- United States

- /

- Real Estate

- /

- NasdaqGS:OPEN

Even With A 30% Surge, Cautious Investors Are Not Rewarding Opendoor Technologies Inc.'s (NASDAQ:OPEN) Performance Completely

Opendoor Technologies Inc. (NASDAQ:OPEN) shareholders are no doubt pleased to see that the share price has bounced 30% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 17% in the last twelve months.

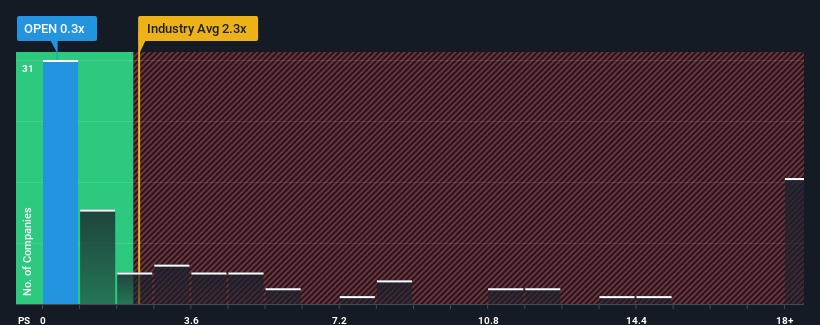

In spite of the firm bounce in price, Opendoor Technologies may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.3x, considering almost half of all companies in the Real Estate industry in the United States have P/S ratios greater than 2.3x and even P/S higher than 9x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Opendoor Technologies

How Opendoor Technologies Has Been Performing

While the industry has experienced revenue growth lately, Opendoor Technologies' revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Opendoor Technologies will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Opendoor Technologies would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 45% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 11% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 18% each year during the coming three years according to the eleven analysts following the company. With the industry only predicted to deliver 12% per annum, the company is positioned for a stronger revenue result.

With this information, we find it odd that Opendoor Technologies is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Opendoor Technologies' P/S

The latest share price surge wasn't enough to lift Opendoor Technologies' P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Opendoor Technologies' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 5 warning signs for Opendoor Technologies that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:OPEN

Opendoor Technologies

Operates a digital platform for residential real estate transactions in the United States.

Adequate balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives