- United States

- /

- Real Estate

- /

- NYSE:FOR

Will Forestar Group’s Integration With D.R. Horton Enhance Its Competitive Edge in Challenging Markets (FOR)?

Reviewed by Sasha Jovanovic

- Forestar Group Inc. recently released its annual report, emphasizing its focus on market consolidation, disciplined land investments, and national operations, supported by a close relationship with D.R. Horton.

- An important insight is that Forestar's measures to optimize returns come amid ongoing challenges such as affordability constraints and regulatory delays, but its integrated model and diversified market reach are considered sources of resilience and growth potential.

- We'll explore how Forestar's disciplined land strategy and integration with D.R. Horton influence its investment outlook and growth prospects.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Forestar Group Investment Narrative Recap

If you invest in Forestar Group, you need to believe in its national scale, disciplined land investment model, and, most critically, its ongoing integration with D.R. Horton to drive steady lot sales regardless of short-term housing cycles. While the recent undervaluation headlines support the view that Forestar remains well-positioned if homebuilding activity rebounds, especially if mortgage rates dip further, concentration risk with D.R. Horton is still the most significant near-term challenge that could materially affect revenue if their purchasing behavior shifts. The undervaluation highlighted in the news does not materially change this central dynamic for the stock.

The annual report update focusing on Forestar’s disciplined land investments and integration with D.R. Horton is particularly relevant here, as it underlines the company’s approach to optimizing returns in a housing market that is beginning to show signs of stabilization. This strengthens the case for sustained revenues if D.R. Horton continues its lot purchases at the projected pace, supporting the main catalyst for near-term performance.

But investors should also be aware that, despite operational strengths, risks tied to heavy reliance on a single customer could have outsized impacts if...

Read the full narrative on Forestar Group (it's free!)

Forestar Group's narrative projects $1.9 billion revenue and $155.2 million earnings by 2028. This requires 7.8% yearly revenue growth and a $7.4 million earnings decrease from $162.6 million currently.

Uncover how Forestar Group's forecasts yield a $32.50 fair value, a 32% upside to its current price.

Exploring Other Perspectives

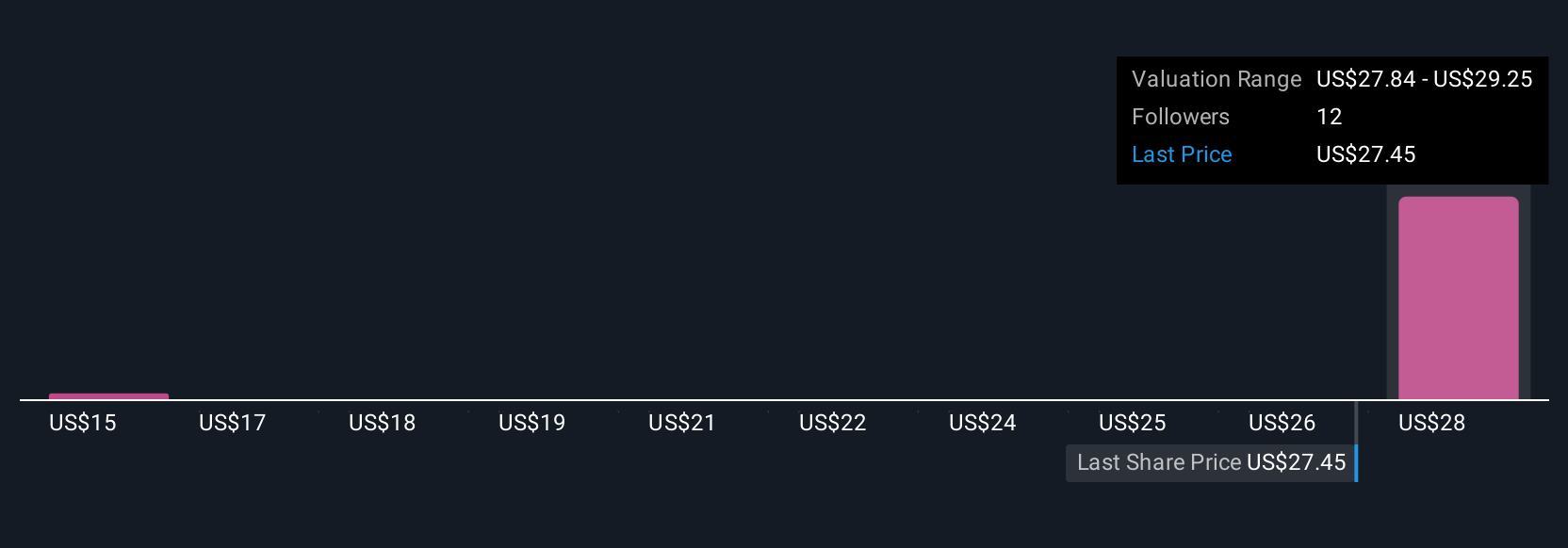

Simply Wall St Community members recently shared two fair value estimates for Forestar Group ranging widely from US$7.58 to US$32.50. While these figures reveal contrasting outlooks, the ongoing concentration risk with D.R. Horton remains a central consideration for future performance.

Explore 2 other fair value estimates on Forestar Group - why the stock might be worth as much as 32% more than the current price!

Build Your Own Forestar Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Forestar Group research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Forestar Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Forestar Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FOR

Forestar Group

Operates as a residential lot development company in the United States.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives