- United States

- /

- Real Estate

- /

- NasdaqGM:EXPI

A Fresh Look at eXp Realty (EXPI) Valuation Following New AI Tools and Sports & Entertainment Expansion

Reviewed by Simply Wall St

eXp World Holdings (EXPI) has captured the market’s attention with a series of strategic launches, including an AI business assistant, dedicated agent training in automation, and a new division focused on sports and entertainment clients. Investors may be watching to see how these moves improve earnings potential and long-term growth.

See our latest analysis for eXp World Holdings.

eXp’s share price has been relatively steady in recent months, with a 1.2% gain over the last week and a 3.2% uptick across the past month. However, the bigger story is that total shareholder return is down nearly 12% over the past year despite all these bold initiatives. This suggests investors may not be fully convinced by the near-term impact of new growth efforts, even as momentum appears to be building from recent lows.

If you’re curious about what else is catching investors’ attention lately, consider broadening your search and discover fast growing stocks with high insider ownership

With new tech rollouts and niche market expansions gathering pace, the question now is whether eXp shares are trading below their true value or if the market has already accounted for future growth prospects and left little room for upside.

Most Popular Narrative: 8% Undervalued

eXp World Holdings’ widely followed consensus narrative points to a fair value of $12.00, which stands above the last closing price of $11.04. This suggests that, according to narrative projections, there is still meaningful upside embedded in the shares if the growth story plays out as expected.

Accelerating global expansion supported by a scalable cloud-based platform is allowing eXp to rapidly launch into new markets (Peru, Turkey, Ecuador, Japan, South Korea) and capture productive agents quickly. This increases potential transaction fees and top-line revenue in tandem with the ongoing digitalization of commerce and work.

What’s the secret behind this lofty valuation? Analysts appear to rely on a hot mix of double-digit profit growth, margin improvement, and a bold profit multiple that is far from the industry average. The financial roadmap behind this target price might surprise even bullish investors.

Result: Fair Value of $12.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing commission compression and demographic shifts could act as headwinds. These factors may potentially challenge eXp’s ambitious growth and valuation narrative in the coming years.

Find out about the key risks to this eXp World Holdings narrative.

Another View: SWS DCF Model Paints a Different Picture

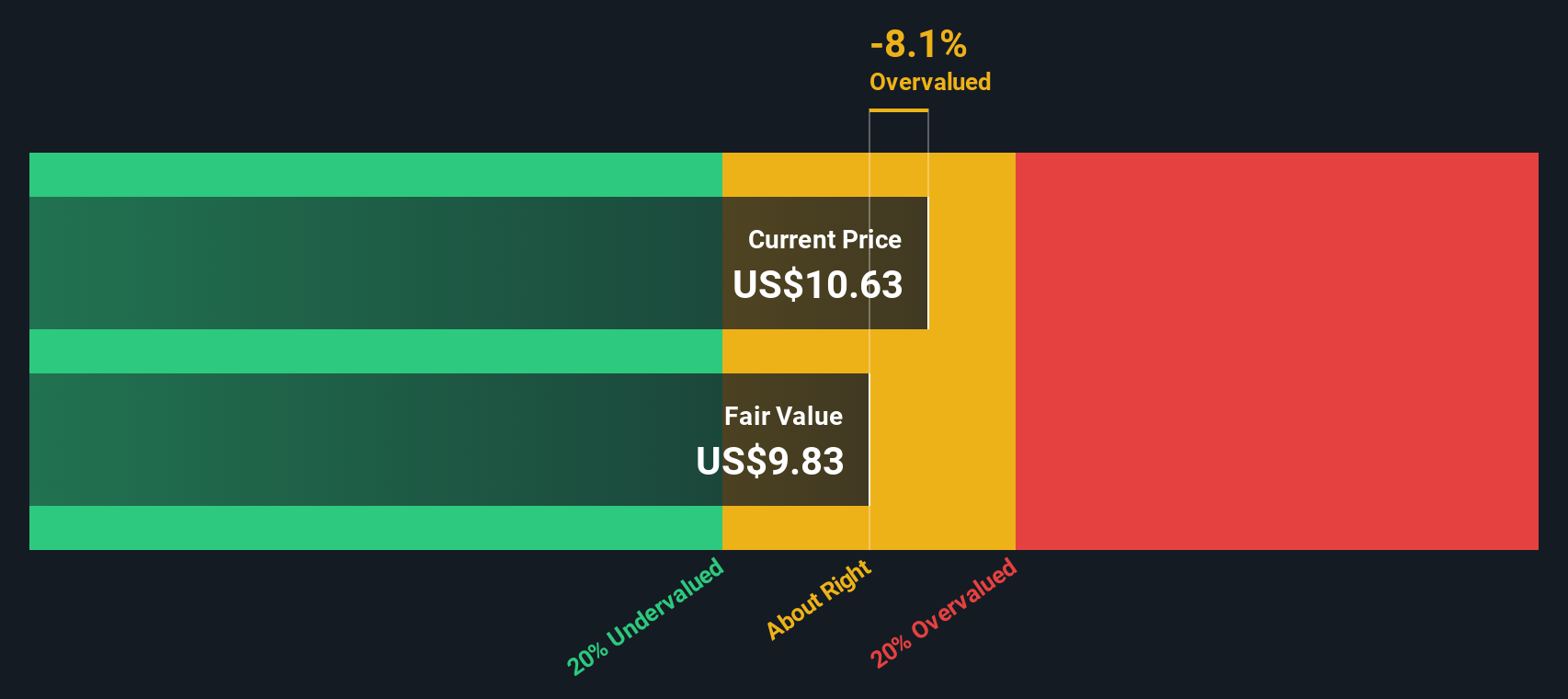

Switching gears, our SWS DCF model suggests that eXp may actually be trading slightly above its estimated fair value of $9.82 per share. At the same time, the price-to-sales approach flags the stock as undervalued. This divergence highlights how different valuation models can tell contrasting stories about what is considered “fair.” Which method tells the more actionable story: current market optimism or future cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out eXp World Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own eXp World Holdings Narrative

If you’re keen to draw your own conclusions or question these assumptions, it's easy to build your own perspective based on the numbers in just a few minutes. Simply select Do it your way.

A great starting point for your eXp World Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Smart Investment Opportunities?

Your next market win could be just a click away. Tap into unique themes before the crowd and give your watchlist a powerful edge by targeting stocks with proven momentum, high yield, or future-defining potential.

- Supercharge your income potential by focusing on reliable companies offering attractive yields through these 17 dividend stocks with yields > 3%.

- Stay ahead of technological change by targeting those shaping tomorrow’s breakthroughs in artificial intelligence with these 26 AI penny stocks.

- Unlock value by capitalizing on hidden gems trading below their cash flow potential using these 875 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:EXPI

eXp World Holdings

Provides cloud-based real estate brokerage services for residential homeowners and homebuyers.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives