- United States

- /

- Real Estate

- /

- NasdaqGM:EXPI

The eXp World Holdings (NASDAQ:EXPI) Share Price Gained 1380% And Shareholders Are Jubilant

It hasn't been the best quarter for eXp World Holdings, Inc. (NASDAQ:EXPI) shareholders, since the share price has fallen 20% in that time. But that does not change the realty that the stock's performance has been terrific, over five years. In that time, the share price has soared some 1380% higher! So it might be that some shareholders are taking profits after good performance. Of course what matters most is whether the business can improve itself sustainably, thus justifying a higher price.

We love happy stories like this one. The company should be really proud of that performance!

Check out our latest analysis for eXp World Holdings

eXp World Holdings wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last 5 years eXp World Holdings saw its revenue grow at 70% per year. That's well above most pre-profit companies. Arguably, this is well and truly reflected in the strong share price gain of 71%(per year) over the same period. It's never too late to start following a top notch stock like eXp World Holdings, since some long term winners go on winning for decades. On the face of it, this looks lke a good opportunity, although we note sentiment seems very positive already.

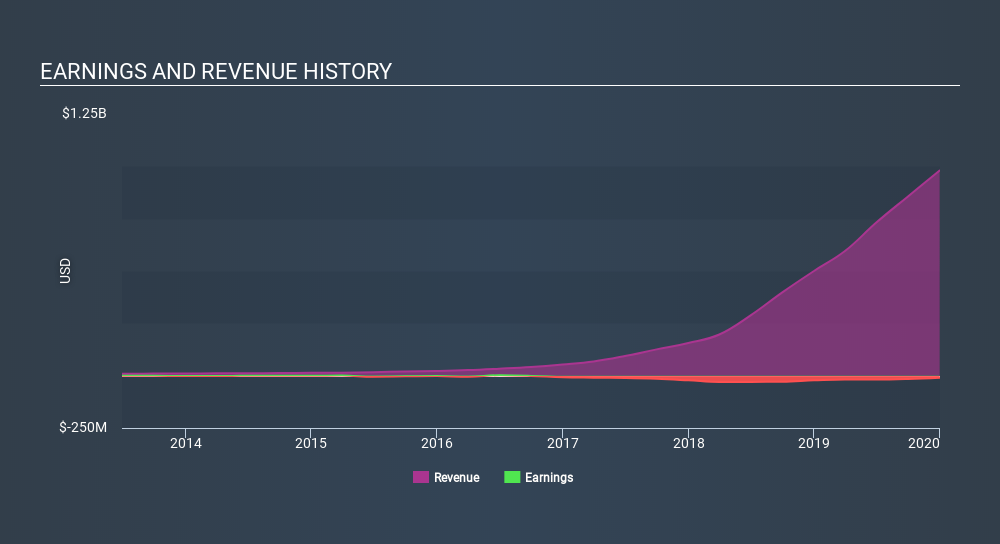

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling eXp World Holdings stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We regret to report that eXp World Holdings shareholders are down 21% for the year. Unfortunately, that's worse than the broader market decline of 6.0%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. On the bright side, long term shareholders have made money, with a gain of 71% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that eXp World Holdings is showing 2 warning signs in our investment analysis , you should know about...

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGM:EXPI

eXp World Holdings

Provides cloud-based real estate brokerage services for residential homeowners and homebuyers.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives