- United States

- /

- Real Estate

- /

- NYSE:NYC

American Strategic Investment Co.'s (NYSE:NYC) Shares Bounce 28% But Its Business Still Trails The Industry

American Strategic Investment Co. (NYSE:NYC) shares have had a really impressive month, gaining 28% after a shaky period beforehand. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 2.5% in the last twelve months.

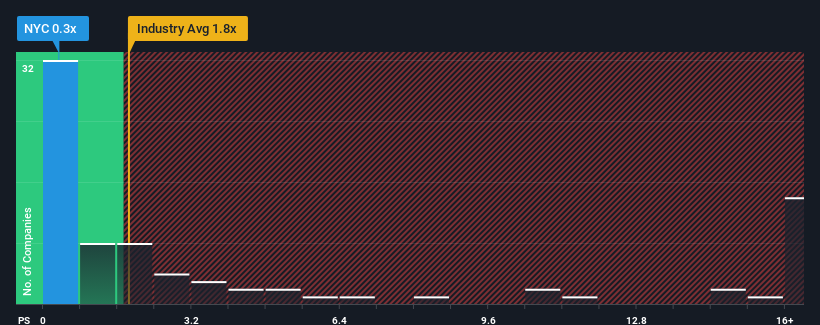

Even after such a large jump in price, American Strategic Investment may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.3x, considering almost half of all companies in the Real Estate industry in the United States have P/S ratios greater than 1.8x and even P/S higher than 10x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for American Strategic Investment

How Has American Strategic Investment Performed Recently?

American Strategic Investment could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on American Strategic Investment will help you uncover what's on the horizon.How Is American Strategic Investment's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like American Strategic Investment's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 2.0%. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 2.5% per year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 12% per annum, which is noticeably more attractive.

With this information, we can see why American Strategic Investment is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Despite American Strategic Investment's share price climbing recently, its P/S still lags most other companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As expected, our analysis of American Strategic Investment's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

There are also other vital risk factors to consider and we've discovered 5 warning signs for American Strategic Investment (2 are potentially serious!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on American Strategic Investment, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:NYC

American Strategic Investment

American Strategic Investment Co. (including, New York City Operating Partnership L.P., (the “OP”) and its subsidiaries, the “Company”) is an externally managed company that currently owns a portfolio of commercial real estate located within the five boroughs of New York City, primarily Manhattan.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives