- United States

- /

- Health Care REITs

- /

- NasdaqGS:DHC

How Investors May Respond To Diversified Healthcare Trust (DHC) Securing $375 Million in 2030 Notes Refinancing

Reviewed by Sasha Jovanovic

- In September 2025, Diversified Healthcare Trust completed a US$375 million senior secured notes offering due in 2030, using part of the proceeds to partially redeem its 2026 notes while earmarking remaining funds for fees, expenses, and general business purposes.

- This refinancing initiative, secured by 36 U.S. properties and governed by restrictive covenants, marks a substantial step in reshaping the company’s capital structure and near-term financial commitments.

- We'll examine how refinancing a sizeable portion of its debt may influence Diversified Healthcare Trust's investment narrative and outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Diversified Healthcare Trust Investment Narrative Recap

To be a shareholder in Diversified Healthcare Trust, you need to believe in the long-term recovery and margin growth potential of the company’s healthcare-focused real estate portfolio, especially as US demographics age and senior housing demand rises. The September 2025 refinancing meaningfully extends debt maturities, slightly reduces near-term leverage risk, and addresses the biggest short-term concern, but the long-term challenge of sustainable revenue growth in a competitive market remains. The transaction does not materially alter the central catalyst of SHOP occupancy improvements and operational margin recovery, but it helps stabilize the funding environment over the next several years.

Among recent announcements, the $150 million secured revolving credit facility completed in June 2025 stands out for its relevance, as it complements the new notes offering by providing greater liquidity and further extending DHC’s financial flexibility. This access to steady capital works in tandem with debt refinancing efforts to support the company’s ability to meet obligations while focusing capital on higher growth areas, giving the company a better platform to pursue its operational goals. Together, these moves are positioned to relieve refinancing pressure while allowing management to concentrate on occupancy and margin drivers in the core portfolio.

In contrast, investors should be aware that even with new financing, persistent headwinds in occupancy and rental yields could...

Read the full narrative on Diversified Healthcare Trust (it's free!)

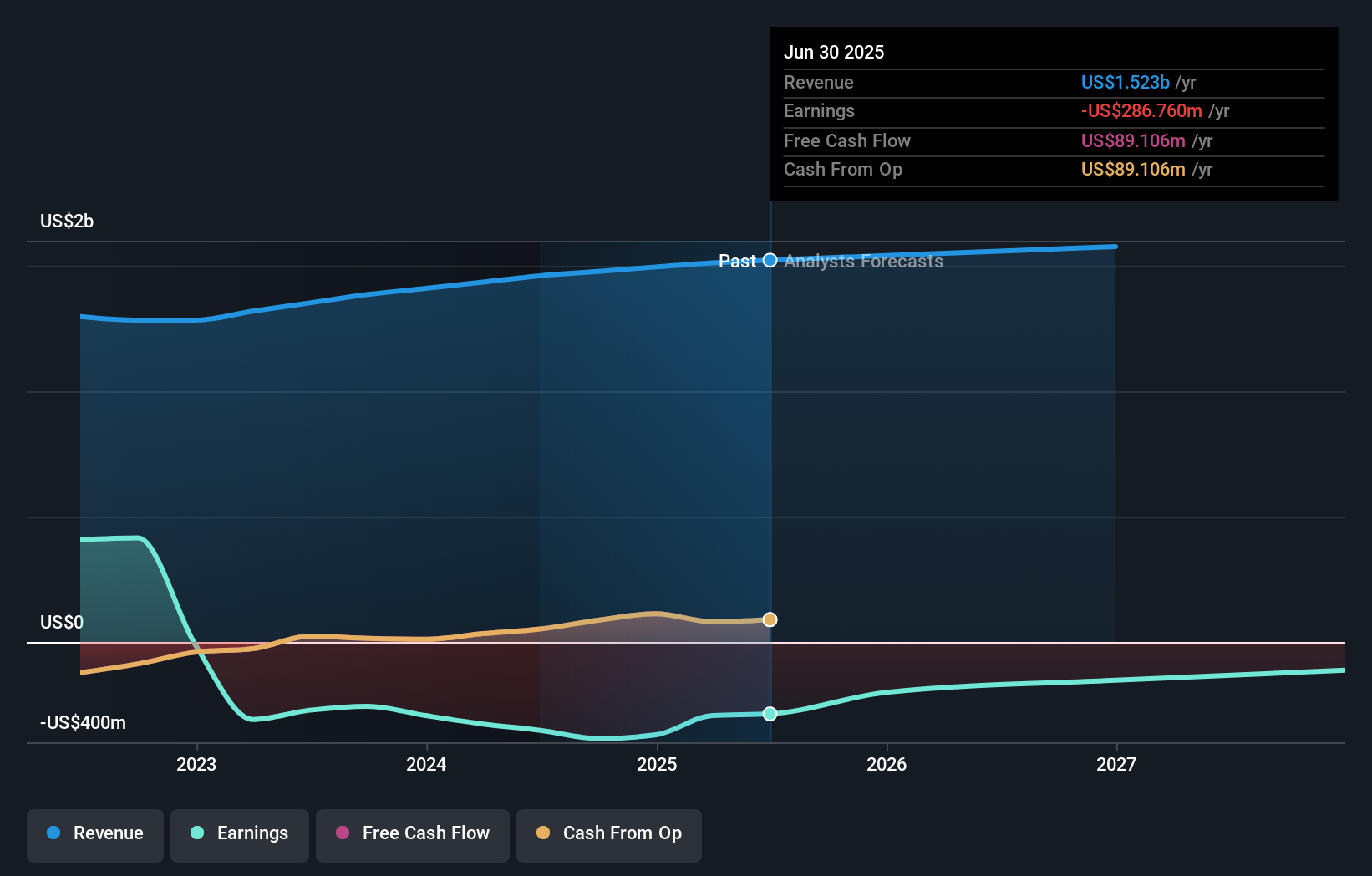

Diversified Healthcare Trust's forecasts point to $1.6 billion in revenue and $381.0 million in earnings by 2028. Achieving this outlook relies on annual revenue growth of 2.4% and an earnings increase of $667.8 million from the current loss of $-286.8 million.

Uncover how Diversified Healthcare Trust's forecasts yield a $4.25 fair value, a 3% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided just one fair value estimate for DHC, at US$1.58 per share. While refinancing eases near-term debt concerns, the narrow range of community opinions reflects uncertainty about the company’s future earnings power and growth outlook.

Explore another fair value estimate on Diversified Healthcare Trust - why the stock might be worth less than half the current price!

Build Your Own Diversified Healthcare Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Diversified Healthcare Trust research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Diversified Healthcare Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Diversified Healthcare Trust's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DHC

Diversified Healthcare Trust

DHC is a real estate investment trust focused on owning high-quality healthcare properties located throughout the United States.

Fair value unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives