- United States

- /

- Real Estate

- /

- NasdaqGS:OPEN

Opendoor (OPEN) Valuation Check After New Leadership Team Drives Speculation Around ‘Opendoor 2.0’ Strategy

Reviewed by Simply Wall St

Opendoor Technologies (OPEN) just refreshed its leadership bench by naming fintech veteran Lucas Matheson as president and elevating long time insider Christy Schwartz to CFO, a move squarely aimed at accelerating the company’s Opendoor 2.0 pivot.

See our latest analysis for Opendoor Technologies.

The leadership reshuffle caps a wild year in which Opendoor’s 2025 share price return has jumped roughly 300 percent, even as more recent share price performance has cooled and momentum looks more tentative.

If this kind of high risk turnaround story has your attention, it could be worth scanning other real estate adjacent plays, as well as fast growing stocks with high insider ownership, for fresh ideas.

After a meme style 300 percent surge that now trades above cautious analyst targets despite ongoing losses, the real question is whether Opendoor is still a misunderstood turnaround or if markets already reflect its Opendoor 2.0 ambitions.

Most Popular Narrative: 115% Overvalued

With the stock last closing at $6.42 against a narrative fair value near $3, the gap between price and projections is hard to ignore.

Enhancements in pricing models and a refined customer experience could lead to higher conversion rates, potentially increasing revenue as more sellers convert their initial engagement into completed transactions. Aligning marketing strategies with seasonal buying patterns may improve operational efficiency and enhance revenue by acquiring homes when demand is high and spreads are favorable.

It may seem counterintuitive that a business still losing money is modeled to have a future profit profile, steady margins, and a valuation multiple far below its industry. The narrative describes the full math behind that tension in detail.

Result: Fair Value of $2.99 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macro headwinds, along with Opendoor’s heavy inventory and debt load, could quickly undermine margin assumptions and pressure the bullish Opendoor 2.0 narrative.

Find out about the key risks to this Opendoor Technologies narrative.

Another Take on Valuation

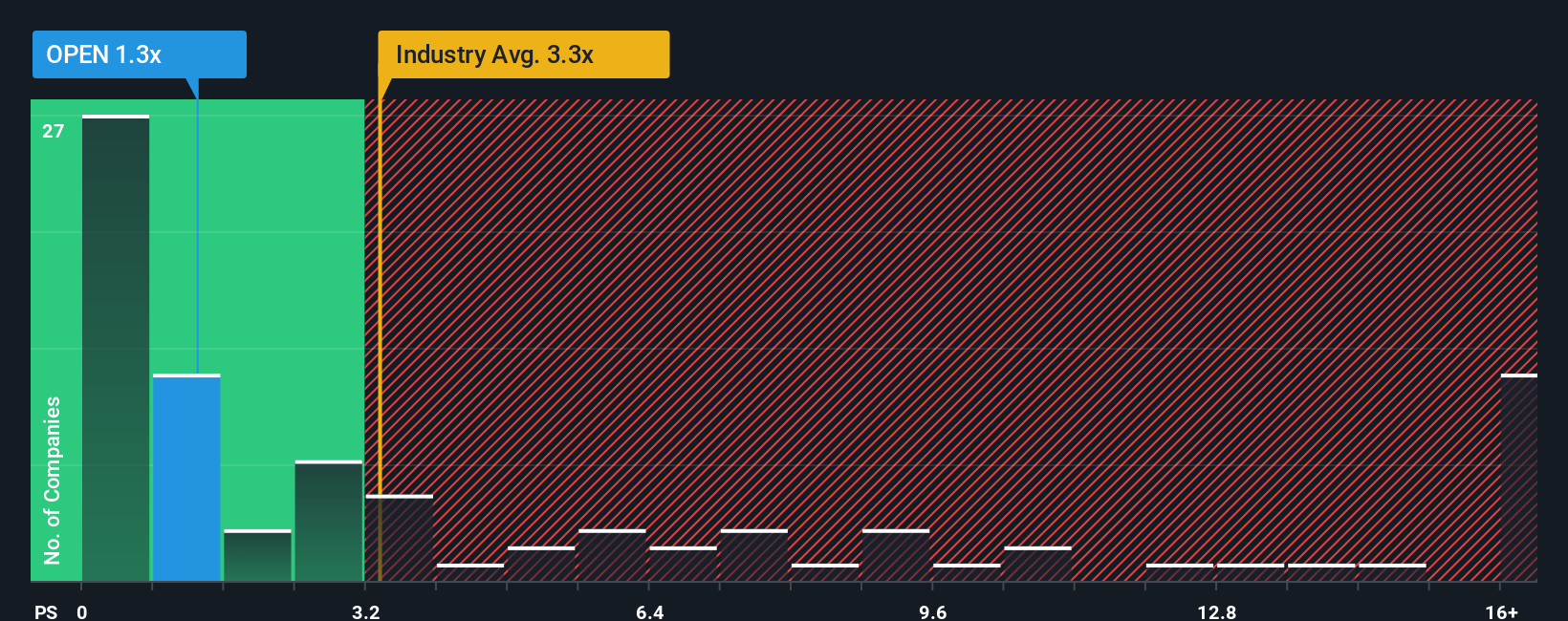

Price to sales paints a very different picture. Opendoor trades around 1.3 times sales versus a peer average of 0.9 times and a fair ratio of just 0.7 times. This implies the market is pricing in far more success than history or rivals justify. Is that a risk you are willing to underwrite?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Opendoor Technologies Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a full narrative in just minutes using Do it your way.

A great starting point for your Opendoor Technologies research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Opendoor might only be the start, and the smartest investors keep fresh ideas flowing. Use the Simply Wall St screener now so opportunities do not slip past you.

- Target powerful income potential by reviewing these 10 dividend stocks with yields > 3% that can help anchor your portfolio with consistent cash returns.

- Capture early growth stories by analyzing these 3630 penny stocks with strong financials positioned for outsized upside if their business momentum continues.

- Strengthen your watchlist with these 900 undervalued stocks based on cash flows that markets may be mispricing based on their underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OPEN

Opendoor Technologies

Operates a digital platform for residential real estate transactions in the United States.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion