- United States

- /

- Real Estate

- /

- NasdaqGS:OPEN

Could Opendoor's (OPEN) Cash Plus Reveal a New Path to Sustainable Revenue Growth?

Reviewed by Simply Wall St

- Opendoor recently launched Cash Plus, a new service allowing home sellers to unlock most of their equity upfront while working with partner agents to market their homes in Dallas, Nashville, and Raleigh, with plans for a wider rollout.

- The introduction of Cash Plus reflects Opendoor’s broader push to offer flexible solutions that blend speed, convenience, and the potential for higher sale prices.

- We’ll explore how Opendoor’s launch of Cash Plus could influence its ongoing efforts to expand product offerings and boost revenue.

AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Opendoor Technologies Investment Narrative Recap

To be an Opendoor Technologies shareholder today, you need to believe in the company’s ability to successfully expand and monetize its digital real estate platform, particularly by introducing new products that enhance flexibility for home sellers. The launch of Cash Plus likely provides incremental support to Opendoor’s near-term catalyst: growing revenue through expanded product offerings, but material risks remain around inventory management and ongoing financial flexibility, as these operational challenges could still overshadow short-term gains if not addressed effectively.

Among recent company announcements, the rollout of the Opendoor Key Agent app stands out alongside Cash Plus, as both initiatives aim to deepen relationships with agents and streamline the sales process. By making it easier for agents to connect sellers to fast offers and market exposure, Opendoor continues to push for wider adoption of its services, which supports the key revenue catalyst, but sustained success will depend on how efficiently these products translate into improved margins amid market headwinds.

But despite these developments, investors should also be mindful that exposure to inventory risk can threaten margins and is something you should know more about...

Read the full narrative on Opendoor Technologies (it's free!)

Opendoor Technologies' narrative projects $7.1 billion revenue and $370.0 million earnings by 2028. This requires 11.3% yearly revenue growth and a $762 million increase in earnings from -$392.0 million.

Uncover how Opendoor Technologies' forecasts yield a $1.17 fair value, a 44% downside to its current price.

Exploring Other Perspectives

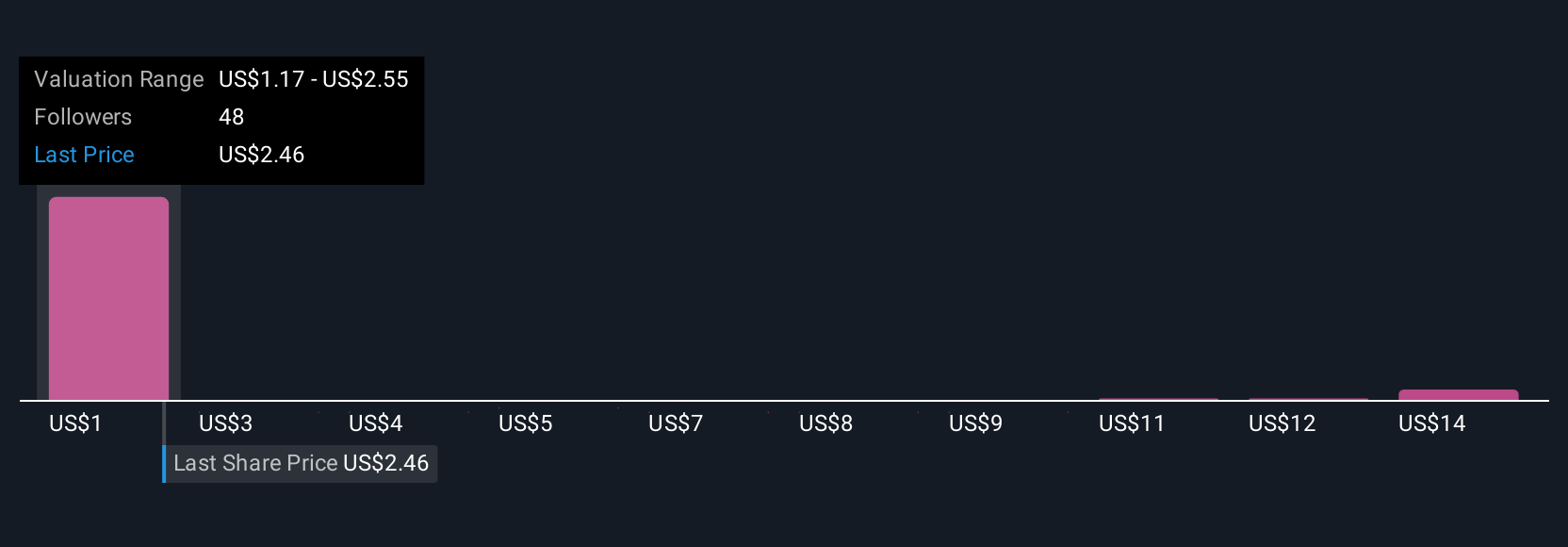

Fourteen fair value estimates for Opendoor from the Simply Wall St Community range from US$1.17 to US$14.96 per share. While some see significant upside, concerns about persistent inventory risk remain top of mind given the business model’s dependence on housing market dynamics; your view may differ, so check out other community analyses.

Explore 14 other fair value estimates on Opendoor Technologies - why the stock might be worth 44% less than the current price!

Build Your Own Opendoor Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Opendoor Technologies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Opendoor Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Opendoor Technologies' overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OPEN

Opendoor Technologies

Operates a digital platform for residential real estate transactions in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives