- United States

- /

- Real Estate

- /

- NasdaqCM:CHCI

I Ran A Stock Scan For Earnings Growth And Comstock Holding Companies (NASDAQ:CHCI) Passed With Ease

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Comstock Holding Companies (NASDAQ:CHCI). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Comstock Holding Companies

How Fast Is Comstock Holding Companies Growing Its Earnings Per Share?

In a capitalist society capital chases profits, and that means share prices tend rise with earnings per share (EPS). So like a ray of sunshine through a gap in the clouds, improving EPS is considered a good sign. You can imagine, then, that it almost knocked my socks off when I realized that Comstock Holding Companies grew its EPS from US$0.39 to US$1.89, in one short year. When you see earnings grow that quickly, it often means good things ahead for the company. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

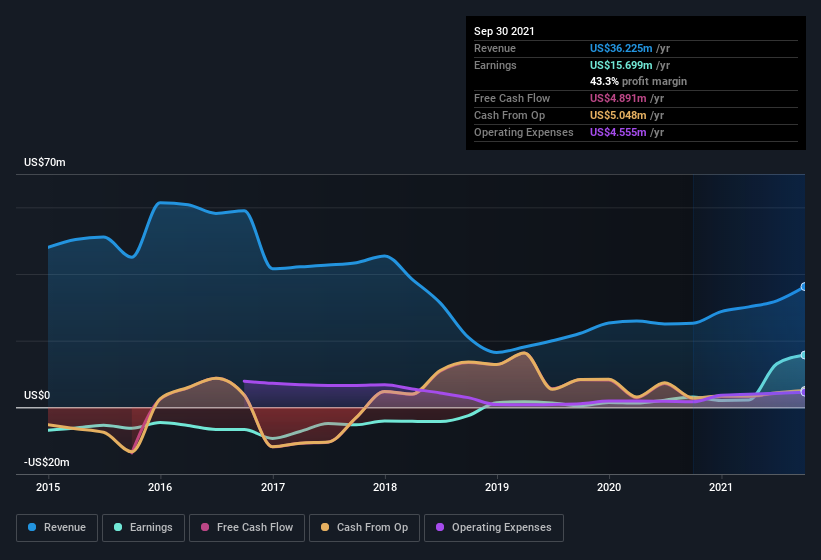

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). While we note Comstock Holding Companies's EBIT margins were flat over the last year, revenue grew by a solid 43% to US$36m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since Comstock Holding Companies is no giant, with a market capitalization of US$37m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Comstock Holding Companies Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So as you can imagine, the fact that Comstock Holding Companies insiders own a significant number of shares certainly appeals to me. In fact, they own 68% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. In terms of absolute value, insiders have US$25m invested in the business, using the current share price. That should be more than enough to keep them focussed on creating shareholder value!

Should You Add Comstock Holding Companies To Your Watchlist?

Comstock Holding Companies's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. That EPS growth certainly has my attention, and the large insider ownership only serves to further stoke my interest. At times fast EPS growth is a sign the business has reached an inflection point; and I do like those. So to my mind Comstock Holding Companies is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. It's still necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Comstock Holding Companies (at least 1 which makes us a bit uncomfortable) , and understanding these should be part of your investment process.

Although Comstock Holding Companies certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CHCI

Comstock Holding Companies

Operates as a asset manager, developer, and operator of mixed-use and transit-oriented properties in the Washington, D.C.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives