- United States

- /

- Real Estate

- /

- NYSE:BEKE

KE Holdings (NYSE:BEKE): How a Fresh ESG Upgrade Shapes the Latest Valuation Narrative

Reviewed by Simply Wall St

KE Holdings (NYSE:BEKE) just received an upgrade in its MSCI ESG rating from A to AA, marking its third consecutive year of improvement. The recognition highlights progress in governance and environmental efforts.

See our latest analysis for KE Holdings.

Momentum around KE Holdings is starting to shift as the company racks up sustainability wins, but the stock has yet to reflect those efforts in total shareholder returns. While the share price has been relatively flat this year, investors have seen a 3-year total shareholder return of 85.6% combined with a -17.1% result over the past twelve months. This suggests recent performance has not kept pace with the company’s longer-term track record or its latest ESG progress.

If you're weighing your next move, it might be worth broadening your perspective and discovering fast growing stocks with high insider ownership.

With shares trading at a notable discount to analyst targets and recent business improvements making headlines, investors may be wondering if KE Holdings is undervalued right now or if the market has already accounted for its future growth potential.

Most Popular Narrative: 21.2% Undervalued

With the most recent fair value estimate set at $22.83, KE Holdings' last close at $17.99 looks materially discounted according to the most widely followed narrative. This gap has investors questioning if current growth and efficiency drives are already priced into the stock or if substantial upside remains.

“KE Holdings is diversifying revenue through rapid expansion of its high-margin, recurring service businesses, such as home renovation, furniture, and rental services, with these non-transactional revenues now comprising 41% of total sales. This reduces cyclicality and supports more stable revenue and higher blended margins as the platform matures. The company's enhanced focus on operational efficiency, including centralized procurement, AI-led process improvements, and business model innovation, has already yielded tangible improvements in segment margins, notably in home renovation and rental. This signals a path to sustainable margin expansion and stronger future earnings.”

Want a peek at the financial blueprint powering this valuation? The narrative centers on future profitability and a dramatic shift in revenue mix that could alter the company's profit potential. Find out which bold projections are driving analysts' confidence, and see the numbers that could change how you view this stock.

Result: Fair Value of $22.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in China’s real estate market and increased regulatory uncertainty remain key risks that could affect KE Holdings’ future growth.

Find out about the key risks to this KE Holdings narrative.

Another View: What Do the Multiples Say?

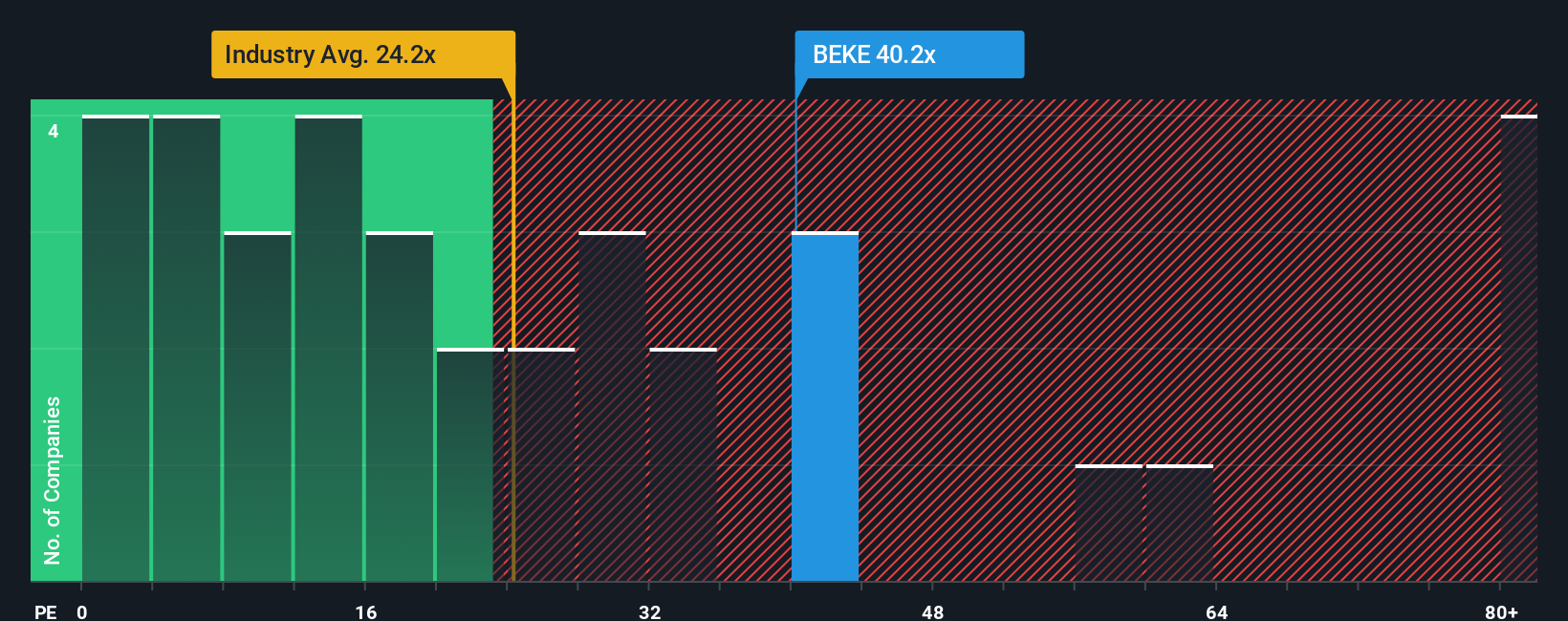

While the fair value estimate suggests KE Holdings is trading at an attractive discount, looking at its price-to-earnings ratio paints a much less optimistic picture. The company’s current multiple of 38.5x is higher than both the peer average of 32.4x and the US real estate industry’s typical 25.3x. Even compared to what our research finds to be a fair ratio, 28.8x, KE Holdings looks pricey. This raises a key question for investors: does the high multiple signal real profit growth ahead, or does it add risk if expectations fall short?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own KE Holdings Narrative

If you see things differently or want to dig deeper into the numbers yourself, crafting your own take only takes a few minutes. Do it your way.

A great starting point for your KE Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t limit your strategy to just one stock. Uncover unique opportunities with screens designed to highlight companies making headlines in the market's hottest trends.

- Catalyze your search for high potential with these 3554 penny stocks with strong financials, which combine strong fundamentals with disruptive market positions.

- Prioritize long-term wealth by reviewing these 19 dividend stocks with yields > 3% that deliver stable yields above 3%, helping to grow your portfolio with reliable income.

- Spot opportunities in breakthrough sectors by evaluating these 28 quantum computing stocks and gain exposure to tomorrow’s game-changing technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KE Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BEKE

KE Holdings

Through its subsidiaries, engages in operating an integrated online and offline platform for housing transactions and services in the People's Republic of China.

Flawless balance sheet and fair value.

Market Insights

Community Narratives