- United States

- /

- Biotech

- /

- NYSEAM:PLX

Protalix BioTherapeutics (PLX) Valuation in Focus After EMA Setback on Elfabrio Dosing Schedule

Reviewed by Kshitija Bhandaru

See our latest analysis for Protalix BioTherapeutics.

Shares of Protalix BioTherapeutics tumbled 22.5% in a day as the market reacted to the EMA’s negative decision, swiftly erasing gains from earlier momentum. Despite this sharp setback, investors who held on over the past year have still seen a total shareholder return of more than 70%. This highlights the stock’s volatile but rewarding ride for the patient.

If today’s volatility has you weighing other opportunities, now might be the perfect time to discover See the full list for free..

With shares now well below analyst price targets, the question becomes: is Protalix BioTherapeutics undervalued after the selloff, or is the market accurately reflecting its future prospects? Could this be a buying opportunity, or is growth already priced in?

Most Popular Narrative: 56% Undervalued

According to Zwfis, the narrative sees significant upside for Protalix BioTherapeutics. With the last close at $1.86, their estimated fair value of $4.23 suggests a large discount, setting the stage for a bold claim about the company’s potential if current products and pipeline drugs deliver.

They currently have no debt as well on their balance sheet. Overall the only thing that scares me is along the lines of the new bill trump just passed about medications, and also the war in Israel which can affect their production. However, if they are just able to normally produce their current two products I believe the stock could easily go back up to $3/share. If they are able to get their other drugs that are in the pipeline green lit then I can see this stock going a lot higher.

Curious what powers this bullish narrative? The foundation lies in ambitious growth forecasts, a profit margin leap, and expectations for pivotal product approvals. Secrets behind this $4.23 valuation could upend your perspective on PLX’s future.

Result: Fair Value of $4.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as changing drug regulations and geopolitical tensions could quickly shift sentiment and challenge the bullish case for Protalix BioTherapeutics.

Find out about the key risks to this Protalix BioTherapeutics narrative.

Another View: Relatively Expensive by Market Standards

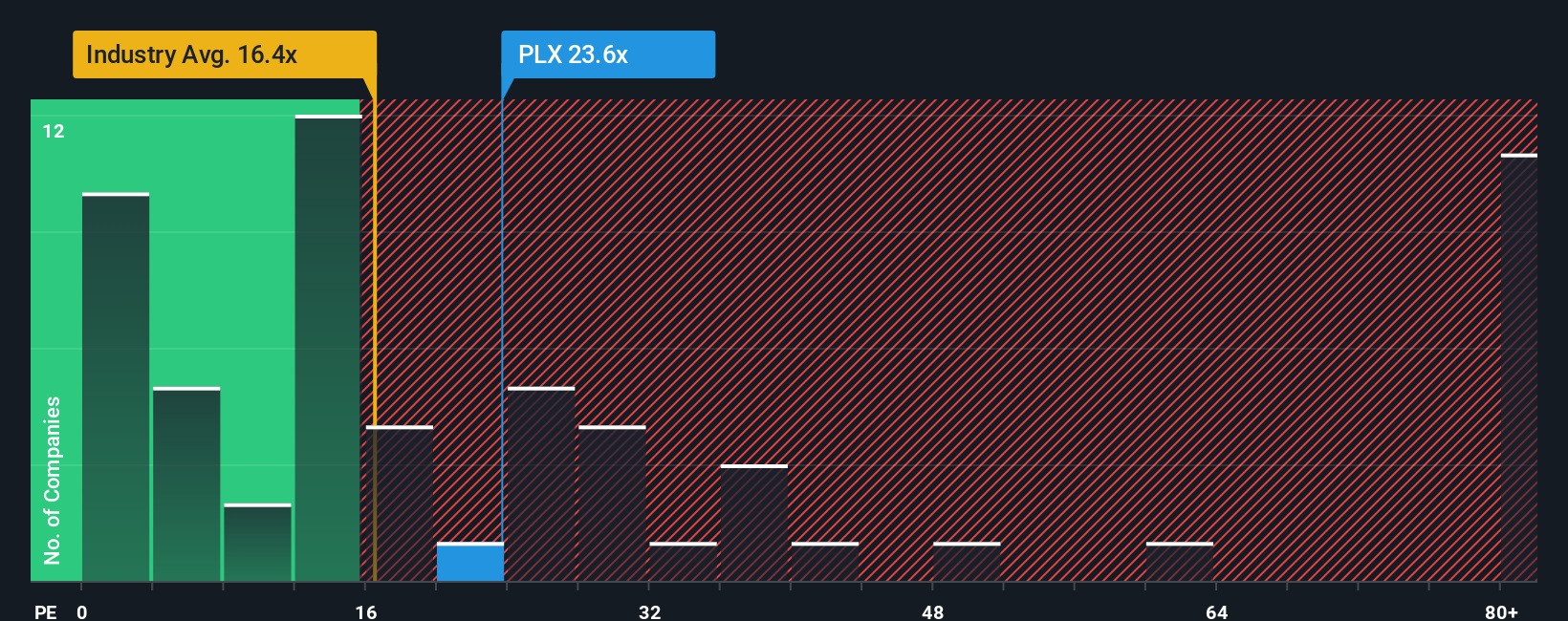

While the $4.23 fair value places Protalix BioTherapeutics as undervalued, a look at its price-to-earnings ratio tells a different story. At 23.6x, shares trade well above the US Biotechs industry average of 16.4x and the peer average of just 6.6x. Although the fair ratio stands at 43.2x, today’s higher-than-average level means there is valuation risk if the market reverts to the norm. Which narrative will win out in the end?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Protalix BioTherapeutics Narrative

If you see things differently or thrive on independent analysis, feel free to dive into the numbers yourself and craft your own outlook in just minutes. Do it your way.

A great starting point for your Protalix BioTherapeutics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Capitalize on emerging trends. Every day, investors who act decisively seize new opportunities before the crowd. Don’t let the next big winner pass you by.

- Unlock growth by tapping into these 24 AI penny stocks, which are at the forefront of game-changing artificial intelligence innovations.

- Secure potential income streams and strengthen your portfolio with these 18 dividend stocks with yields > 3%, offering yields consistently above 3%.

- Ride the future wave of currency by checking out these 79 cryptocurrency and blockchain stocks, which are powering the evolution of decentralized finance and blockchain breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:PLX

Protalix BioTherapeutics

A biopharmaceutical company, engages in the development, production, and commercialization of recombinant therapeutic proteins based on the ProCellEx plant cell-based protein expression system.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives