- United States

- /

- Specialized REITs

- /

- NasdaqGS:EQIX

Equinix (NasdaqGS:EQIX) Welcomes Shane Paladin as New Chief Customer and Revenue Officer

Reviewed by Simply Wall St

Equinix (NasdaqGS:EQIX) recently appointed Shane Paladin as Executive Vice President and Chief Customer and Revenue Officer, bringing more than 20 years of experience to enhance customer experience and revenue strategies. Despite this leadership update, shares declined by 2.63% over the last week. This price move aligns with the flat performance of broader markets, where overall investor sentiment has been cautious amid trade policy uncertainties. Equinix's strategic appointment could provide strong leadership during a time of market ambiguity, but recent declines mirror the general hesitancy observed in the market as investors weigh external economic signals.

We've identified 3 possible red flags for Equinix that you should be aware of.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Equinix's recent appointment of Shane Paladin as Executive Vice President and Chief Customer and Revenue Officer is pivotal for enhancing customer experience and formulating effective revenue strategies. Despite a short-term share price decline of 2.63%, there is potential that this leadership change may drive long-term growth in revenue and earnings by focusing on customer-centric strategies and expanding services such as AI infrastructure. This aligns with the company's approach of serving better, solving smarter, and building bolder, which aims to boost recurring revenue.

Over the last three years, Equinix's total shareholder return, including share price appreciation and dividends, amounted to 30.60%, reflecting robust longer-term performance and investor confidence in its strategic direction. This is in contrast to its recent annual performance, where the company underperformed both the US market, which returned 11.4%, and the Specialized REITs industry, which returned very close to flat.

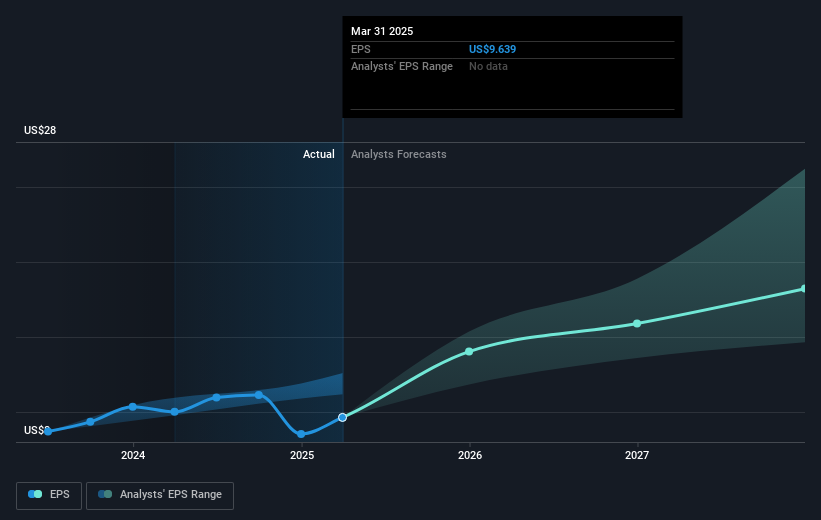

In terms of earnings forecasts, analysts predict an increase in profitability with earnings expected to rise to US$1.8 billion by 2028, supported by an annual revenue growth rate of 8.1%. The introduction of AI services and expansion of larger data centers could be significant contributors to these financial targets. Despite the current share price of US$875.38 being at a discount to the consensus price target of US$1011.27, indicating a 13.4% potential upside, investors remain cautious. The market's hesitance could be perceived as a reflection of underlying concerns regarding execution risks and external economic factors affecting customer spending.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equinix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EQIX

Equinix

Equinix (Nasdaq: EQIX) is the world's digital infrastructure company.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives