- United States

- /

- Real Estate

- /

- NasdaqCM:FTHM

Why Investors Shouldn't Be Surprised By Fathom Holdings Inc.'s (NASDAQ:FTHM) Low P/S

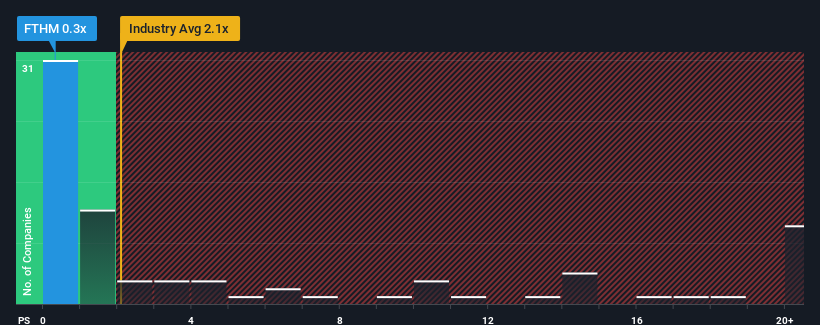

You may think that with a price-to-sales (or "P/S") ratio of 0.3x Fathom Holdings Inc. (NASDAQ:FTHM) is a stock worth checking out, seeing as almost half of all the Real Estate companies in the United States have P/S ratios greater than 2.1x and even P/S higher than 12x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Fathom Holdings

What Does Fathom Holdings' P/S Mean For Shareholders?

Recent times have been advantageous for Fathom Holdings as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Fathom Holdings will help you uncover what's on the horizon.How Is Fathom Holdings' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Fathom Holdings' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a decent 8.0% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 228% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 3.6% during the coming year according to the four analysts following the company. That's not great when the rest of the industry is expected to grow by 9.4%.

With this in consideration, we find it intriguing that Fathom Holdings' P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Fathom Holdings' P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, Fathom Holdings' poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 3 warning signs for Fathom Holdings that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:FTHM

Fathom Holdings

Provides a real estate services platform that integrates residential brokerage, mortgage, title, and insurance services in the United States.

Moderate risk and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026