- United States

- /

- Real Estate

- /

- NYSE:OPAD

Offerpad Solutions Inc. (NYSE:OPAD) Stock's 27% Dive Might Signal An Opportunity But It Requires Some Scrutiny

To the annoyance of some shareholders, Offerpad Solutions Inc. (NYSE:OPAD) shares are down a considerable 27% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 36% share price drop.

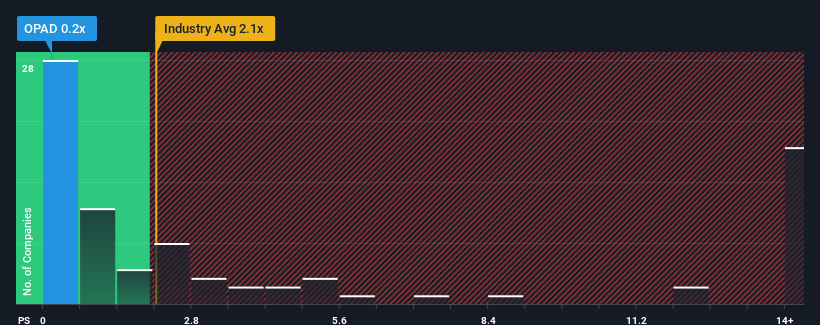

Following the heavy fall in price, Offerpad Solutions' price-to-sales (or "P/S") ratio of 0.2x might make it look like a buy right now compared to the Real Estate industry in the United States, where around half of the companies have P/S ratios above 2.1x and even P/S above 10x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Offerpad Solutions

How Offerpad Solutions Has Been Performing

Offerpad Solutions could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Offerpad Solutions' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Offerpad Solutions?

Offerpad Solutions' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 69%. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 31% each year over the next three years. With the industry only predicted to deliver 11% per year, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Offerpad Solutions' P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

The southerly movements of Offerpad Solutions' shares means its P/S is now sitting at a pretty low level. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Offerpad Solutions' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Offerpad Solutions, and understanding these should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:OPAD

Offerpad Solutions

Provides technology-enabled solutions for residential real estate market in the United States.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives