- United States

- /

- Real Estate

- /

- NasdaqGS:ASPS

We Think Altisource Portfolio Solutions S.A.'s (NASDAQ:ASPS) CEO Compensation Package Needs To Be Put Under A Microscope

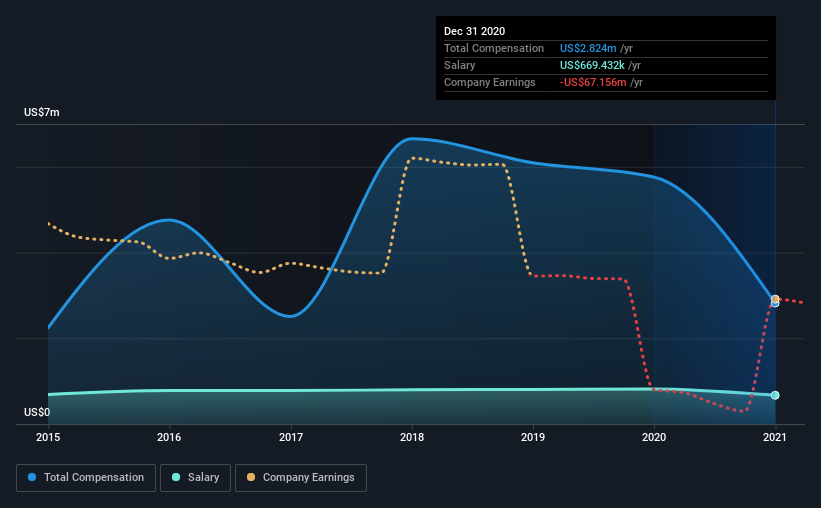

The results at Altisource Portfolio Solutions S.A. (NASDAQ:ASPS) have been quite disappointing recently and CEO Bill Shepro bears some responsibility for this. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 18 May 2021. It would also be an opportunity for shareholders to influence management through voting on company resolutions such as executive remuneration, which could impact the firm significantly. We present the case why we think CEO compensation is out of sync with company performance.

Check out our latest analysis for Altisource Portfolio Solutions

Comparing Altisource Portfolio Solutions S.A.'s CEO Compensation With the industry

At the time of writing, our data shows that Altisource Portfolio Solutions S.A. has a market capitalization of US$99m, and reported total annual CEO compensation of US$2.8m for the year to December 2020. We note that's a decrease of 51% compared to last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$669k.

On comparing similar-sized companies in the industry with market capitalizations below US$200m, we found that the median total CEO compensation was US$321k. This suggests that Bill Shepro is paid more than the median for the industry. Moreover, Bill Shepro also holds US$3.2m worth of Altisource Portfolio Solutions stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$669k | US$819k | 24% |

| Other | US$2.2m | US$4.9m | 76% |

| Total Compensation | US$2.8m | US$5.8m | 100% |

Speaking on an industry level, nearly 29% of total compensation represents salary, while the remainder of 71% is other remuneration. Altisource Portfolio Solutions pays a modest slice of remuneration through salary, as compared to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Altisource Portfolio Solutions S.A.'s Growth

Over the last three years, Altisource Portfolio Solutions S.A. has shrunk its earnings per share by 101% per year. In the last year, its revenue is down 51%.

Few shareholders would be pleased to read that EPS have declined. And the impression is worse when you consider revenue is down year-on-year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Altisource Portfolio Solutions S.A. Been A Good Investment?

With a total shareholder return of -78% over three years, Altisource Portfolio Solutions S.A. shareholders would by and large be disappointed. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. In our study, we found 3 warning signs for Altisource Portfolio Solutions you should be aware of, and 1 of them is significant.

Important note: Altisource Portfolio Solutions is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you’re looking to trade Altisource Portfolio Solutions, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:ASPS

Altisource Portfolio Solutions

Operates as an integrated service provider and marketplace for the real estate and mortgage industries in the United States.

Moderate risk and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion