- United States

- /

- Real Estate

- /

- NasdaqCM:MRNO

Murano Global Investments (MRNO) Losses Worsen 99.7% Annually, Challenging Value-Focused Narratives

Reviewed by Simply Wall St

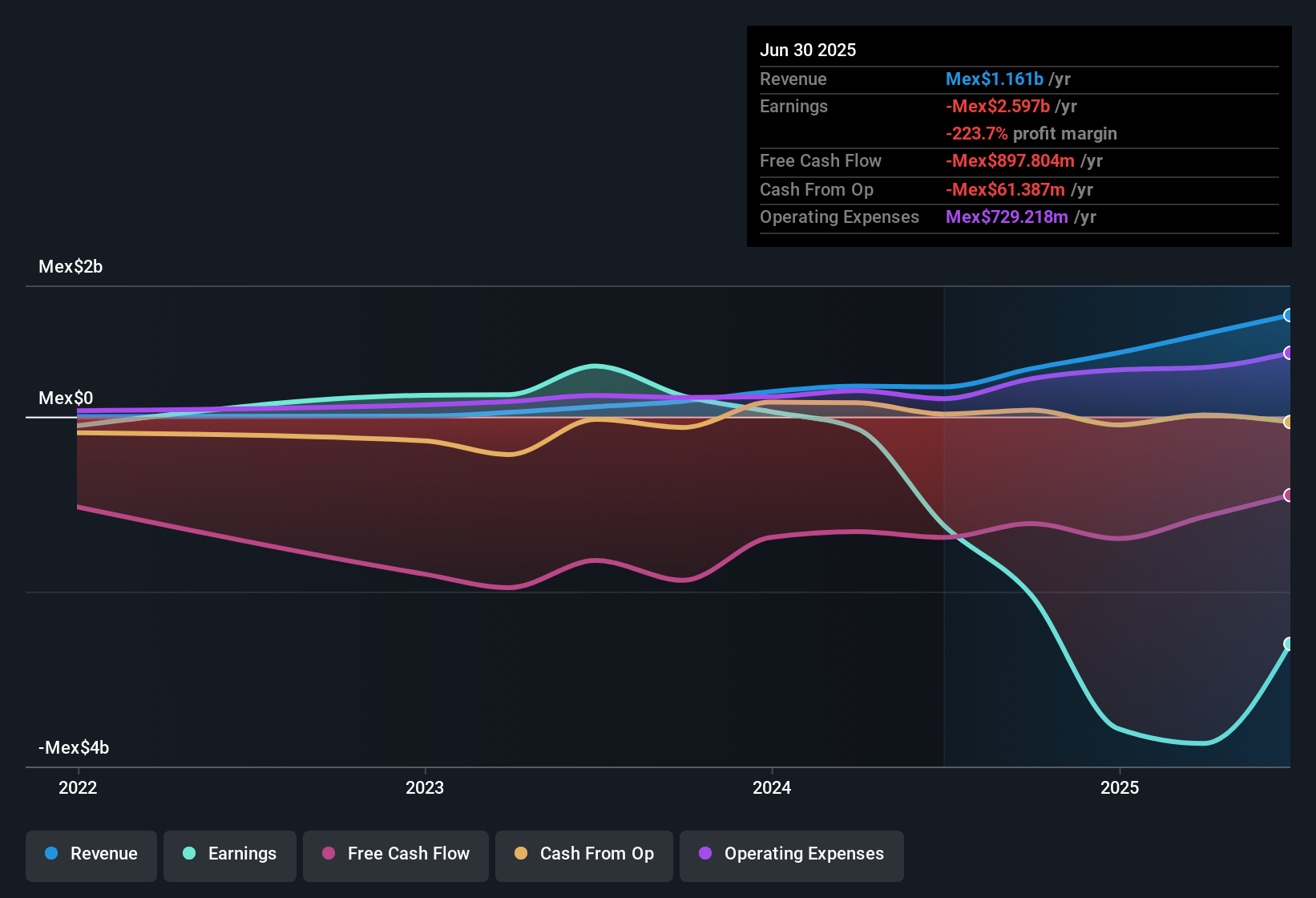

Murano Global Investments (MRNO) has seen its losses accelerate at a striking rate of 99.7% per year over the past five years, with its net profit margin remaining firmly in negative territory. While the stock’s Price-to-Sales Ratio of 3.3x looks cheap compared to peer group averages of 6.9x, it remains slightly above the broader US real estate industry average of 3x. Despite appearing attractively valued on this metric, persistent unprofitability and growing losses present a cautious set of results for investors.

See our full analysis for Murano Global Investments.Now, let’s see how these headline numbers compare to the broader narratives driving sentiment in the market. Consider what that means for investors sizing up their next move.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Growing Faster Than Peers

- MRNO’s losses have accelerated at a rate of 99.7% per year over the past five years, outpacing typical trends seen in the broader US real estate industry.

- Market watchers highlight that this rapid escalation in losses presents a challenge for the prevailing optimism about the company’s growth-focused strategies.

- Even though analysts and media outlets have pointed out recent positive developments like partnerships and expansion, the stark rate at which losses are compounding makes long-term profitability look increasingly remote.

- These persistent and worsening losses heavily outweigh claims that management’s strategic moves will spark a turnaround in near-term financials.

Financial Instability Adds to Investor Caution

- MRNO is not in a good financial position according to the EDGAR summary, with ongoing unprofitability and instability compounded by a share price of $2.64 that has not remained stable over the past three months.

- Some analysts caution that the company’s continued financial instability, coupled with expectations for flat or negative growth, means it may struggle to weather future industry headwinds.

- Repeated lack of profit and minimal growth outlook provide little margin for error, challenging claims that favorable market sentiment can support a rebound.

- The company’s volatile share price reinforces the need for careful risk management among potential investors.

Valuation Discounts Mask Deeper Risks

- With a Price-to-Sales Ratio of 3.3x, MRNO appears inexpensive compared to its peer group average of 6.9x but is still slightly pricier than the broader US real estate industry average of 3x.

- The prevailing market view suggests that while this relative discount to peers might catch the eye, it is overshadowed by the company’s growing losses and unaddressed financial weaknesses.

- The apparent valuation advantage quickly narrows once investors factor in MRNO’s ongoing unprofitability and lack of quality past earnings.

- Current sector conditions reward firms with strong fundamentals, and lingering risk factors mean MRNO’s modest discount may not translate into a true long-term opportunity.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Murano Global Investments's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

MRNO's accelerating losses, ongoing financial instability, and lack of profit highlight challenges that make its long-term prospects uncertain for investors.

If you want companies with stronger finances and greater resilience, use our solid balance sheet and fundamentals stocks screener to find stocks built to weather tough conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MRNO

Murano Global Investments

A real estate company, owns, develops, and invests in hotel, resort, and commercial properties in Mexico.

Low risk and overvalued.

Similar Companies

Market Insights

Community Narratives