- United States

- /

- Specialized REITs

- /

- NasdaqGS:FRMI

Fermi (FRMI) Is Up 44.3% After Securing Major Nuclear Partnerships and Incentives for Project Matador

Reviewed by Sasha Jovanovic

- Fermi America announced a series of transformative partnerships, including long-term nuclear supply and engineering agreements with Doosan Enerbility and Hyundai Engineering & Construction, to advance its 11GW Project Matador private energy campus in Texas and secured key water and tax incentives from local government bodies.

- These developments uniquely position Fermi as a central player in the emerging intersection of energy infrastructure and AI data center growth, combining public and private support to accelerate U.S. energy and technology ambitions.

- We'll explore how Fermi’s nuclear collaborations strengthen its investment narrative and support its drive to power next-generation AI campuses.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Fermi's Investment Narrative?

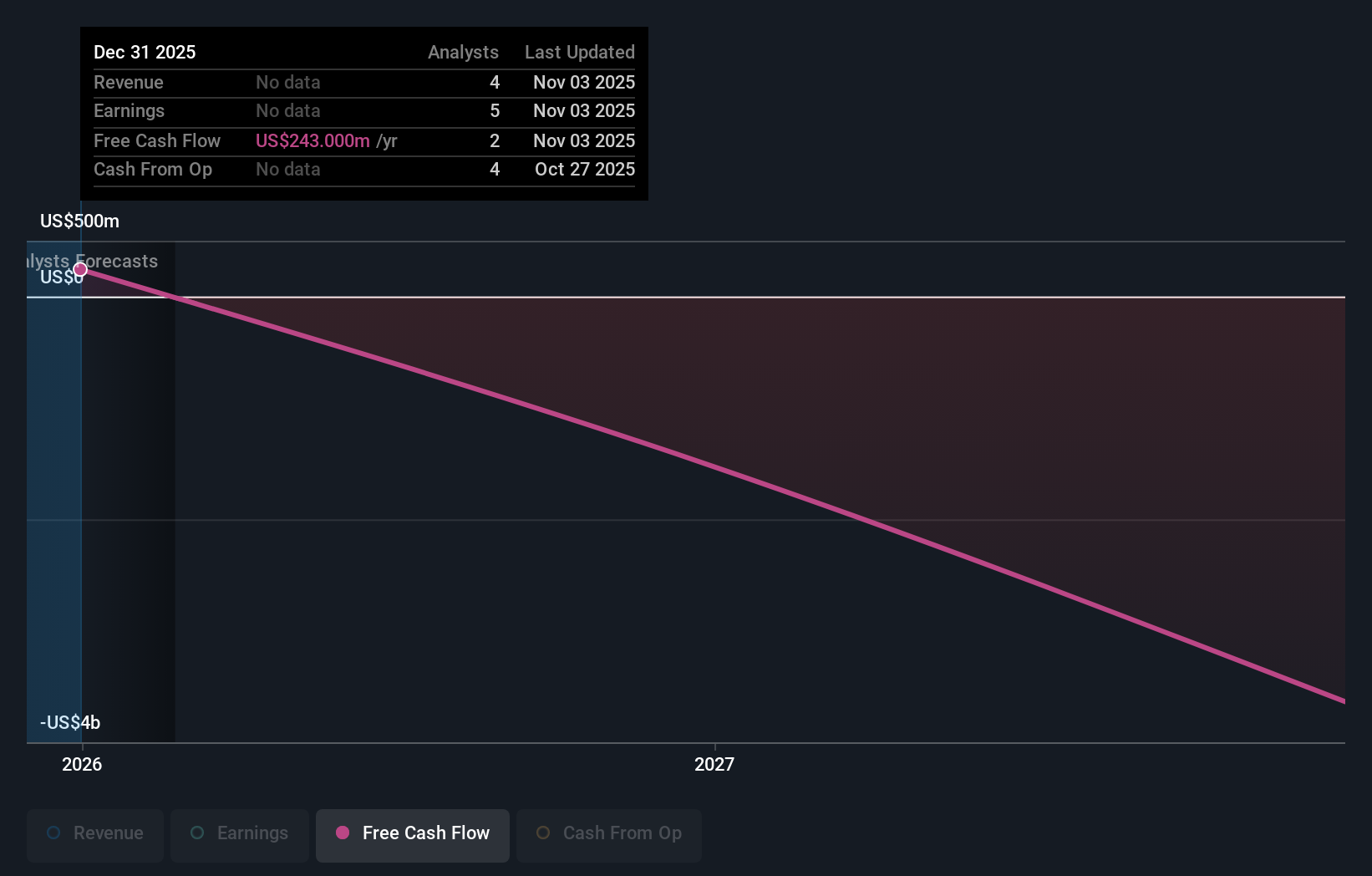

For anyone considering Fermi as a potential holding, the investment case has always centered on its ambitious plan to build out a massive, private energy campus catering to the surging power needs of AI data centers. The latest series of announcements, including long-term nuclear collaborations and the lease of flexible gas turbines, significantly bolster the odds that Fermi can move from concept to initial power generation as early as 2026. These partnerships with global engineering leaders and supportive local government agreements address some of the biggest short-term execution risks by securing technology, fuel, water, and tax incentives, which were major question marks before. The near-term catalyst remains delivery of the first 500 MW of generation capacity, while successful project execution and revenue generation are now even more critical milestones. However, given Fermi’s lack of revenue, unproven business model, and very new management team, material risks still exist despite recent optimism and price gains driven largely by sentiment rather than underlying results. But investors should remember: management experience remains a key issue for a business at this scale.

Our expertly prepared valuation report on Fermi implies its share price may be too high.Exploring Other Perspectives

Explore 5 other fair value estimates on Fermi - why the stock might be worth as much as 22% more than the current price!

Build Your Own Fermi Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fermi research is our analysis highlighting 1 important warning sign that could impact your investment decision.

- Our free Fermi research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fermi's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FRMI

Fermi

Fermi is focused on developing electric grids that deliver on-demand power at gigawatt scale, required to create next-generation artificial intelligence.

Minimal risk with weak fundamentals.

Similar Companies

Market Insights

Community Narratives