- United States

- /

- Real Estate

- /

- NasdaqGM:EXPI

Evaluating eXp World Holdings (EXPI) Valuation as Tech Transformation and Global Expansion Drive Operational Growth

Reviewed by Simply Wall St

eXp World Holdings (EXPI) is making headlines as it pivots from its core real estate brokerage model to become a technology-powered platform. The company is emphasizing AI to streamline operations and support its expanding network of agents.

See our latest analysis for eXp World Holdings.

EXPI’s push toward a tech-first platform and solid international growth has started to catch investor attention, with the share price jumping 11.8% over the past week. However, when you take a broader view, the total shareholder return over the last year remains negative, reflecting how the stock is rebuilding momentum after last year’s drawdown.

If you’re curious about what other innovative companies are making headlines, now’s a great chance to discover fast growing stocks with high insider ownership.

But with EXPI’s shares still below their analyst price target and the company reporting strong operational gains, could investors be overlooking fresh upside, or has the market already priced in the next leg of growth?

Most Popular Narrative: 9.8% Undervalued

Compared to the last closing price of $11.73, the most followed narrative sets a fair value at $13.00 per share. This positions eXp World Holdings as modestly undervalued, highlighting its rapidly changing fundamentals.

Significant improvements in agent retention and recruitment of higher-productivity teams (such as mega teams, luxury divisions, and team-based model adoption) are driving increases in transactions per agent. This can bolster revenue growth and help offset broader market downturns.

Curious what underpins this valuation leap? The full narrative reveals bold growth assumptions and a turnaround in future profit margins that might surprise you. Want to know which projected trends are boosting eXp’s premium? Unlock the core details propelling this price target.

Result: Fair Value of $13.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing commission compression and demographic shifts could hamper eXp’s growth and pose real challenges to the bullish narrative around its valuation.

Find out about the key risks to this eXp World Holdings narrative.

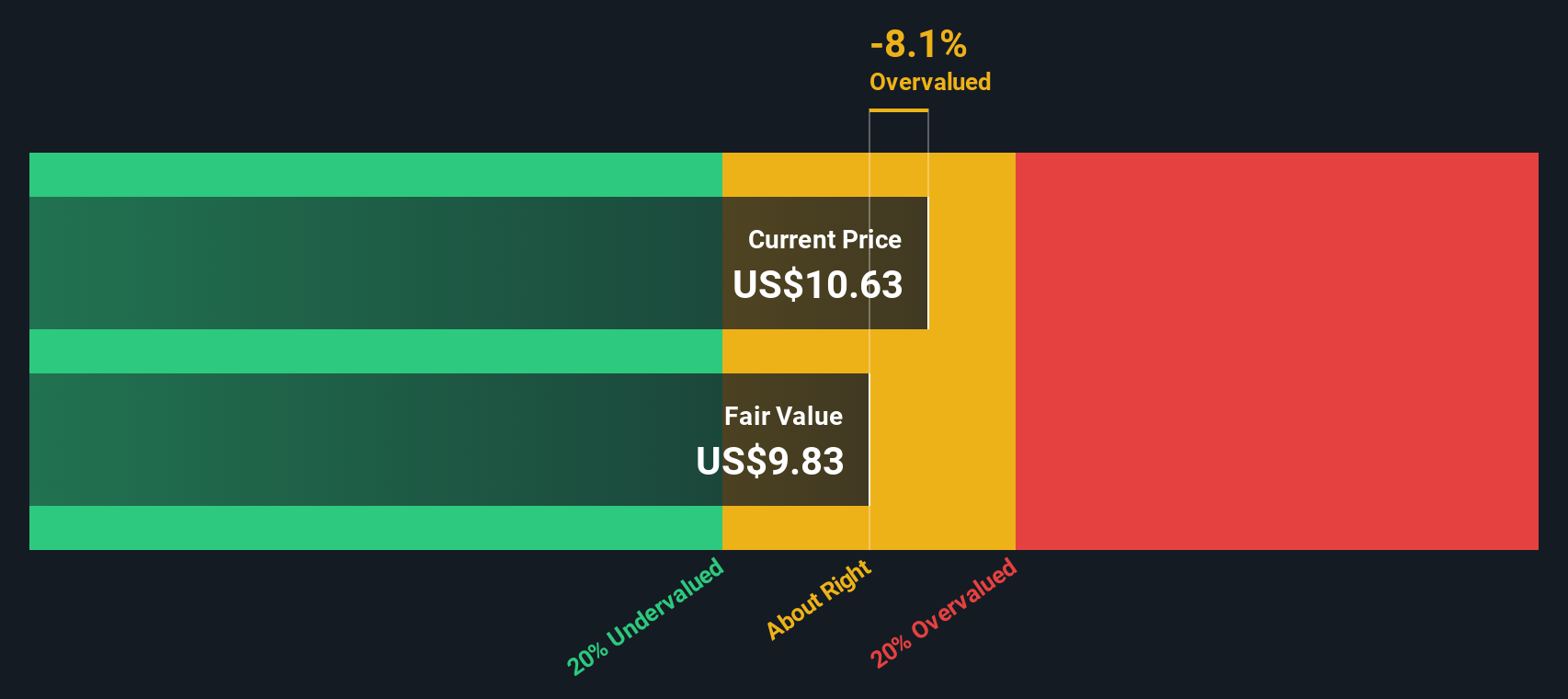

Another View: SWS DCF Model Suggests Caution

While the price-to-sales approach suggests EXPI is undervalued, our SWS DCF model tells a different story. According to this method, EXPI’s shares are actually trading above their calculated fair value. This stark contrast raises the question: which narrative will prove true as new data arrives?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out eXp World Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 921 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own eXp World Holdings Narrative

If you see things differently or want to dig into the numbers yourself, you can build your own perspective on eXp World Holdings in just a few minutes with Do it your way.

A great starting point for your eXp World Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why limit yourself to just one opportunity? Sharpen your investing edge today using tailored stock ideas, each one with a unique upside you might miss elsewhere.

- Power up your portfolio with generous yields by checking out these 14 dividend stocks with yields > 3%, targeting stocks offering reliable income above the usual benchmarks.

- Spot game-changers in artificial intelligence when you scan these 26 AI penny stocks, where today's breakthrough technologies become tomorrow's market leaders.

- Start strong by uncovering hidden gems through these 3582 penny stocks with strong financials, focusing on small caps with financial muscle, ideal for savvy investors looking for the next big win.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:EXPI

eXp World Holdings

Provides cloud-based real estate brokerage services for residential homeowners and homebuyers.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.