- United States

- /

- Hotel and Resort REITs

- /

- NasdaqGS:HST

Host Hotels & Resorts (HST): Valuation Insights After Earnings Beat and Upgraded Full-Year Outlook

Reviewed by Simply Wall St

Host Hotels & Resorts (HST) reported quarterly results that beat expectations, followed by a boost to its financial guidance for the rest of the year. This signals stronger performance and optimistic projections ahead.

See our latest analysis for Host Hotels & Resorts.

Momentum is building for Host Hotels & Resorts, with its share price climbing over 8% in the past month and a year-to-date gain following several upbeat milestones, including better-than-expected Q3 earnings, a new round of senior notes, and upgraded growth guidance. The 1-year total shareholder return of 7.7% and 47.5% over five years show the stock rewarding patient investors, which suggests confidence in both its near-term and long-term story.

If news of Host’s upgraded outlook got you thinking about other opportunities, now’s the perfect time to discover fast growing stocks with high insider ownership

Yet with Host Hotels & Resorts showing rising momentum and a stronger outlook, investors may wonder if the current valuation is still attractive or if these gains are already built into the price. Is there a buying opportunity, or is the market pricing in all future growth?

Most Popular Narrative: 6.7% Undervalued

With the narrative fair value at $18.86 versus Host Hotels & Resorts’ recent close at $17.59, analysts currently see upside ahead. This may be a positive signal for value-focused investors sizing up the runway left after recent gains.

The company's strategic focus on upgrading and repositioning premium assets in top markets, exemplified by substantial ROI from major renovations and development projects, continues to enhance RevPAR index and property values. This signals a strong runway for RevPAR-led earnings growth as consumer demand for high-end urban and resort experiences rises.

Curious how aggressive asset upgrades and bold reinvestment plans are shaping the math behind this price target? The narrative leans on forward-thinking moves and rising margins. But do you know which key assumptions tip the scales? Unlock the full story to find out what drives this valuation.

Result: Fair Value of $18.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent challenges in business travel demand and rising capital expenditures could have a negative impact on Host Hotels & Resorts' future revenue growth and profit margins.

Find out about the key risks to this Host Hotels & Resorts narrative.

Another View: Market Ratios Offer a Different Perspective

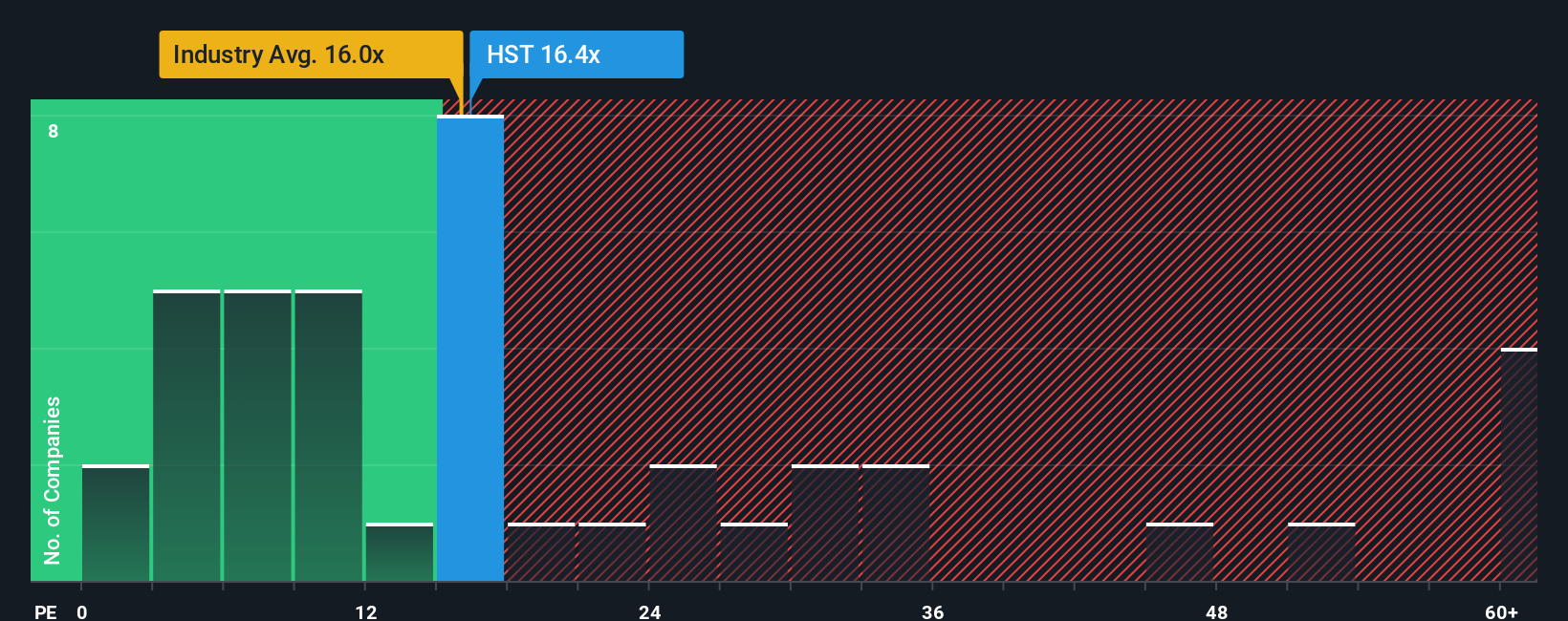

Looking at market ratios provides a less optimistic take. Host Hotels & Resorts trades at a price-to-earnings of 16.4x, which is above the sector average of 15.8x, but below the peer average of 24.5x. Compared to a fair ratio of 29.9x, this leaves room for debate. Could the market be overestimating or underestimating future growth, and what does this mean for value investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Host Hotels & Resorts Narrative

If you see the numbers differently or want to dig deeper yourself, you can run your own analysis and craft a narrative in just a few minutes. Do it your way

A great starting point for your Host Hotels & Resorts research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for one opportunity. Get ahead by targeting unique stocks that fit your strategy with the right tools and research at your fingertips.

- Uncover hidden potential among undervalued companies by tracking these 886 undervalued stocks based on cash flows, which are poised for strong returns based on their cash flow fundamentals.

- Turbocharge your portfolio with growth by following these 25 AI penny stocks, which are pushing boundaries in artificial intelligence, automation, and next-generation data innovation.

- Secure reliable income streams by analyzing these 16 dividend stocks with yields > 3%, which offer consistent yields greater than 3% and the financial resilience to keep rewarding shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Host Hotels & Resorts might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HST

Host Hotels & Resorts

An S&P 500 company and is the largest lodging real estate investment trust and one of the largest owners of luxury and upper-upscale hotels.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives