- United States

- /

- Real Estate

- /

- NasdaqGS:OPEN

Will Opendoor's (OPEN) Mortgage Partnership Reveal a Winning Edge in Homebuyer Affordability?

Reviewed by Sasha Jovanovic

- In the past week, Roam announced a partnership with Opendoor Technologies to offer assumable mortgage tools on Opendoor’s platform, expanding access to sellers’ existing low mortgage rates and aiming to improve home affordability for buyers.

- This collaboration not only reunites leadership with deep ties to mortgage innovation but also introduces new transaction features intended to address buyer affordability in today's high-rate housing market.

- Now, we’ll explore how this expanded access to low-rate assumable mortgages could influence Opendoor’s evolving investment narrative and growth prospects.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Opendoor Technologies Investment Narrative Recap

For an investor to back Opendoor Technologies, belief in the company's ability to drive transaction volume, by blending technology, operational efficiency, and expanded financing tools, remains crucial. The new partnership with Roam, which provides access to assumable low-rate mortgages, could support transaction volumes by broadening buyer access, but the most significant short-term catalyst is still Opendoor’s inventory turnover; the biggest risk is the company’s exposure to properties that linger unsold. This partnership may help address buyer affordability, but its full impact on clearing aged inventory remains to be seen.

The recent announcement of a follow-on equity offering, adding more shares to the market, is particularly relevant as fresh capital could support initiatives like the Roam partnership and operational improvements. However, while this could strengthen the company's balance sheet and fund efforts to unlock transaction growth, it also introduces dilution concerns that accompany any large equity issuance, especially for a business striving for profitability and improved margins.

By contrast, investors should also keep in mind the ongoing risk posed by homes that remain unsold for extended periods, as this...

Read the full narrative on Opendoor Technologies (it's free!)

Opendoor Technologies' narrative projects $4.7 billion revenue and $239.7 million earnings by 2028. This requires a 2.9% yearly revenue decline and a $544.7 million earnings increase from -$305.0 million.

Uncover how Opendoor Technologies' forecasts yield a $1.87 fair value, a 80% downside to its current price.

Exploring Other Perspectives

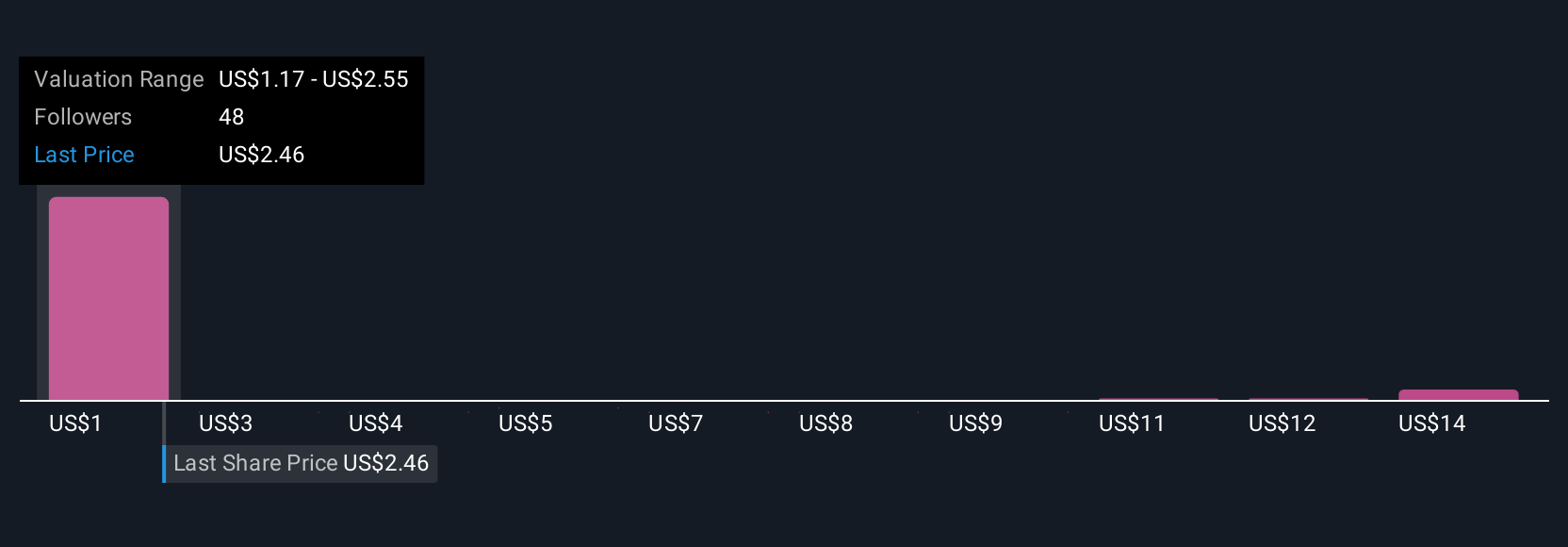

Twenty-three Simply Wall St Community members offered fair value estimates for Opendoor, ranging from US$0.70 to US$30.94 per share. While opinions span the spectrum, the risk of prolonged unsold inventory remains top of mind for assessing the company's financial trajectory.

Explore 23 other fair value estimates on Opendoor Technologies - why the stock might be worth over 3x more than the current price!

Build Your Own Opendoor Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Opendoor Technologies research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Opendoor Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Opendoor Technologies' overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OPEN

Opendoor Technologies

Operates a digital platform for residential real estate transactions in the United States.

Adequate balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives