- United States

- /

- Industrial REITs

- /

- NasdaqGS:ILPT

Industrial Logistics Properties Trust (ILPT): Losses Deepen 41.5% Per Year, Testing Value Narrative

Reviewed by Simply Wall St

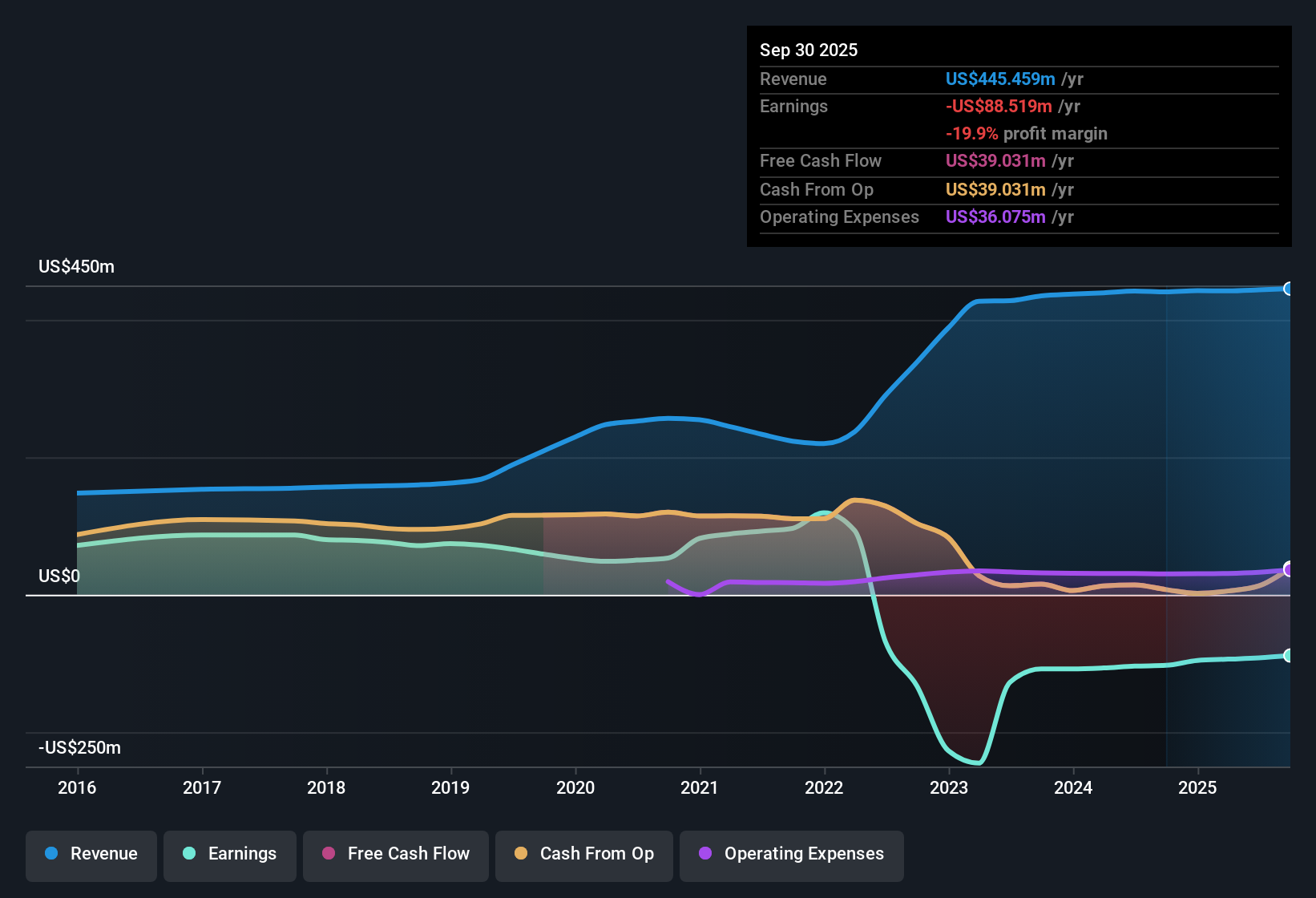

Industrial Logistics Properties Trust (ILPT) has seen losses deepen over the past five years, with annual losses increasing by 41.5%. The company remains unprofitable and is expected to continue operating at a loss for at least the next three years. Revenue is forecasted to grow at 3.1% per year, which trails the US market average of 10.2%. As a result, investors face a mix of recognized value given a price-to-sales ratio of 0.8x and a share price of $5.26, which is below the estimated fair value of $7.43, weighed against continued risks to profitability and uncertain dividend sustainability.

See our full analysis for Industrial Logistics Properties Trust.Now, let's see how the latest results hold up when compared to the narratives circulating in the market. Some expectations might be confirmed, while others could be challenged by what the numbers reveal.

See what the community is saying about Industrial Logistics Properties Trust

Leverage Remains Elevated at 69.9%

- Industrial Logistics Properties Trust’s net debt to total assets ratio stands at a high 69.9%, underlining that most of the company’s asset value is backed by debt rather than equity.

- Analysts' consensus view highlights that such heavy leverage heightens the company’s sensitivity to rising interest rates and tighter lending conditions.

- If refinancing costs increase or asset sales meet resistance, pressure could build on earnings and net income, especially with $1.4 billion in floating-rate joint venture loans maturing in 2026 and 2027.

- Bears cite this financial structure as a real risk, suggesting ILPT may face forced asset sales or lower cash flow if macro credit conditions worsen or properties do not lease up quickly.

Portfolio Boasts 94.3% Occupancy and 7.6-Year Lease Terms

- The company’s industrial portfolio achieves 94.3% occupancy and an average lease term of 7.6 years, both above the national average for the sector.

- Analysts' consensus view underscores that strong leasing performance and a long weighted-average lease term underpin predictable cash flow and may support revenue expansion.

- The heavy exposure to investment-grade tenants reduces day-to-day cash flow volatility, while limited near-term lease expiries (just 3.6% in the next 12 months) further support stability.

