- United States

- /

- Real Estate

- /

- NasdaqGM:EXPI

Is eXp World Holdings Fairly Priced After Dividend Suspension and Prolonged Share Slide?

Reviewed by Bailey Pemberton

If you are watching eXp World Holdings these days, you are likely trying to figure out whether to double down, hit pause, or pivot. The stock has felt the heat this year, slipping by 5.3% so far in 2024, following a tough year with a 17.2% drop and an even steeper 61.3% decline over five years. After a brief uptick in late spring, shares have softened again, closing recently at $10.74. Some of this choppiness can be tied to shifting market sentiment around real estate tech and renewed debates about growth versus profitability in a higher-rate environment. The swings are real, and so is the uncertainty that keeps the conversation going among investors.

Still, volatility is only part of the story. As you weigh your choices, a logical next step is to figure out if eXp is undervalued or just catching a falling knife. Based on our value score framework, eXp World Holdings clocks in with a score of 3, meaning it looks undervalued in half of the six key checks we use. That is not a home run, but it is enough to warrant a closer look, especially for anyone wondering if the market may be underestimating the long-term potential behind the headlines.

Let’s break down how these different valuation tools stack up. More importantly, we will talk about a smarter way to make sense of all this at the end of the article.

Why eXp World Holdings is lagging behind its peers

Approach 1: eXp World Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects a company’s future free cash flows and discounts them back to present value to estimate what the business is really worth today. For eXp World Holdings, this involves examining how much cash the company generates and forecasting those figures years into the future, then adjusting for the time value of money.

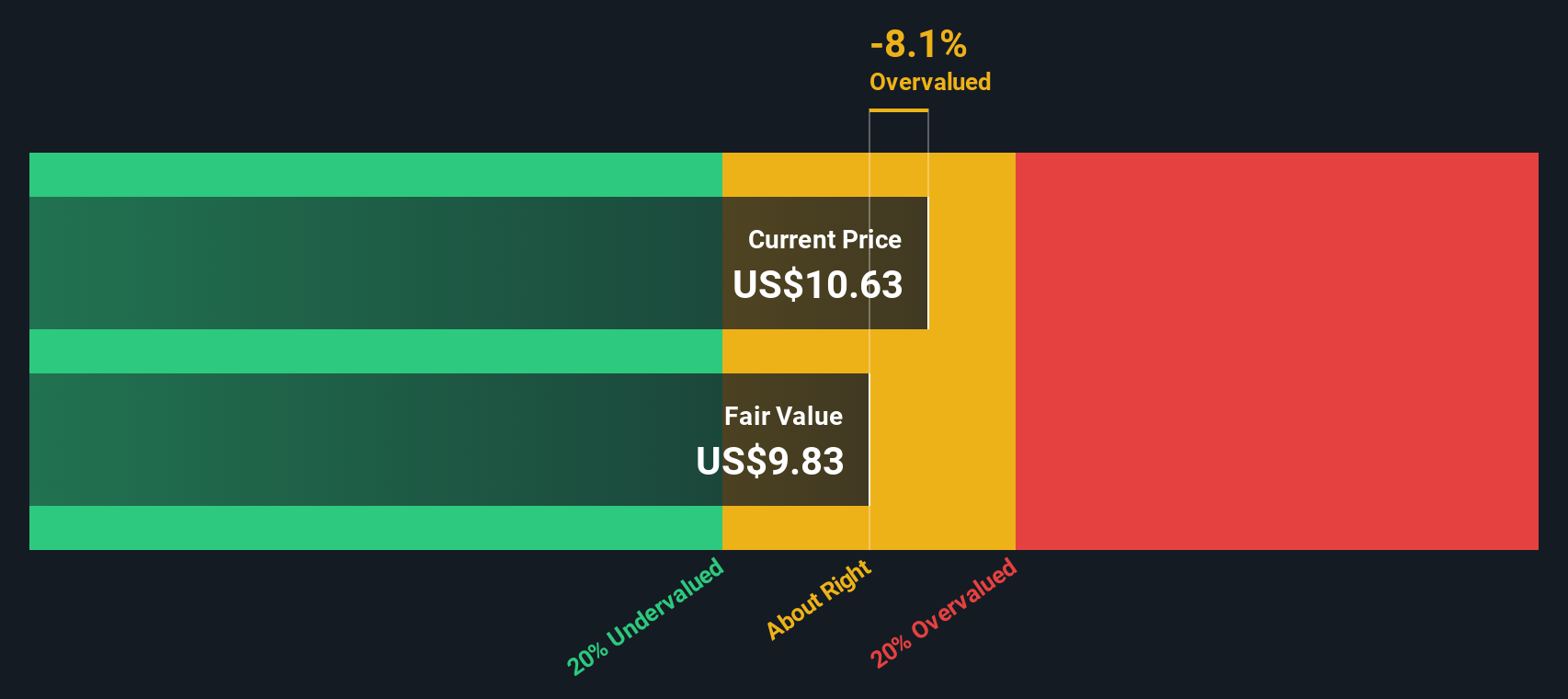

Currently, eXp reported Last Twelve Months Free Cash Flow of $126.87 Million. Analysts provide estimates for up to five years, and projections for later years are extrapolated to complete the 10-year outlook. Over the next decade, cash flows are expected to fluctuate, with free cash flow projected at about $102.12 Million in 2026, $86.81 Million in 2027, and down to $45.67 Million by 2035. This reflects a general trend of modest declines according to Simply Wall St's methodology.

This analysis produces an estimated intrinsic value of $9.82 per share. With the current stock price at $10.74, the DCF model suggests eXp World Holdings is about 9.4% overvalued. In practical terms, there is not a significant gap between market price and estimated value, so investors may want to keep this in mind before making any major decisions.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out eXp World Holdings's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: eXp World Holdings Price vs Sales (P/S)

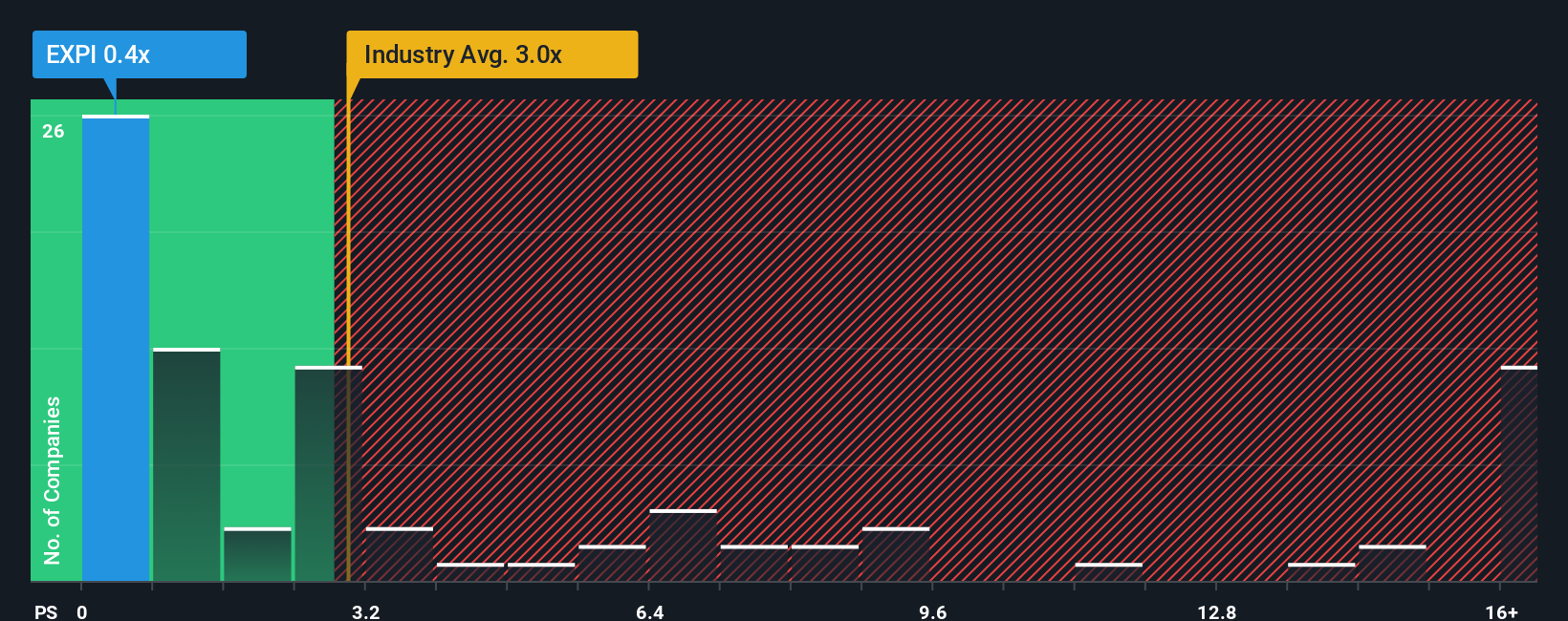

The Price-to-Sales (P/S) ratio is a preferred valuation metric for eXp World Holdings because the company operates in a sector where earnings can be volatile. Sales provide a steadier view of its scale and performance. For businesses with inconsistent profits or unique expense structures, such as those in real estate services, P/S offers investors a clear snapshot of the price investors are paying for each dollar of revenue.

Typically, the level of a "normal" or "fair" P/S ratio depends on the company’s expected growth, risk profile, profit margins, and how these measures compare within its industry. Higher growth or better risk management can justify a higher multiple, while greater uncertainty might require a discount.

Right now, eXp World Holdings trades at a P/S of 0.37x. This is notably lower than both the industry average of 2.91x and the peer average of 0.59x, suggesting the company looks inexpensive against traditional benchmarks. However, a more tailored metric is the Fair Ratio from Simply Wall St, which fine-tunes the comparison by incorporating eXp’s growth outlook, profit margins, risks, industry context, and market cap. With a Fair Ratio of 0.44x, this approach provides a more nuanced and realistic barometer than simply looking at industry or peer averages.

Comparing the Fair Ratio (0.44x) to the actual P/S (0.37x), there is a small gap. This means the stock is trading fairly in line with its fundamentals.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your eXp World Holdings Narrative

Earlier we mentioned there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is a simple, structured story you tell about a company—your perspective on its future growth, risks, and what it’s actually worth—based on your own fair value, and what you believe about revenue, earnings, and margins over time.

Narratives bridge the gap between a company’s story and its numbers, connecting your thesis about the business to a clear set of financial forecasts and finally to a fair value. They are designed to be approachable and accessible for every investor. You can explore, create, or discuss them directly on Simply Wall St’s Community page, where millions share their viewpoints.

With Narratives, you can take action by comparing your estimated Fair Value to the current share price. This can help you decide if eXp World Holdings might be a buy, hold, or sell for you, based on your unique assumptions. Each Narrative automatically updates as new information, such as earnings or major news, comes out. This helps keep your insights current in real time.

For example, among the Community’s Narratives on eXp World Holdings, some see rapid cloud platform expansion and international growth justifying a Fair Value of $12.00. Others cite agent reliance and commission risks to estimate a value well below current prices. This reminds us there is no one right answer, but there is a smarter process.

Do you think there's more to the story for eXp World Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:EXPI

eXp World Holdings

Provides cloud-based real estate brokerage services for residential homeowners and homebuyers.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives