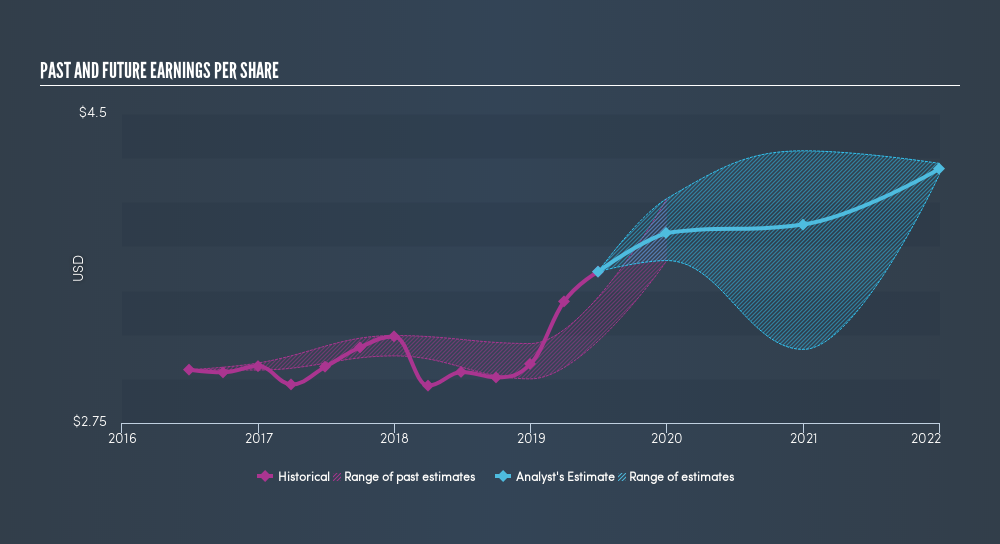

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Lamar Advertising Company (REIT) achieved compound earnings per share (EPS) growth of 56% per year. This EPS growth is higher than the 9.0% average annual increase in the share price. So it seems the market isn't so enthusiastic about the stock these days.

We know that Lamar Advertising Company (REIT) has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Lamar Advertising Company (REIT) the TSR over the last 5 years was 97%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's nice to see that Lamar Advertising Company (REIT) shareholders have received a total shareholder return of 11% over the last year. Of course, that includes the dividend. However, the TSR over five years, coming in at 15% per year, is even more impressive. If you would like to research Lamar Advertising Company (REIT) in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

Of course Lamar Advertising Company (REIT) may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:LAMR

Lamar Advertising

Operates as an outdoor advertising company in the United States and Canada.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives