- United States

- /

- Specialized REITs

- /

- NasdaqGS:FRMI

Can Unusual Options Activity in FRMI Reveal Shifting Investor Confidence in Fermi’s Strategy?

Reviewed by Sasha Jovanovic

- In the past week, Fermi (NASDAQ:FRMI) attracted significant attention as investors showed a bullish stance, with an unusual spike in options activity highlighting 11 extraordinary trades flagged by Benzinga’s scanner.

- This surge in market activity has coincided with a renewed focus from analysts, who have recently updated their ratings and maintained a generally positive outlook on the company.

- With extraordinary options activity in focus, we'll explore how these developments could influence Fermi’s ongoing investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Fermi's Investment Narrative?

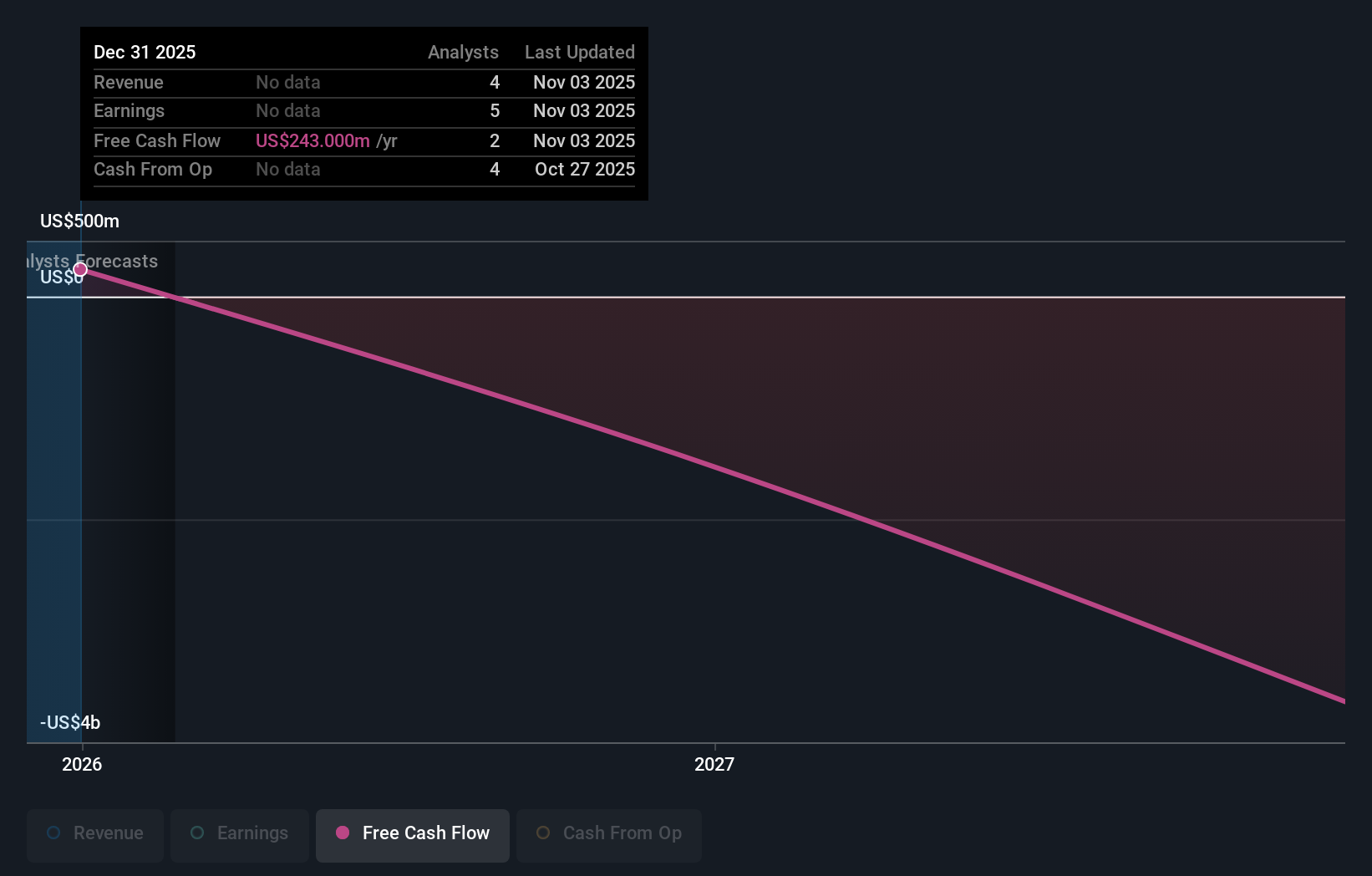

For investors considering Fermi today, the essential argument lies in the belief that the company can turn its ambitious power projects and recent client wins into a sustainable business model, especially as it pushes forward with its large-scale nuclear and natural gas initiatives. While the recent surge in bullish options activity and refreshed analyst coverage add spotlight, the immediate catalysts, such as execution of client agreements, regulatory milestones, and securing further project funding, remain pivotal. However, the significant options activity, paired with a 6.5% drop in the past week and much steeper pullbacks this month, suggests that near-term optimism may be more speculative than grounded in fundamentals. Fermi’s lack of revenue, ongoing losses, and relatively inexperienced board heighten execution risk, and these risks remain at the center of the investment thesis even as the options news draws attention. Overall, while market excitement has picked up, there is not enough to materially alter the fundamental short-term catalysts or address the underlying risks facing the business just yet. But amid the recent excitement, board inexperience still looms as a risk investors should be aware of.

Fermi's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 4 other fair value estimates on Fermi - why the stock might be worth less than half the current price!

Build Your Own Fermi Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fermi research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Fermi research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fermi's overall financial health at a glance.

No Opportunity In Fermi?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FRMI

Fermi

Fermi America (Nasdaq: FRMI) is pioneering the development of next-generation electric grids that deliver highly redundant power at gigawatt scale, required to create next-generation artificial intelligence.

Overvalued with minimal risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success