- Consensus expects these dynamics to help ILPT capitalize on continued logistics sector strength, but warns that regional concentration in Hawaii, which accounts for 76% of revenues, could expose the portfolio to local economic and environmental risks.

Valuation Discount: 0.8x Price-to-Sales vs. Peer Average of 5.1x

- ILPT trades at a price-to-sales ratio of 0.8x, substantially below peers (5.1x) and the industry average (8.9x), with its current share price of $5.26 also below both the analyst price target ($6.85) and DCF fair value ($7.43).

- Analysts' consensus view points out that such a remarkable valuation gap could attract investors seeking value, yet cautions that persistent unprofitability and uncertain dividend sustainability remain headwinds.

- The consensus notes that while strong leasing metrics and proactive refinancing boost the long-term story, the deep valuation discount may only narrow if ILPT proves it can return to sustainable profitability or improve free cash flows.

- Compared to a projected profit margin rebound from -20.7% to an industry average of 31.0% by 2028, the stock’s low valuation reflects ongoing skepticism about delivering those gains.

If you want to see how the consensus view stacks up against the latest numbers and what factors could sway the story next, check out the full consensus narrative for deeper insights. 📊 Read the full Industrial Logistics Properties Trust Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Industrial Logistics Properties Trust on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the results? Quickly transform your unique perspective into a personal narrative in just a few minutes. Do it your way

A great starting point for your Industrial Logistics Properties Trust research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite solid leasing and occupancy metrics, Industrial Logistics Properties Trust faces persistent losses and high financial leverage. This makes the company sensitive to rising interest rates and refinancing risks.

If you’d prefer companies with stronger balance sheets and less debt risk, use our solid balance sheet and fundamentals stocks screener (1980 results) to discover businesses that prioritize financial health and can better handle uncertain markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ILPT

Industrial Logistics Properties Trust

ILPT is a real estate investment trust focused on owning and leasing high quality industrial and logistics properties.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026