- United States

- /

- Real Estate

- /

- NYSE:COMP

Compass (COMP): Assessing Valuation After a 37% Rally and Fresh Investor Optimism

Reviewed by Simply Wall St

See our latest analysis for Compass.

Compass has seen momentum build as its share price return hit 63.8% year-to-date, with fresh gains over the past week confirming renewed investor interest. Looking at the bigger picture, its three-year total shareholder return of 209.5% stands out. This suggests that recent optimism is not just a short-term phenomenon.

If you're curious where else rapid growth and changing investor sentiment are creating opportunities, it's a perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares rallying and key metrics showing impressive growth, the question remains: Is Compass still trading below its true value, or has the market already factored in all the future upside, leaving little room for further gains?

Most Popular Narrative: 1.9% Undervalued

Compass closed at $9.50, which is slightly below the most popular fair value estimate of $9.69. The modest difference suggests that, in the eyes of the analyst consensus, shares are trading near their justified value, with just a small margin of undervaluation. Investors are paying close attention to the company's prospects as it approaches the critical threshold between perceived bargain and fully priced territory.

Rapid adoption and continuous improvement of Compass's AI-powered, end-to-end technology platform is increasing agent productivity, driving higher transaction volumes, improving retention, and is expected to widen margins as AI-driven process efficiencies scale throughout the organization. This is positively impacting revenue, EBITDA, and net margins.

Ever wonder what’s fueling Compass’s valuation? The answer isn’t just headline growth. Hidden within the narrative are bold profit margin forecasts and a future earnings multiple that could put the company in league with industry titans. Craving details on what really underpins this price target? Dive in to uncover the key financial levers that shape the consensus view.

Result: Fair Value of $9.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant industry changes or regulatory pressures could undermine Compass’s growth story. This raises questions about the durability of recent optimism.

Find out about the key risks to this Compass narrative.

Another View: The Value Through Multiples

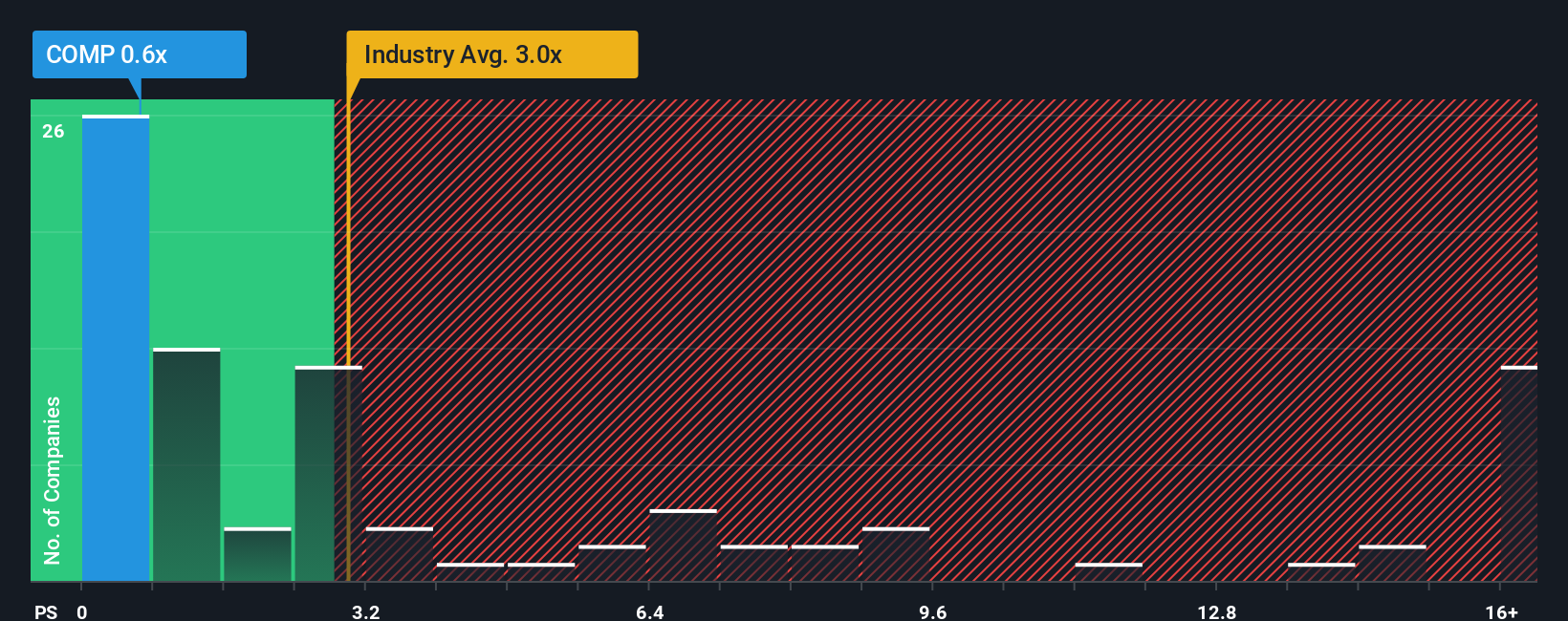

An alternative perspective looks at Compass’s price-to-sales ratio compared to industry standards. Currently, Compass trades at 0.7x, which is far below the US Real Estate sector average of 3x but slightly above the company’s fair ratio of 0.6x. While this points toward potential value relative to peers, it also signals that future market shifts could narrow this gap and impact returns either way. Does this pricing leave enough margin for safety, or could changing conditions flip the story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Compass Narrative

If the consensus view doesn't quite fit your perspective, or you'd rather dive into the numbers yourself, you can shape your own conclusions in minutes Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Compass.

Looking for More Investment Ideas?

Smart investing is all about acting on fresh opportunities before the crowd catches on. The Simply Wall Street Screener can lead you straight to stocks making headlines, quietly outperforming, or offering untapped potential, so you’re never left behind.

- Capture high yields and stability by checking out these 14 dividend stocks with yields > 3% delivering strong income streams with reliable performance.

- Get ahead of the curve in artificial intelligence by exploring these 27 AI penny stocks powering innovative breakthroughs and reshaping entire industries.

- Tap into hidden bargains with these 883 undervalued stocks based on cash flows, showcasing top picks trading under their true worth right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COMP

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives