- United States

- /

- Real Estate

- /

- NYSE:CWK

Does Cushman & Wakefield's (CWK) Credit Extension Reveal Shifting Priorities in Financial Flexibility?

Reviewed by Sasha Jovanovic

- Cushman & Wakefield recently amended its Credit Agreement to extend the revolving credit maturity from April 2027 to October 2030 and reduced the applicable interest rate for certain leverage levels.

- This action highlights management’s focus on improving financial flexibility and aligning available credit with the company’s current capital needs.

- We’ll examine how the company’s proactive credit agreement extension and rate reduction could influence its longer-term investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Cushman & Wakefield Investment Narrative Recap

To be a Cushman & Wakefield shareholder, one needs to see value in the company’s ability to capture consulting, project management, and facility services growth while managing the cyclical nature of transaction-based revenue streams. The recent extension and repricing of the company’s credit facility strengthens its financial flexibility, but it does not materially reduce the company’s heavy exposure to swings in commercial real estate activity, which remains the biggest near-term risk for earnings stability.

Among the company’s recent updates, the appointment of Walid Cheaib to lead its institutional Capital Markets practice in Canada stands out. His arrival boosts Cushman & Wakefield’s expertise and reach at a time when transaction-driven fee growth remains both a critical catalyst and a source of risk as capital markets sentiment fluctuates. Still, the firm’s revenue and net margin quality depend on...

Read the full narrative on Cushman & Wakefield (it's free!)

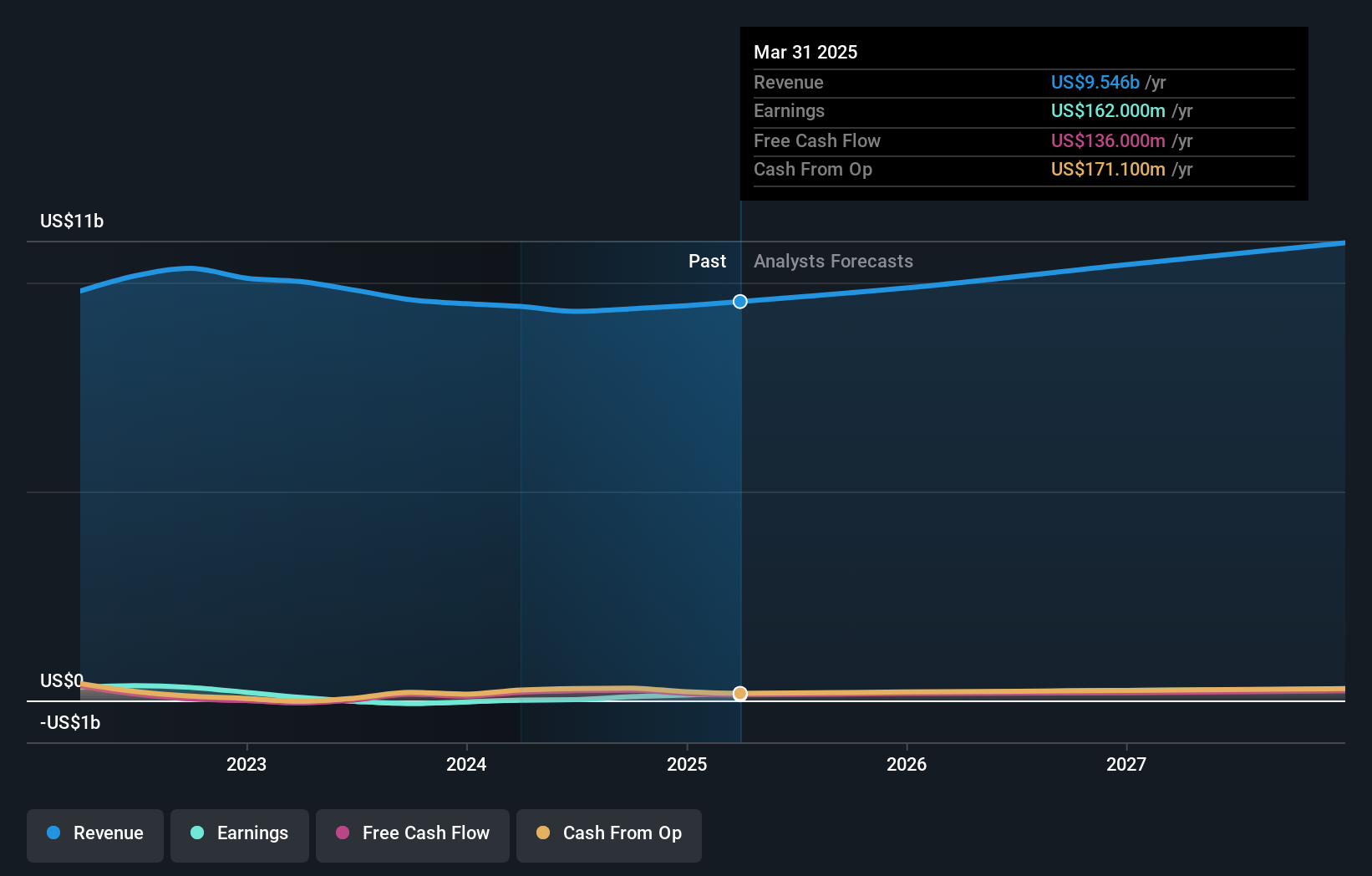

Cushman & Wakefield's narrative projects $11.4 billion in revenue and $342.8 million in earnings by 2028. This requires 5.4% yearly revenue growth and a $137 million earnings increase from $205.8 million today.

Uncover how Cushman & Wakefield's forecasts yield a $17.22 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community members set fair values between US$4.64 and US$20.59 based on 3 distinct forecasts. With transaction-driven revenues so closely tied to market cycles, your outlook could hinge on how you weigh that risk, see how others are pricing in the uncertainty.

Explore 3 other fair value estimates on Cushman & Wakefield - why the stock might be worth as much as 21% more than the current price!

Build Your Own Cushman & Wakefield Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cushman & Wakefield research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cushman & Wakefield research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cushman & Wakefield's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CWK

Cushman & Wakefield

Provides commercial real estate services under the Cushman & Wakefield brand in the Americas, Europe, Middle East, Africa, and Asia Pacific.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives