- United States

- /

- Real Estate

- /

- NasdaqGS:OPEN

Lacklustre Performance Is Driving Opendoor Technologies Inc.'s (NASDAQ:OPEN) 28% Price Drop

Opendoor Technologies Inc. (NASDAQ:OPEN) shares have retraced a considerable 28% in the last month, reversing a fair amount of their solid recent performance. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 109% in the last twelve months.

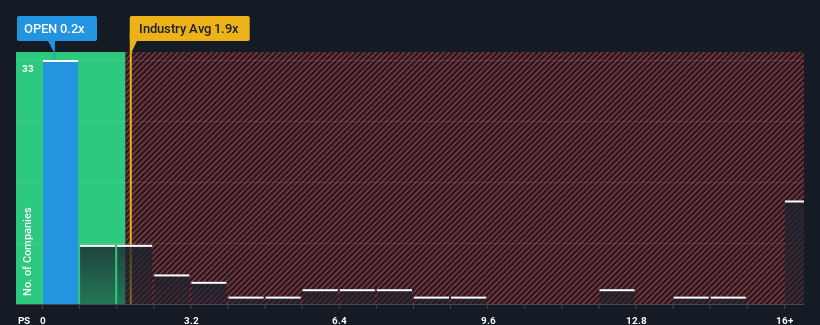

After such a large drop in price, Opendoor Technologies' price-to-sales (or "P/S") ratio of 0.2x might make it look like a buy right now compared to the Real Estate industry in the United States, where around half of the companies have P/S ratios above 1.9x and even P/S above 9x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Opendoor Technologies

What Does Opendoor Technologies' P/S Mean For Shareholders?

Opendoor Technologies could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Opendoor Technologies.How Is Opendoor Technologies' Revenue Growth Trending?

In order to justify its P/S ratio, Opendoor Technologies would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 46%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 149% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 7.3% per annum as estimated by the twelve analysts watching the company. With the industry predicted to deliver 11% growth per annum, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Opendoor Technologies' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Opendoor Technologies' recently weak share price has pulled its P/S back below other Real Estate companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As expected, our analysis of Opendoor Technologies' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about these 6 warning signs we've spotted with Opendoor Technologies.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:OPEN

Opendoor Technologies

Operates a digital platform for residential real estate transactions in the United States.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026