- United States

- /

- Real Estate

- /

- NYSE:OPAD

Even With A 28% Surge, Cautious Investors Are Not Rewarding Offerpad Solutions Inc.'s (NYSE:OPAD) Performance Completely

Those holding Offerpad Solutions Inc. (NYSE:OPAD) shares would be relieved that the share price has rebounded 28% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 18% over that time.

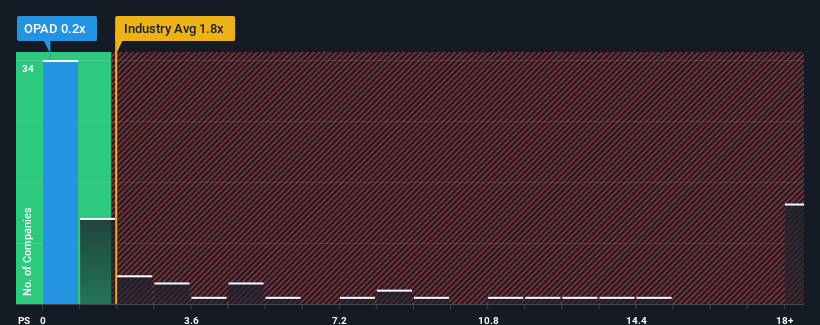

In spite of the firm bounce in price, Offerpad Solutions' price-to-sales (or "P/S") ratio of 0.2x might still make it look like a buy right now compared to the Real Estate industry in the United States, where around half of the companies have P/S ratios above 1.8x and even P/S above 10x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Offerpad Solutions

What Does Offerpad Solutions' Recent Performance Look Like?

While the industry has experienced revenue growth lately, Offerpad Solutions' revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Offerpad Solutions' future stacks up against the industry? In that case, our free report is a great place to start.How Is Offerpad Solutions' Revenue Growth Trending?

In order to justify its P/S ratio, Offerpad Solutions would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 58%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 65% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 19% per annum as estimated by the six analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 11% each year, which is noticeably less attractive.

With this information, we find it odd that Offerpad Solutions is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Offerpad Solutions' P/S?

Despite Offerpad Solutions' share price climbing recently, its P/S still lags most other companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

To us, it seems Offerpad Solutions currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Before you settle on your opinion, we've discovered 3 warning signs for Offerpad Solutions (1 is a bit unpleasant!) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:OPAD

Offerpad Solutions

Provides technology-enabled solutions for residential real estate market in the United States.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026