- United States

- /

- Biotech

- /

- NYSEAM:PLX

How Could EMA's Elfabrio Decision Reshape Protalix BioTherapeutics' (PLX) Rare Disease Strategy?

Reviewed by Sasha Jovanovic

- Earlier in October 2025, Protalix BioTherapeutics and Chiesi Group received a negative opinion from the European Medicines Agency’s (EMA) Committee for Medicinal Products for Human Use (CHMP) regarding Elfabrio’s proposed less-frequent dosing regimen for Fabry disease, as the data was considered insufficient to demonstrate similar efficacy to the currently approved schedule.

- This regulatory decision highlights ongoing challenges in achieving flexibility for rare disease treatments, with implications for both patient care and future product adoption efforts.

- We'll assess how the EMA's rejection of Elfabrio's revised dosing impacts the company’s expansion strategy and risk profile.

The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Protalix BioTherapeutics Investment Narrative Recap

Owning shares in Protalix BioTherapeutics today requires confidence in the ongoing commercialization of Elfabrio for Fabry disease, and successful execution of its partnership with Chiesi. The EMA’s recent rejection of the less-frequent Elfabrio dosing does curb a potential near-term growth catalyst, but does not directly threaten the company’s current ability to generate revenue from its already-approved schedule. The most significant immediate risk remains the company’s heavy reliance on this single product and ongoing regulatory approvals.

One relevant recent announcement is Protalix’s August 2025 earnings update, which highlighted revenue growth and a return to net profitability in the latest quarter. While this financial improvement reflects the underlying strength of existing Elfabrio sales, the limited label expansion following EMA’s negative opinion could make future revenue visibility more challenging if alternative dosing regimens stay off the table. Yet amid this, investors should also take note that...

Read the full narrative on Protalix BioTherapeutics (it's free!)

Protalix BioTherapeutics' outlook anticipates $188.6 million in revenue and $132.1 million in earnings by 2028. This scenario assumes a 44.9% annual revenue growth rate and a $125.8 million increase in earnings from the current $6.3 million.

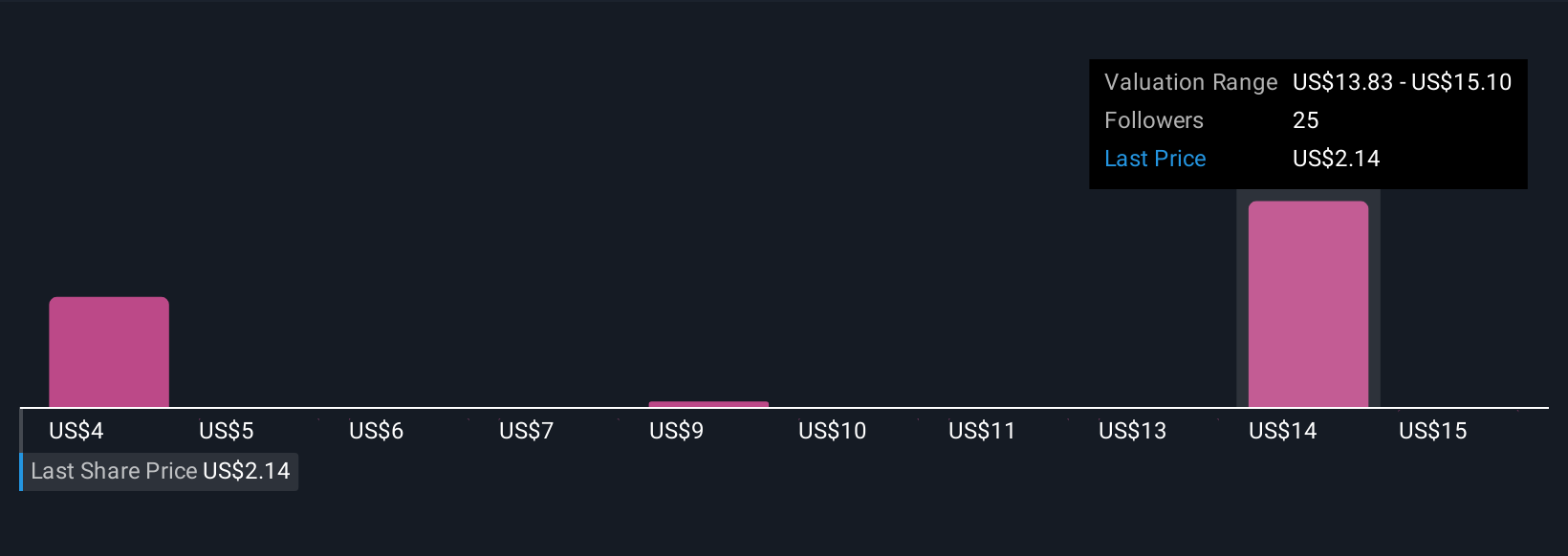

Uncover how Protalix BioTherapeutics' forecasts yield a $14.00 fair value, a 653% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided 8 fair value estimates for Protalix, ranging from US$3.68 to US$16.37 per share. Against this backdrop of widely differing expectations, the company’s dependence on Elfabrio for sales growth means any regulatory hurdles can have an outsized impact, be sure to consider all the perspectives before making your own assessment.

Explore 8 other fair value estimates on Protalix BioTherapeutics - why the stock might be worth just $3.68!

Build Your Own Protalix BioTherapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Protalix BioTherapeutics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Protalix BioTherapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Protalix BioTherapeutics' overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:PLX

Protalix BioTherapeutics

A biopharmaceutical company, engages in the development, production, and commercialization of recombinant therapeutic proteins based on the ProCellEx plant cell-based protein expression system.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)