- United States

- /

- Specialized REITs

- /

- NasdaqGS:EQIX

Equinix (NasdaqGS:EQIX) Announces Financial Guidance Raise and Dividend Declarations

Reviewed by Simply Wall St

Equinix (NasdaqGS:EQIX) reported a significant 5.36% price increase over the past month, strongly aligning with market momentum, as both the S&P 500 and Nasdaq gained. This gain coincides with Equinix's robust first-quarter earnings announcements, where net income rose to $343 million, and higher revenue guidance for 2025, possibly bolstering investor confidence. The affirmed quarterly dividend of $4.69 per share and the positive broader market trend, driven by strong tech sector performance and high AI investment, further supported the share price increase. Overall, these elements positively contributed to Equinix's total shareholder returns amidst a vibrant market environment.

Every company has risks, and we've spotted 3 warning signs for Equinix you should know about.

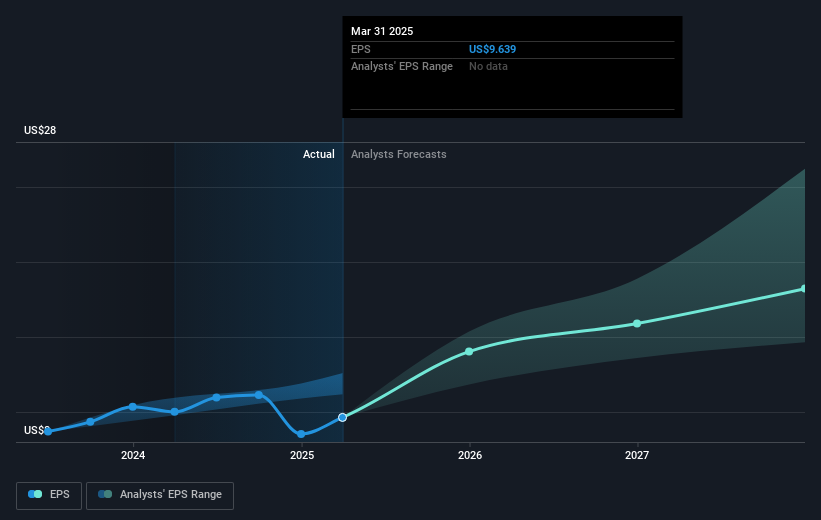

The recent 5.36% increase in Equinix's share price, bolstered by enhanced future revenue guidance and a reaffirmed US$4.69 dividend, suggests increased investor confidence. This aligns with the company's strategy to address growing AI and compute demands by expanding offerings like xScale and Fabric. However, the performance context reveals that over the past five years, Equinix's total return, including dividends, was 39.43%. Compared to this broader growth, the recent monthly uptick is a short-term reflection of current confidence in their strategic direction and market position.

In the past year, Equinix outperformed the US Specialized REITs industry, which returned 14.5%, highlighting its relative strength. While recent news may propel revenue and earnings forecasts due to strategic investments and infrastructure advancements, potential challenges like currency fluctuations and competitive pressures remain. Analysts set a price target of US$1002.48, about 15% higher than today's US$851.65, reflecting cautious optimism. The consensus indicates significant revenue and earnings growth potential, as long as the company successfully manages operational constraints and market challenges.

Gain insights into Equinix's future direction by reviewing our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equinix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EQIX

Equinix

Equinix (Nasdaq: EQIX) is the world's digital infrastructure company.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives