- United States

- /

- Specialized REITs

- /

- NasdaqGS:EQIX

Where Does Equinix Stand After This Year’s 13% Share Price Drop?

Reviewed by Bailey Pemberton

Thinking about what to do with Equinix stock right now? You are definitely not alone. After a decade as one of the biggest beneficiaries of cloud growth and digital infrastructure demand, Equinix's share price journey has become more of a roller coaster this year. Over the past twelve months, Equinix shares fell about 4.4%, with a year-to-date dip of nearly 13%. But if you take a look at the bigger picture, over the last three years the stock has still delivered an impressive 57.5% gain, holding up relatively well for a leader in a sector facing new competitive pressures and economic headwinds.

This blend of near-term caution and long-term resilience is exactly what has kept investors guessing. Recent headlines have shined a spotlight on regulatory shifts and evolving demand from hyperscaler clients, contributing to price swings and a more cautious outlook. Despite solid fundamentals, the market seems to be grappling with how to value an asset so deeply intertwined with global digital transformation without overpaying.

So is Equinix truly undervalued right now? According to the latest value score, which is a simple tally of six key checks, it comes in at 2 out of 6. That puts it in the “selectively undervalued” camp and raises important questions about where the real value for investors lies today. Next, we will break down the standard valuation approaches to see how Equinix measures up. Stay tuned, because there is an even sharper way to size up its true worth coming at the end.

Equinix scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Equinix Discounted Cash Flow (DCF) Analysis

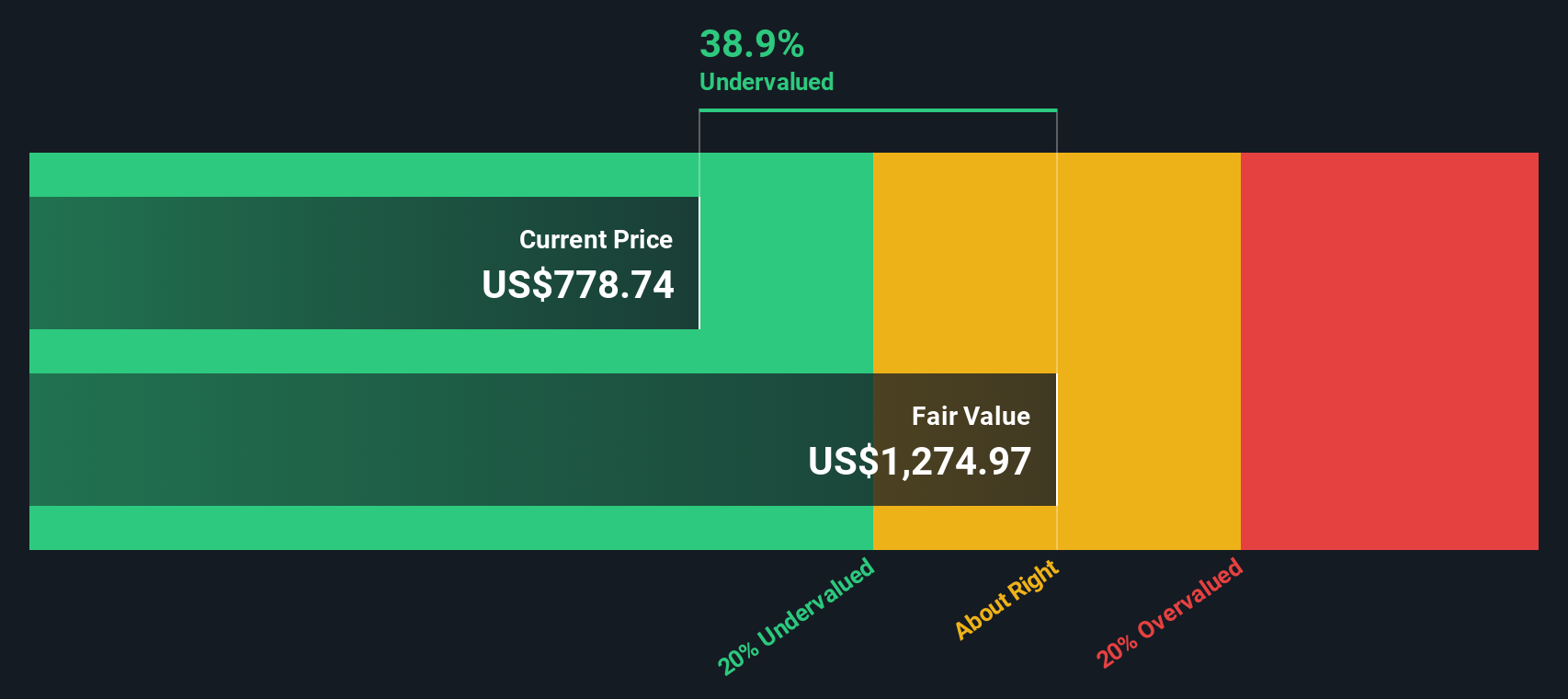

The Discounted Cash Flow (DCF) model is a classic valuation method that estimates a company's true worth by projecting its future cash flows and discounting them back to today's value. For Equinix, this approach looks at adjusted funds from operations, evaluating both near-term analyst forecasts and longer-term projections extrapolated from recent growth trends.

Currently, Equinix is generating free cash flow of $3.36 billion (Last Twelve Months). Over the next few years, analysts forecast steady growth, with 2029's projected free cash flow climbing to over $5.31 billion. Beyond the analyst window, Simply Wall St extends these projections by assuming moderating growth rates and provides a ten-year outlook of approximately $7.25 billion in free cash flow by 2035.

Aggregating and discounting these future cash flows yields an estimated fair value of $1,280.76 per share. This is 35.8% higher than the current trading price, suggesting that the stock is distinctly undervalued by the market at this time.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Equinix is undervalued by 35.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

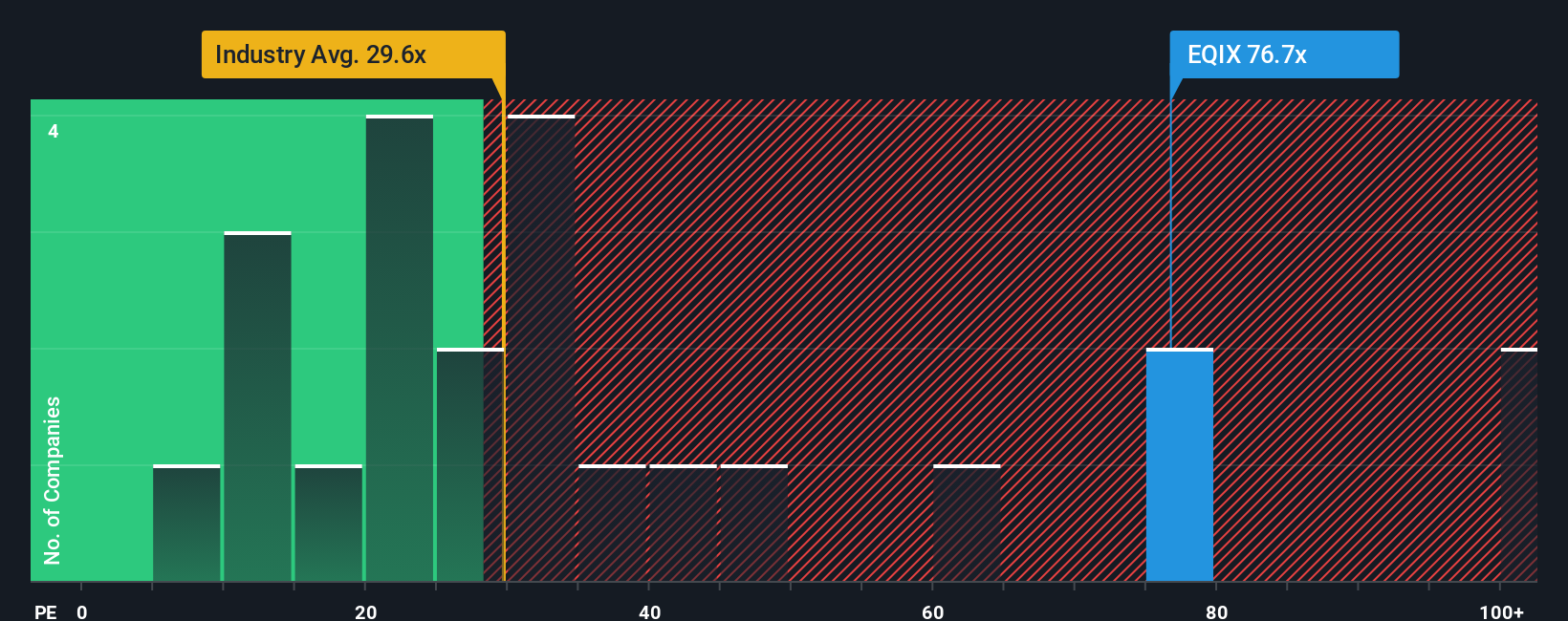

Approach 2: Equinix Price vs Earnings

When a company is consistently profitable, the Price-to-Earnings (PE) ratio is a trusted and widely used measure to gauge valuation. The PE multiple compares the company's current share price to its per-share earnings, providing investors a simple way to assess how much they are paying for each dollar of profit. However, it is important to consider that growth prospects and risks dramatically influence what constitutes a "fair" PE. High-growth or low-risk businesses often command higher PE ratios, while slower or riskier plays usually trade at lower multiples.

As of now, Equinix trades at a lofty PE ratio of 80.9x. This is significantly higher than the average for its industry, Specialized REITs, which sits at 17.8x, and also above the average of its close peers at 31.3x. On the surface, this could produce concerns about the stock being overvalued. However, standard comparisons like industry averages or peer groups often miss the nuances that drive a company’s unique earnings multiple, such as its exceptional growth prospects, profit margins, scale, and risk profile.

To address these nuances, Simply Wall St calculates a “Fair Ratio,” which, in this case, is 39.5x for Equinix. This proprietary metric is designed to reflect the multiple that fits best given Equinix’s sector, earnings growth, risk, margins, and market cap. It goes beyond the blunt instrument of averages and offers a tailored benchmark that better adjusts for the company’s strengths and challenges.

When we place Equinix’s current PE of 80.9x against its Fair Ratio of 39.5x, the stock appears noticeably overvalued by this measure, even when growth and profitability are accounted for.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

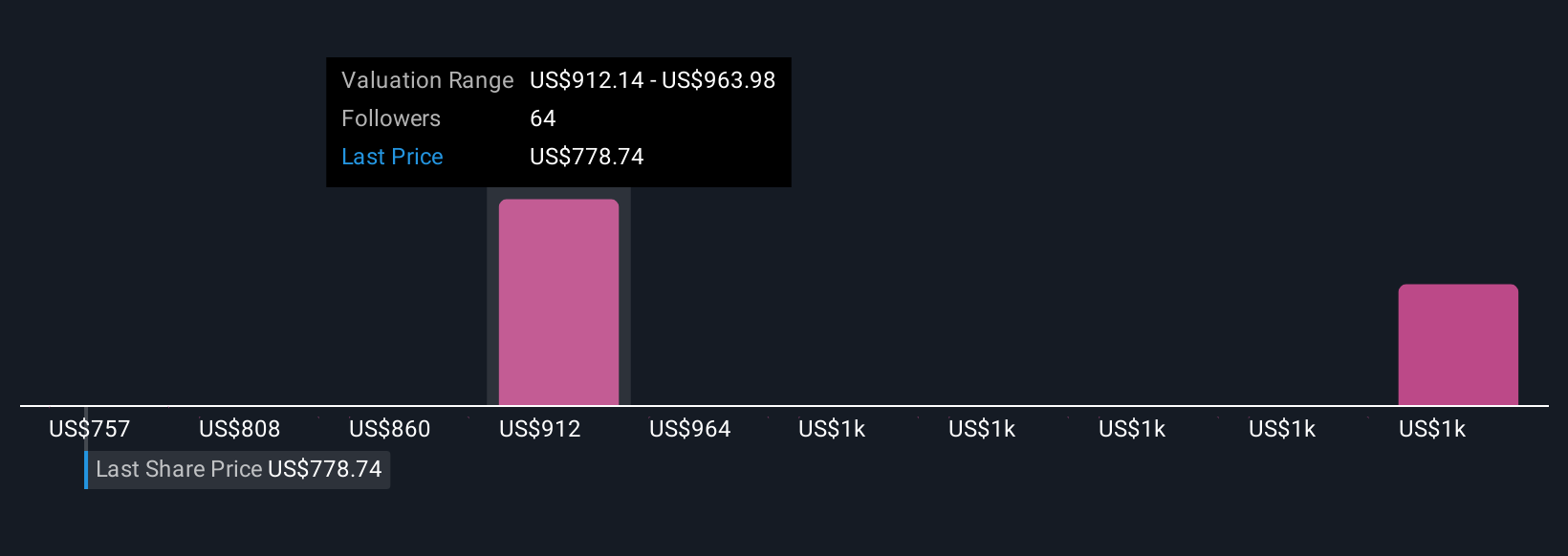

Upgrade Your Decision Making: Choose your Equinix Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your view of a company, connecting your story about its future with your own estimates for revenue, earnings, and profit margins, ultimately leading to your version of fair value. This approach links everything together: your perspective on what’s driving or slowing the business, a financial forecast you can adjust over time, and a fair value that reflects your unique outlook. Narratives are easy to use and available right on Simply Wall St’s Community page, where millions of investors share and compare their thinking.

With Narratives, investors can quickly see whether they think Equinix is a buy or sell by comparing their own Fair Value to the live share price, and these estimates automatically update when fresh news or earnings come in, keeping your analysis up to date without extra effort. For example, some Equinix Narratives see long-term AI and cloud-driven growth unlocking high price targets of $1,200 per share, while others focus on market risks and set more cautious targets around $804. Your perspective could land anywhere in between.

Do you think there's more to the story for Equinix? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equinix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EQIX

Equinix

Equinix, Inc. (Nasdaq: EQIX) shortens the path to boundless connectivity anywhere in the world.

Established dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives